As of June, 8,995 Units Remain, Down by 4,992 in 2 Years and 3 Months

In the Past, Price Increases Drove Declines; Recently, Reduced Supply Has Lowered Unsold Inventory

Pace of Unsold Inventory Decline May Slow

Need to Enhance Effectiveness of Buyback Programs and Establish Supply Management Measures

The number of unsold apartments in Daegu fell below 9,000 units as of June, and the downward trend in unsold inventory due to reduced supply is expected to continue into the second half of the year. However, some experts point out that the pace of decline in unsold inventory may slow, and that the passage of relevant legislation to normalize the market should accompany this trend.

An apartment construction site in Bukgu, Daegu, where construction has been halted for 10 months. Photo by Kang Jinhyung

An apartment construction site in Bukgu, Daegu, where construction has been halted for 10 months. Photo by Kang Jinhyung

According to the "Daegu Housing Market Analysis" briefing published by the Korea Construction Industry Research Institute on August 10, the number of unsold apartments in Daegu decreased from 13,987 units in February 2023 to 8,995 units as of June this year. Of these, 3,824 units remained unsold after completion.

In response to the increase in unsold inventory, Daegu suspended all new residential construction project approvals at the end of January 2023. As a result, the volume of new apartment supply plummeted, leading to a decrease in unsold units. Over the past 10 years, Daegu’s annual average supply was 20,824 units, but only 8,514 units were supplied in the 2 years and 5 months since January 2023, representing a drop of more than 80% compared to previous years.

Heo Yoonkyung, a research fellow at the Korea Construction Industry Research Institute, explained, "Typically, there is a time lag of about 18 months between new supply and unsold inventory. Considering that the level of unsold inventory in the second half of this year is greatly influenced by the supply in the first half of 2024, it is highly likely that the downward trend will continue in the second half of the year."

Even during the financial crisis, Daegu experienced severe unsold inventory, but the reasons for resolving it were different. The number of unsold units, which stood at 21,560 in January 2009, decreased to 296 in April 2014, largely due to rising housing prices at the time. Actual transaction prices for Daegu apartments rose by 83.0% over a period of about five years.

Recently, the decrease in unsold inventory has been largely driven by reduced supply. From March 2023, when the decline in unsold inventory began, actual transaction prices rose, but started to fall again from October 2023, and this downward trend continued through May 2025. Heo noted, "Despite the downward trend in prices, unsold inventory continues to decrease, suggesting that the sharp reduction in new supply is having a significant impact."

The Korea Construction Industry Research Institute expects the decline in unsold inventory in Daegu to continue in the second half of this year due to the reduced supply, but also warns that the pace may slow. The slight increase in unsold inventory in June this year is attributed to a higher volume of new supply in the first half compared to the previous year, a slowdown in the leading indicator of sales transactions, and the concurrent indicator of falling prices.

To accelerate the reduction of unsold inventory, it is pointed out that the effectiveness of institutional measures should be enhanced and relevant legislation should be passed quickly to attract demand and capital to regional markets. Measures such as reflecting realistic purchase prices and expanding incentives for private sector participation are needed to increase the effectiveness of post-completion unsold apartment purchases, CR-REITs, and HUG's Unsold Apartment Buyback Program. In addition, it is suggested that related laws, such as acquisition tax reductions for post-completion unsold apartments in regional areas, should be passed quickly, and that the scope of support should be expanded to cover all unsold units.

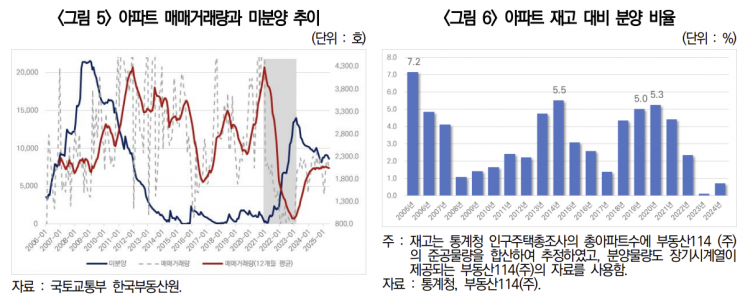

Table of apartment sales transaction volume and unsold housing trends (left), and apartment supply ratio relative to inventory (right). Korea Construction Industry Research Institute Trend Briefing

Table of apartment sales transaction volume and unsold housing trends (left), and apartment supply ratio relative to inventory (right). Korea Construction Industry Research Institute Trend Briefing

The Korea Construction Industry Research Institute also proposed that, in the long term, systematic supply management measures should be established to reduce volatility in the supply market. In Daegu, when the supply of new apartments exceeded 5% of inventory in 2005 and again in 2019-2020, unsold inventory surged after a lag of one to two years, leading to a market downturn. This pattern of concentrated supply at certain times, followed by market stagnation due to increased supply and then a long-term decrease in supply, has been repeated.

Heo emphasized, "It is necessary to establish management measures to reduce supply volatility and maintain a stable supply volume through detailed comprehensive housing plans. In the long term, creating quality jobs and improving infrastructure to foster a stable local economic environment is essential to sustaining appropriate housing demand and revitalizing the regional housing market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.