Legal Community's Outlook on "Lee Choonseok Stock Transaction Allegations"

Stock Trading in the Main Chamber of the National Assembly

Approximately 97 Million Won in Kakao Pay and Others

Key Issue: Proving Causality with Undisclosed Information

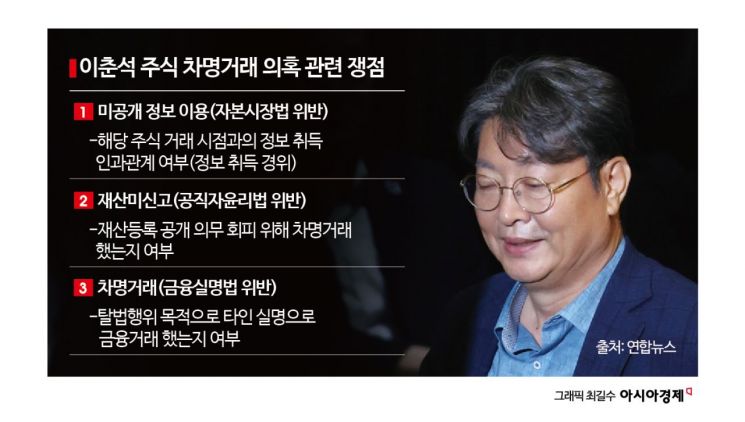

As President Lee Jaemyung has ordered a thorough investigation into the incident involving independent lawmaker Lee Choonseok (former Chair of the National Assembly Legislation and Judiciary Committee), who was caught engaging in stock transactions under a borrowed name in the main chamber of the National Assembly, and as the opposition party has introduced the "Lee Choonseok Gate Special Prosecutor Act" as its official party stance, the police investigation is expected to accelerate. In legal circles, it is widely believed that violations of the Real Name Financial Transactions Act and failure to report assets are clearly supported by photographic evidence, while the charge of using undisclosed information is expected to become a fiercely contested legal issue in the future.

This controversy surfaced after a photo was taken showing Lee conducting stock transactions using a mobile application in the main chamber of the National Assembly. At the time, stocks estimated to be owned by Lee but registered under his aide, identified as Mr. Cha, included 537 shares of Kakao Pay, 150 shares of Naver, and 420 shares of LG CNS, amounting to approximately 97 million won based on the closing prices as of August 5.

Legal experts generally agree that if it is confirmed that Lee used his aide's name to invest in stocks, he will not be able to avoid charges such as borrowed-name transactions (violation of the Real Name Financial Transactions Act) and omission of asset disclosure (violation of the Public Officials' Ethics Act). Attorney Ryu Jaeyul of Jungshim Law Firm stated, "Since Lee is subject to the Public Officials' Ethics Act, if he engaged in borrowed-name stock transactions to evade the asset registration and disclosure obligations stipulated by the Act, this could constitute a violation of Article 3, Paragraph 3 of the Real Name Financial Transactions Act."

Going forward, the main point of contention between the prosecution and Lee's side is expected to be whether he purchased stocks using undisclosed information. Lee previously held key positions such as head of the presidential campaign office for President Lee and head of the Economy Division 2 of the National Policy Planning Committee, leading to suspicions that he may have used his official position to trade stocks.

For such suspicions to lead to punishment, substantial evidence is required. A lawyer who previously served as a deputy chief prosecutor explained, "Under the Capital Markets Act, to punish Lee for using undisclosed information, the person in question must have a 'punishable status,' such as being an executive or major shareholder of a listed company who possesses the information, or an agent such as a law firm entrusted with such information. The scope of punishment extends to the first recipient who directly receives the undisclosed information from such a person."

For example, if the Financial Supervisory Service or the stock exchange leaks internal information before a listed company makes a public disclosure, punishment can be imposed up to the first person who receives the information. Therefore, it must first be determined whether the information Lee obtained before purchasing the stocks was of this nature. Attorney Oh Sunhee of Hyemyung Law Firm stated, "It is necessary to determine when the information Lee received was generated, when he acquired it, when it was disclosed, and whether he used it in transactions prior to disclosure."

There is some room to interpret the status of a National Assembly member as having "supervisory or other authority over specific companies." However, the cautious view is that it is difficult to recognize direct authority over individual companies.

On the other hand, some argue that the relevance of Lee's official duties?having served as both Chair of the Legislation and Judiciary Committee and as head of the Economy Division 2 of the National Policy Planning Committee, which is equivalent to a presidential transition committee?can be interpreted broadly. Ultimately, the core issues in Lee's case are likely to be: ▲the nature and timing of the information, ▲how it was obtained, ▲the causal relationship between acquisition and trading, and ▲the scope of relevance to the duties of a National Assembly member.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)