Additional Profits from HBM: SK hynix to Benefit First

Samsung Electronics Value Chain Companies Gain from Increased Investment

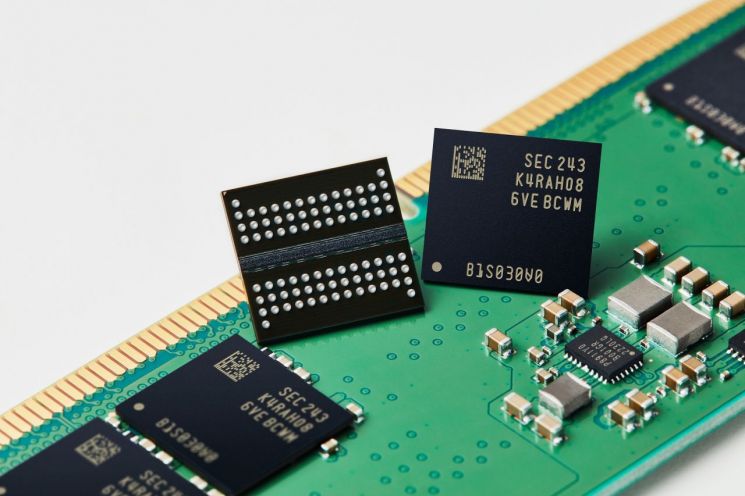

U.S. memory semiconductor company Micron has raised its quarterly earnings guidance, citing improvements in DRAM prices. For the June to August period, the company increased its revenue forecast from the previous $10.4-11.0 billion to $11.1-11.3 billion, and its earnings per share (EPS) guidance from $2.35-2.65 to $2.78-2.92. The impact of rising DRAM demand and prices is also expected to affect Samsung Electronics and SK hynix.

On August 13, Korea Investment & Securities stated in its report, "Micron’s Preview: Strong Prospects for Q3," that "in the third quarter, excess DRAM demand has actually been reported, mainly from multiple CSP (Chip Scale Package) companies focused on servers." The report further explained, "As DRAM suppliers are ending DDR4 production and transitioning their processes to DDR5, the overall supply volume is limited, while server-centric demand is increasing, which is expected to drive DRAM prices higher in the third quarter." In other words, the increase in server-driven DRAM demand is likely to lead to a rise in average selling prices (ASP).

It is estimated that demand for general servers is rising alongside AI server demand. As the number of AI service users grows, the need for non-AI computing infrastructure to deliver AI-generated results to users is also increasing. Data storage, preprocessing, and retrieval before and after AI model training and inference are handled by CPU-based general servers. In addition, general servers are needed to reduce network bottlenecks when delivering AI-generated responses to tens of millions of users. Ultimately, as AI demand increases, data center investments are expected to expand both AI servers centered on GPUs and HBM, and general servers and storage servers based on DDR5 and eSSD. This will drive growth in DRAM and NAND demand, serving as a positive factor for memory suppliers in defending their ASPs.

Chae Min-sook, an analyst at Korea Investment & Securities who recommended increasing exposure to the semiconductor sector, stated, "The price momentum driven by rising DRAM demand is expected to be a positive factor for both Samsung Electronics and SK hynix," adding, "In particular, SK hynix, which secures about 50% of its DRAM revenue from HBM, is likely to be relatively more advantageous." This is because, with HBM revenue remaining stable, SK hynix can generate additional profits from general DRAM.

However, from the perspective of the semiconductor value chain, Samsung Electronics is expected to benefit first. This is because Samsung Electronics has already begun investing in 1c nm DRAM, putting its order cycle ahead of SK hynix’s value chain. The analyst added, "Within the front-end equipment coverage, Samsung Electronics will directly benefit from capacity expansion, and Eugene Technology, which has high exposure to DRAM, is recommended as a top pick."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)