Kumho Petrochemical and Kolon Industries See Sharp Profit Declines

Dongseo Petrochemical, LX MMA, and Other Unlisted Firms Also Struggle

Product Prices for Latex, Phenol, and Others Drop 3% to 18%

"Complex Crisis Hits: U.S. Tariffs and Econ

Non-NCC (companies without naphtha cracking centers) and specialty chemical firms, previously considered "defensive stocks" within the domestic petrochemical industry, are now facing widespread instability. Although these companies have weathered cyclical downturns by focusing on high value-added and downstream-oriented portfolios, their strategies to defend earnings effectively collapsed in the second quarter of this year. This was due to a simultaneous downturn in downstream industries, global oversupply, and deteriorating profitability. The petrochemical industry crisis, once concentrated among large corporations with NCCs, is now spreading downstream.

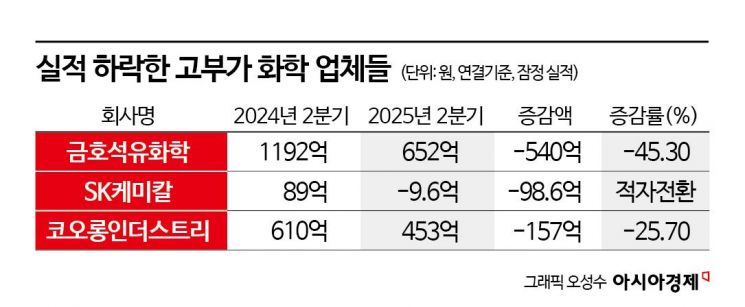

According to the electronic disclosure system on August 13, Kumho Petrochemical, SK Chemicals, and Kolon Industries-all of which have focused on high value-added chemical products-saw their operating profits either decline or turn into losses in the second quarter. Unlisted chemical companies such as Dongseo Petrochemical, LX MMA, and SK Incheon Petrochem also failed to avoid sluggish performance. These companies produce goods by sourcing basic raw materials such as ethylene, propylene, and butadiene from NCCs.

An analysis of each company's earnings disclosures and parent company reports shows that the prices of key products fell by 3-18% year-on-year, and the price premium for specialty products was significantly eroded. Kumho Petrochemical, which holds the top global market share for NB latex, saw its profitability sharply decline due to falling product prices. NB latex, a raw material for rubber gloves, saw its average selling price drop by 15%, from $2.20 per kilogram last year to $1.87 this year. The price of phenol, a key intermediate for downstream industries, also reportedly fell by 10%. In the first quarter, profits were protected by a surge in preemptive orders ahead of the U.S. imposing a 50% tariff on Chinese gloves. However, in the second quarter, China flooded markets outside the U.S. with low-priced products, driving down market prices. As a result, second-quarter operating profit plunged by 45%, from 119.1 billion won a year earlier to 65.2 billion won.

Even for products where a specific company holds a dominant position, such as NB latex, it has become necessary to develop strategies for price defense and market diversification by region. In particular, while U.S. tariff policies may be advantageous in some markets, intensified price competition from low-priced Chinese goods in other regions can rapidly squeeze overall profitability. A Kumho Petrochemical official stated, "Even if the situation becomes favorable in the U.S., the burden of price competition has become much heavier in other markets."

Dongseo Petrochemical also could not avoid difficulties due to the expansion of Chinese supply. The international price of acrylonitrile (AN), used as a raw material for synthetic fibers and automotive parts, plummeted by 18%, from $1,800 per ton to $1,476 per ton.

When prices fall and costs rise simultaneously, a "cost-price mismatch" occurs, compressing spreads. The average price of methyl methacrylate (MMA) produced by LX MMA dropped by 12%, from $2,050 per ton to $1,804 per ton, while costs rose by 5-7%. MMA is used in paints and adhesives. As a result, operating profit declined by 27.6%, from 51.2 billion won to 37 billion won. At SK Incheon Petrochem, the price of paraxylene (PX) fell by 12%, from $1,260 per ton to $1,109 per ton, but the decline in the price of its raw material, naphtha, was less pronounced, leading to continued losses. PX is used as a raw material for fibers and films.

Sluggish demand in downstream industries has shaken even high value-added products. The average selling price of Kolon Industries' tire cord fell by 3%, from $4,050 per ton to $3,929 per ton, and polyester film prices dropped by 5%, from $2,200 per ton to $2,090 per ton. Shipment volumes also fell by 8%, causing operating profit to decrease by 26%, from 143.2 billion won to 105.9 billion won.

SK Chemicals saw its second-quarter sales rise by 44%, from 1.2087 trillion won to 1.7407 trillion won, but operating profit swung from 8.9 billion won to a loss of 960 million won. Investments in polymer and bio-materials, as well as R&D and selling and administrative expenses, increased by more than 20% year-on-year.

Experts note that the petrochemical industry downturn is spreading from upstream to downstream, affecting both high value-added and specialty chemicals alike. Lee Deokhwan, Professor Emeritus of Chemistry at Sogang University, stated, "The complex crisis-including Trump's tariff war, the Ukraine and Israel conflicts, and the delayed economic recovery following COVID-19-is now reaching downstream sectors. It is essential to minimize profit deterioration by expanding the share of markets and products where price defense is possible, reducing costs, and adjusting operating rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.