Rapid Growth in Three Years Thanks to Low-Cost Startup and Simple Operations

Healthy Ice Cream Gains Ground Amid the “Healthy Treasure” Trend

Sales of 52 Million Won per 3.3 Square Meters... Capturing a Niche Without Major Competitors

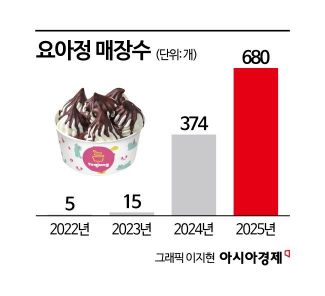

Yogurt ice cream specialty chain "Yogurt Ice Cream's Essence (Yoajung)" has opened over 300 new stores this year alone, bringing its total number of locations nationwide to more than 680. This milestone was achieved just three years after launching its franchise business in 2022. While some initially dismissed Yoajung as a fleeting trend like Tanghulu, the outcome has been quite the opposite. Yoajung is expanding its presence in a market once dominated by major brands such as Baskin Robbins, Natuur, and Haagen-Dazs.

From the First Store in Seongsu-dong to 680 Locations Nationwide

According to franchise business transaction data from the Fair Trade Commission on August 11, Yoajung's franchise locations increased from 5 in 2022 to 15 in 2023. By the end of last year, the number had reached 374, and at the beginning of this year, it surpassed 680. There were 358 new store openings last year, with only one contract termination.

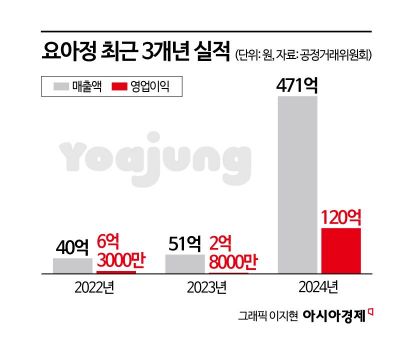

Yoajung began in 2021 as a delivery-only store in Seongsu-dong. Starting in 2022, it opened offline locations in areas such as Ewha, Euljiro, and Mangwon. Sales soared from 4 billion KRW in 2022 to 5 billion KRW in 2023, and then to 47.1 billion KRW last year. Operating profit also jumped from 600 million KRW to 12 billion KRW over the same period.

The rapid growth attracted the attention of investors. On July 31 of last year, operator Trillions sold 100% of its shares to Samhwa Food, the company behind "Arachi Chicken," for 40 billion KRW. The company is now led by Park Hyunhee, the wife of Samhwa Food's third-generation CEO Yang Seungjae.

'A Niche Market Without Rivals' Secures Market Share

The expansion of franchises can be attributed to low entry barriers. The interior cost for an average 33-square-meter (10-pyeong) store is about 16.5 million KRW. The initial investment, including franchise fee, deposit, and training, totals around 53.3 million KRW. Advertising costs are 157 million KRW, with no promotional expenses. Average sales per 3.3 square meters are 5.284 million KRW.

This stands in contrast to major franchises. For example, Natuur stores average 66 square meters (20 pyeong), with interior and equipment costs of 177.65 million KRW and an initial investment (franchise fee, deposit, and training) of 13.16 million KRW. Advertising costs are 300 million KRW, and promotional expenses are 56.06 million KRW. The combined total of Yoajung’s interior/equipment costs and initial investment is 69.8 million KRW, about one-third of Natuur’s 190.81 million KRW.

Operations are also simple. The menu focuses on yogurt ice cream and bingsu, maintaining a single concept. Standardized manuals and a headquarters-designated ingredient supply system make it easy for first-time entrepreneurs to run a store.

The spread of delivery platforms has also contributed to growth. Yogurt ice cream maintains its quality well after delivery, leading to a high proportion of online orders. In some stores, delivery sales account for more than half of total revenue. The ability to maintain stable sales even during off-peak seasons is a key advantage.

The market environment is also favorable. While major franchises focus on complex desserts like cafes and bingsu, there are virtually no brands operating nationwide chains with a single yogurt ice cream concept.

Additionally, the wellness trend has provided further momentum. The image of a "healthy snack"?low-fat, low-calorie yogurt topped with fresh fruit and nuts?appeals to consumers in their 20s and 30s. The DIY system, where customers choose their own toppings, is also popular. While existing brands have remained focused on high-calorie finished products, Yoajung is seen as offering a new option: the "light dessert."

Yoajung is also turning its eyes to overseas markets. Last year, it opened its first directly operated store at Ala Moana Center in Hawaii, and this year, it has launched locations in Australia, Hong Kong, and China. Plans are also underway to expand into major Asian countries such as Singapore.

Following Yoajung's success, more latecomer brands are entering the market. According to Fair Trade Commission data, more than 20 yogurt dessert brands have been registered since 2022, with about half of them in the ice cream sector. "Yomat," a brand launched in 2022 that specializes in fruit-topped yogurt, now operates 60 stores. "Dalongdoryogurticecream," which began franchising last year, opened 84 stores within just one year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)