Paradise and GKL Both Hit 52-Week Highs

Strong Earnings and Anticipation of Increased Chinese Tourists

Positive Momentum Expected to Continue for Now

Casino stocks are hitting record highs. This is due to strong second-quarter earnings and heightened expectations following the visa waiver for Chinese group tourists.

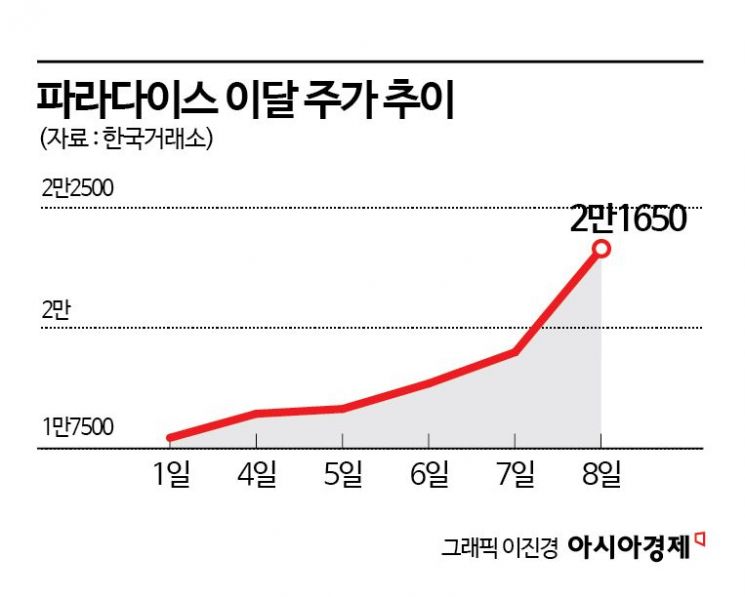

According to the Korea Exchange on August 11, Paradise reached a new 52-week high of 22,600 won during trading on August 8. The stock closed at 21,650 won, up 11.03% from the previous day, marking five consecutive days of gains.

GKL also hit a new 52-week high of 17,970 won during trading. GKL closed at 16,980 won, up 2.47%, also extending its winning streak to five consecutive days.

Strong second-quarter earnings have driven up share prices. Paradise reported a consolidated operating profit of 42.9 billion won for the second quarter, up 33.9% year-on-year. Revenue increased by 4.1% to 284.5 billion won. Revenue from its integrated resort, including Paradise City Casino, rose 15.9% year-on-year to 152.3 billion won, leading the overall growth. The combined second-quarter revenue of the four casinos operated by Paradise?Seoul Walkerhill, Paradise City, Busan, and Jeju?reached a record quarterly high of 229.8 billion won, up 7.1% from the same period last year.

Lee Sunhwa, a researcher at KB Securities, analyzed, "Paradise's second-quarter operating profit exceeded the market consensus of 37.1 billion won," adding, "The operating margin improved due to a low base last year and operational efficiency gains in the casino business."

GKL posted an operating profit of 16 billion won for the second quarter, up 20.8% year-on-year. Revenue rose 2.1% to 100.9 billion won. Lee Hyunji, a researcher at Eugene Investment & Securities, stated, "GKL's second-quarter results surpassed the market consensus. Although the drop amount (the total amount exchanged for chips by casino visitors) declined for three consecutive quarters, improved hold rate (net revenue/drop amount) and efficient cost management led to strong results." She added, "Notably, while the monthly drop amount showed negative growth throughout this year and recorded single-digit growth rates since May, it rebounded to 339.2 billion won in July, up 11.6% year-on-year, marking a return to double-digit growth."

Expectations for a visa waiver for Chinese group tourists also acted as a catalyst for stock price increases. The government has decided to allow visa-free entry for Chinese group tourists from September 29 this year to June 30 next year. As a result, the number of Chinese visitors to Korea this year is expected to recover to pre-pandemic levels. Jeon Jongkyu, a researcher at Samsung Securities, analyzed, "The number of Chinese visitors to Korea is expected to recover to 5 million this year," explaining, "This is due to strengthened policies to boost Chinese consumption, improved Korea-China relations, and measures to facilitate people-to-people exchanges, which are expected to increase deferred inbound demand from China to Korea."

A positive trend for casino stocks is expected to continue for the time being. Ji Inhae, a researcher at Shinhan Investment & Securities, said, "Inbound tourism is booming, companies are entering a period of significant earnings upgrades, and the recovery of Macau's global casino industry, which has the greatest impact on supply and multiples, is also a positive factor." She added, "Although the positive factors have been quickly reflected since April, considering that policy benefits and the Macau rebound have only just begun, the preference for foreigner-only casinos is likely to persist for a while longer."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)