Impact of “National AI Champion” and Data Center Demand

Sector Rotation Flows from Shipbuilding and Defense to AI

While foreign investors have put the brakes on the KOSPI rally, they have actually increased their bets on artificial intelligence (AI) themed stocks.

According to the Korea Exchange on August 12, foreign investors sold 284.5 billion won worth of shares during the first week of this month, through August 8. This marks a pause in the “Buy Korea” rally by foreign investors that had continued for three consecutive months since May. The shift is attributed to disappointment over tax reform, which has strengthened the inclination to realize profits by sector and by individual stocks.

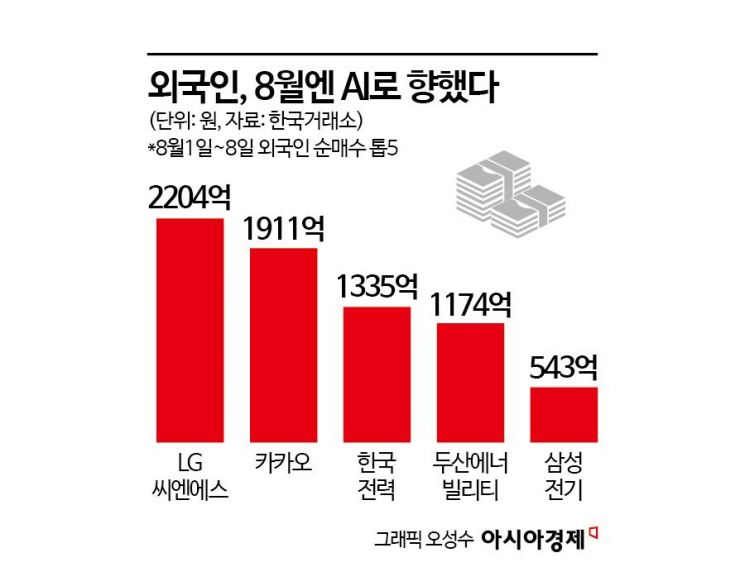

However, even amid this pause, foreign investors have increased their investments in AI-themed stocks. The top five stocks most heavily bought by foreigners so far this month?totaling a net purchase of 716.7 billion won?are LG CNS, Kakao, Korea Electric Power Corporation (KEPCO), Doosan Enerbility, and Samsung Electro-Mechanics. All of these companies have drawn market attention due to positive news related to AI. This stands in contrast to last month, when the top five net purchases by foreigners were spread across a variety of sectors, including semiconductors (Samsung Electronics), shipbuilding (Hanwha Ocean), and biotechnology (Alteogen).

LG CNS, which topped the list of net purchases by foreign investors this month, attracted market attention by being the first Korean company to win a contract for building an overseas AI data center. The data center, to be completed in Jakarta, Indonesia by the end of 2026, is expected to be the largest in the region, with an estimated value of about 100 billion won. LG CNS was also part of a consortium led by the LG Management Development Institute’s AI Research Institute, which won the “National AI Champion” development project. Recently, LG CNS has also been in the spotlight after it was revealed as one of the stocks traded by independent lawmaker Lee Choonseok, who is under suspicion for stock trading under borrowed names.

Kakao, which posted a surprise earnings result in the second quarter, attracted the second largest amount of foreign buying after LG CNS, despite being excluded from the “National AI Champion” list. Although its content division recorded negative growth for five consecutive quarters, the upcoming KakaoTalk overhaul starting next month and the joint service with OpenAI have led to rosy outlooks from securities analysts. Kim Dongwoo, a researcher at Kyobo Securities, raised his target price for Kakao from 68,500 won to 76,000 won, stating, “When the overhaul is fully implemented in 2026, Talk Biz advertising revenue is expected to grow by 14% year-on-year.”

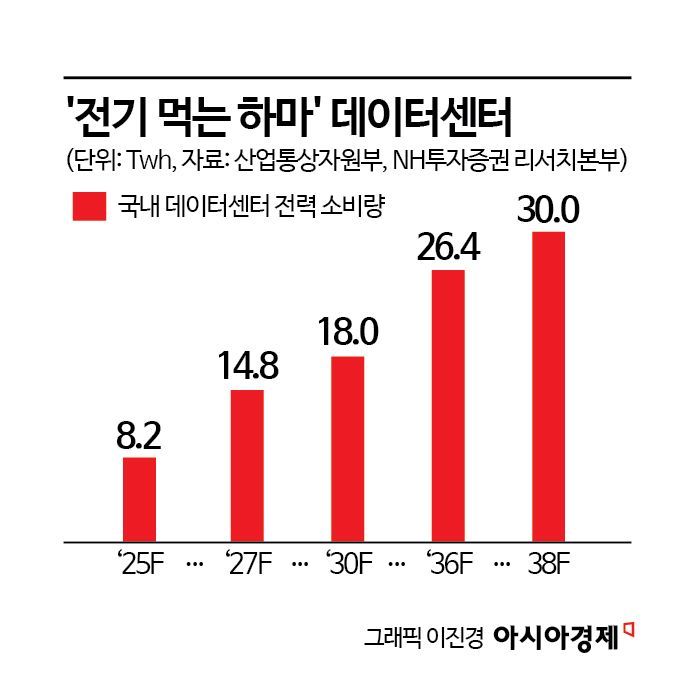

Korea Electric Power Corporation and Doosan Enerbility, both members of “Team Korea” that secured a 26 trillion won nuclear power plant project in the Czech Republic, are also key players in the AI rally. As the expansion of energy-intensive AI data centers drives a surge in electricity demand, nuclear power stocks are gaining even greater prominence. In particular, Doosan Enerbility’s share price rose by more than 4% on this day, following President Lee Jaemyung’s emphasis on nuclear cooperation with Vietnam. Choi Kyuhun, a senior researcher at Shinhan Investment Corp., stated, “Doosan Enerbility is also collaborating with multiple small modular reactor (SMR) design firms, including NuScale Power, X-energy, and TerraPower,” and estimated Doosan Enerbility’s SMR-related orders this year at 500 billion won.

Samsung Electro-Mechanics, long considered a perennial supporting player in the semiconductor market, has also attracted foreign interest since the second quarter by supplying AI accelerator substrates to major U.S. big tech companies such as Amazon and AMD. Yang Seungsoo, a researcher at Meritz Securities, analyzed, “As the supply-demand imbalance for AI flip-chip ball grid array (FC-BGA) intensifies, the benefits for a small number of companies, including Samsung Electro-Mechanics, will become even greater.” He also projected further share price increases, noting that Samsung Electro-Mechanics’ 12-month forward price-to-book ratio (PBR) stands at 1.37 times, below its historical average of 1.6 times.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.