SNE Research, a secondary battery market research firm, announced that the total global loading of anode materials used in the electric vehicle (EV, PHEV, HEV) market from January to June 2025 reached 593 kilotons (K ton), representing a 40.8% increase compared to the same period last year. In markets excluding China, the figure was 223.7 kilotons, showing a moderate growth rate of 25.1%.

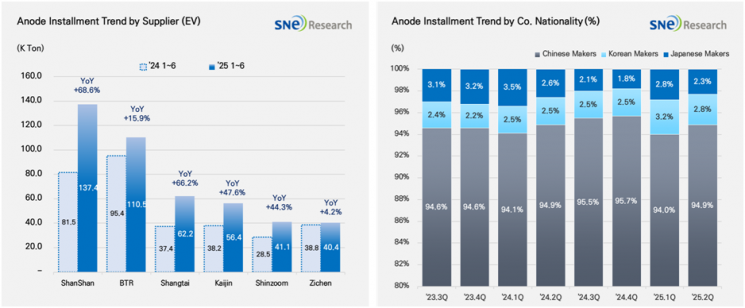

By company, China's Shanshan (137.4 kilotons) and BTR (110.5 kilotons) ranked first and second, respectively, driving the global anode material market. These companies have established a stable customer base by supplying anode materials to major battery manufacturers such as CATL, BYD, and LG Energy Solution.

In addition, Xiangtai (62.2 kilotons), Kaijin (56.4 kilotons), Shinzoom (41.1 kilotons), and Jichen (40.4 kilotons) were also among the top companies, each recording high year-on-year growth rates ranging from 40% to 70%.

Global Electric Vehicle Battery Anode Material Market Status from January to June 2025. SNE Research

Global Electric Vehicle Battery Anode Material Market Status from January to June 2025. SNE Research

By country, Chinese companies maintained an overwhelming dominance, accounting for 95% of the total market. Korean companies held a market share of around 2.8%, but are expanding collaboration with battery cell manufacturers, focusing on POSCO Future M and Daejoo Electronic Materials. Japanese anode material companies such as Hitachi and Mitsubishi, which have maintained a conservative strategy centered on existing customers, recorded a low market share of 2.3%.

In 2025, the global anode material market continues to see stable demand for conventional graphite-based products, while the commercialization of silicon composite anode materials is accelerating. Major Chinese companies are establishing mass production systems for silicon anode materials, thereby securing market leadership. In contrast, the United States and Europe are actively pursuing supply chain restructuring and material self-sufficiency policies to reduce dependence on Chinese graphite.

SNE Research stated, "The speed of technological transition and the ability to secure raw materials are emerging as key factors that will determine corporate competitiveness in the future," and predicted, "The importance of silicon anode materials as a core material for leading the era of high-performance electric vehicles and all-solid-state batteries will also grow rapidly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)