NCSoft Surges 10% While Shift Up Hits New Lows

Target Prices Cut Amid Concerns Over Shift Up's Lack of New Releases

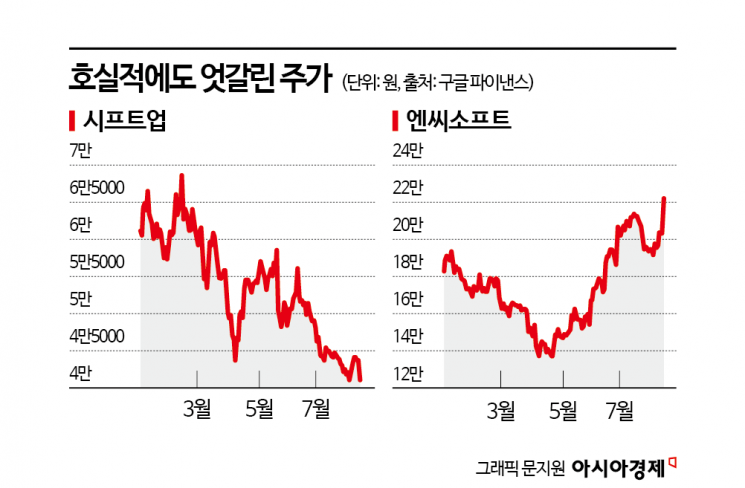

Leading Korean gaming stocks that posted 'surprise earnings' have seen divergent share price performances. Analysts attribute this to differing new title momentum for each company.

According to the Korea Exchange on August 13, NCSoft closed at 223,000 won on the previous day, up 10.12%. In contrast, Shift Up fell by more than 7%, hitting a new 52-week low. While the securities industry is predicting a 'super cycle' for the domestic gaming sector, both companies delivered surprise earnings in the second quarter, but their share prices have taken different paths.

In the second quarter, Shift Up reported operating revenue of 112.4 billion won (up 72.4% year-on-year) and operating profit of 68.2 billion won (up 51.6%), both exceeding market expectations. NCSoft also achieved an 'earnings surprise' with sales of 382.4 billion won (up 3.7%) and operating profit of 15.1 billion won (up 70.5%). This was driven by the solid growth of existing intellectual property (IP) game sales, such as Shift Up's 'Stellar Blade' and NCSoft's 'Lineage' series.

Despite both companies posting strong results, market outlooks have diverged. For NCSoft, its most anticipated title, 'Aion 2', is slated for release within the year, with details of its business model (BM) set to be unveiled next month, drawing significant market attention. Many experts are naming NCSoft as their top pick in the gaming sector.

Kim So-hye, a researcher at Hanwha Investment & Securities, stated, "There is no disagreement regarding the ample pent-up demand for the massively multiplayer online (MMO) genre, and considering the lack of competing blockbuster releases, the initial box office potential is high." She estimated Aion 2's average daily sales in its first month at 2.2 billion won, and its annual sales in 2026 at 324 billion won. She also raised her target price from 250,000 won to 280,000 won.

On the other hand, Shift Up has been hampered by a lack of upcoming new titles. With the release momentum from 'Goddess of Victory: Nikke China' and the Steam version of 'Stellar Blade' having run its course, there are no new titles or plans to expand existing games to new regions or platforms until the expected launches of 'Project Spirit' and 'Stellar Blade 2' in 2027. This stands in contrast to NCSoft, which, in addition to Aion 2, is preparing to launch 'Breakers' (Q1 2026), 'Time Takers' (Q2 2026), and 'LLL' (mid-2026), as well as expanding the Lineage series into China and Southeast Asia.

Oh Donghwan, a researcher at Samsung Securities, commented on Shift Up, "For a rebound in the share price before new title expectations materialize in 2027, the company will need either external game publishing contracts or a significant update to boost revenue from existing games." He downgraded his investment rating from 'Buy' to 'Neutral' and lowered his target price from 54,000 won to 40,000 won. Of the 11 securities firms that issued reports on Shift Up this month, more than half-seven-have reduced their target prices.

However, some analysts believe Shift Up still has a chance to turn things around. While short-term momentum is lacking, they judge that the share price has already bottomed out when considering valuation (the stock price relative to corporate value). Choi Seungho, a researcher at DS Investment & Securities, said, "Major companies get multiple at-bats to hit a home run, but Shift Up, with its industry-leading talent pool, is aiming for a home run with a single swing. Having already hit back-to-back home runs with Nikke and Stellar, the next title, Spirit, clearly has the potential to be an out-of-the-park home run."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.