Woori Asset Management has launched Korea’s first ETF that strategically utilizes the trading trends of foreign investors.

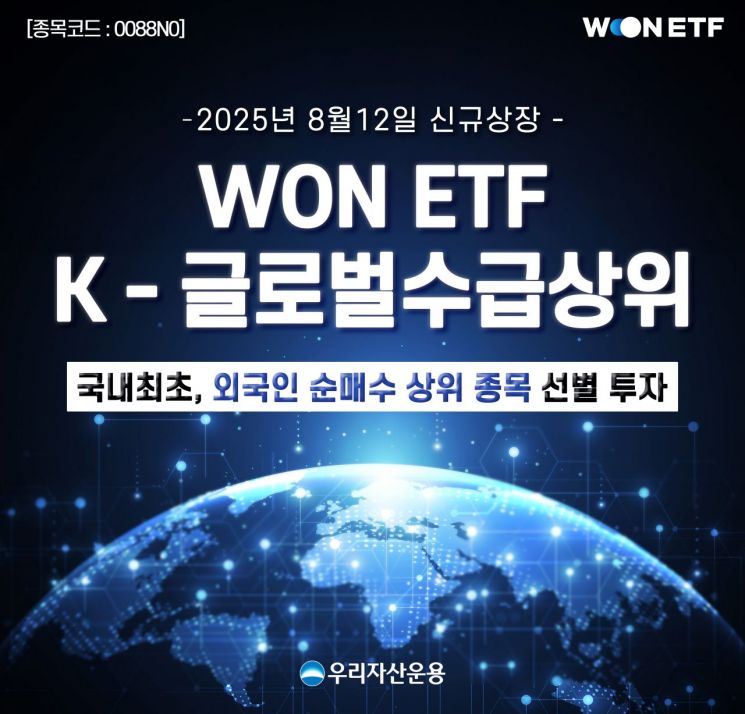

On August 12, Woori Asset Management newly listed the ‘WON K-Global Supply Top ETF’ on the Korea Exchange. This ETF focuses on stocks in the domestic market that show strong net buying by foreign investors.

Foreign investors are recognized for their superior access to information and analytical capabilities, consistently achieving strong performance in the Korean stock market. They are considered a key supply and demand force that significantly influences market direction. By actively incorporating the strategies of foreign investors into its ETF product, Woori Asset Management has introduced a new investment alternative that allows retail investors to strategically leverage the informational and analytical advantages of foreign investors.

The core strategy of this product is to selectively invest in stocks that continue to attract net buying from foreign investors in the domestic market. Among companies in the KRX300 Index with upward earnings revisions, the ETF selects those with strong foreign investor inflows. It also employs AI news trend analysis to monitor for adverse events affecting individual companies, and determines the ETF’s constituent stocks once a month.

Woori Asset Management explained that, through multi-layered filtering, the product enhances investment stability and sustainability, making it suitable for investors seeking to outperform the index while investing in the Korean stock market.

Choi Hongseok, Head of ETF Management, stated, “We designed this ETF so that retail investors can strategically utilize the information and analytical skills of foreign investors, which have traditionally been difficult to access.” He added, “A key advantage of this product is the monthly rebalancing, which allows timely reflection of changes in foreign investor flows and shifts in market-leading sectors.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.