Money Supply (M2) Rises for Third Month in June

Beneficiary Certificates Drive Growth Amid Stock Market Recovery

In June of this year, the amount of money circulating in the market increased by more than 27 trillion won, marking the third consecutive month of growth in the money supply. This was mainly driven by an increase in beneficiary certificates, particularly those linked to equity funds, as the stock market continued to recover.

As the KOSPI index surpasses its highest level in four years, continuously breaking records, the KOSPI and KRW exchange rates are displayed on the monitor in the dealing room of Hana Bank in Jung-gu, Seoul, on the 30th. On this day, the KOSPI showed a firm upward trend from the early session level of around 3,235. As of 9:02 AM, the KOSPI stood at 3,238.10, up 7.53 points (0.23%) from the previous close. July 30, 2025 Photo by Cho Yongjun

As the KOSPI index surpasses its highest level in four years, continuously breaking records, the KOSPI and KRW exchange rates are displayed on the monitor in the dealing room of Hana Bank in Jung-gu, Seoul, on the 30th. On this day, the KOSPI showed a firm upward trend from the early session level of around 3,235. As of 9:02 AM, the KOSPI stood at 3,238.10, up 7.53 points (0.23%) from the previous close. July 30, 2025 Photo by Cho Yongjun

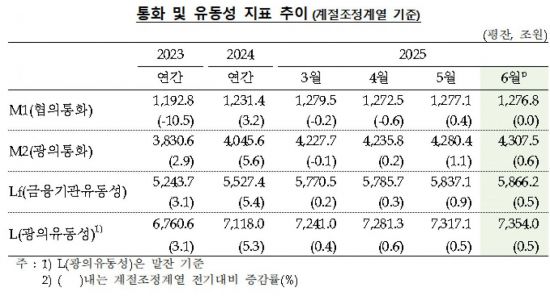

According to the Bank of Korea on August 13, the average seasonally adjusted balance of broad money (M2) in June stood at 4,307.5 trillion won, up 27.1 trillion won (0.6%) from the previous month. M2 has now increased for three consecutive months since April.

M2 is a broad measure of the money supply that includes cash, demand deposits, and passbook savings deposits (M1), as well as money market funds (MMFs), time deposits and installment savings with maturities of less than two years, beneficiary certificates, and repurchase agreements (RPs).

By financial product, beneficiary certificates rose by 8.1 trillion won and money trusts increased by 8.2 trillion won compared to the previous month, leading the overall growth. A Bank of Korea official explained, "The rise in beneficiary certificates was mainly driven by equity-linked funds as the stock market recovered," adding, "The increase in money trusts continued due to a greater inflow of funds from the issuance of asset-backed commercial paper (ABCP) in time deposits."

In contrast, market-type products decreased by 1.4 trillion won from the previous month, mainly due to deposit-taking institutions focusing on raising funds through deposits and savings products.

By economic sector, other financial institutions saw an increase of 19.6 trillion won, mainly in beneficiary certificates and money trusts. Households and nonprofit organizations increased their holdings by 12.3 trillion won, primarily in beneficiary certificates, while other sectors saw a 200 billion won rise, mainly in time deposits and installment savings. In contrast, corporations decreased by 7 trillion won, mainly due to declines in foreign currency deposits and MMFs.

The average balance of M1 stood at 1,276.8 trillion won, remaining at a similar level to the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.