Disappointment Over Tax Reform Spurs Increased Investment in US Stocks

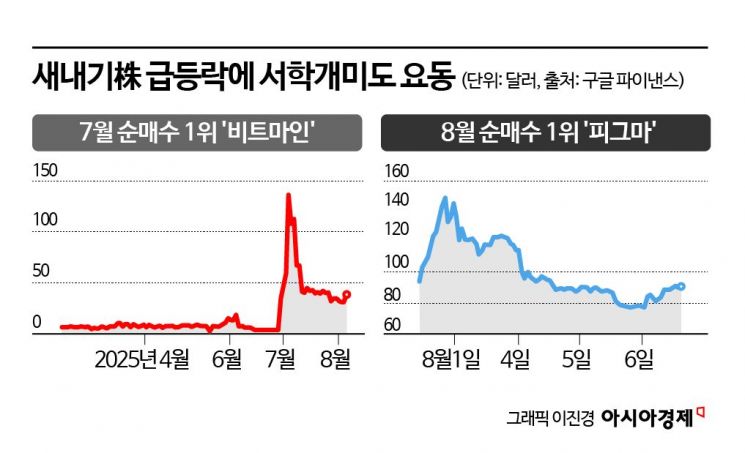

Bitmain and Figma Top Net Purchases in July and August

Disappointed by the proposed tax reform, Korean retail investors who turned to the US stock market are now facing losses. This is due to the roller-coaster performance of newly listed theme stocks that they have aggressively bought since last month.

According to the Korea Securities Depository's SEIBro portal on August 8, individual investors purchased approximately $343.39 million worth of US stocks between the start of this month and August 6. Considering that the total net purchases of US stocks by Korean retail investors last month amounted to about $684.96 million, this means they invested nearly half of July's total in just one week. As disappointment over the tax reform proposal dampened the KOSPI rally, the relative investment appeal of the US stock market appears to have increased as an alternative.

However, Korean retail investors who recently entered the US stock market have not seen much success. This is because the streak of record highs in the US stock market, which had continued since last month, was broken this month. For example, the S&P 500 index, which is dominated by large-cap stocks, hit an intraday high of 6,427.02 on July 31, but then pulled back and has been consolidating for four consecutive trading days.

The biggest blow to Korean retail investors' portfolios came from their stock selection. The most heavily purchased stock by Korean retail investors last month was Bitmain Immersion Technologies, with net purchases totaling $241.65 million in July. Bitmain is a newcomer that was listed on the American New York Stock Exchange in June. As the company with the largest Ethereum holdings in the world, it attracted market attention, and its stock price soared by about 3,900% within a month of listing. However, as profit-taking surged amid the steep rise, the stock price plummeted to one-quarter of its peak value.

An official from a securities firm warned, "Recently, the meme stock craze has returned in the US, causing extreme volatility in the stock prices of companies related to cryptocurrencies and stablecoins. Newly listed theme stocks are particularly risky, as early investors may exit and large volumes may be released, or stock prices can become significantly overvalued compared to fundamentals depending on news and policy. Reckless chasing of such stocks can lead to substantial losses."

The aggressive betting on newly listed stocks by Korean retail investors has continued into August. As of August 6, Figma ranked first among stocks with the highest net purchases by Korean retail investors this month (about $103.7 million). On its first day of listing, July 31, Figma's stock price soared more than 250% above its IPO price. In Korea, investment sentiment was further fueled by news that Ark Investment, led by the well-known "Money Tree Sister" Cathie Wood, had purchased 60,000 shares of Figma.

However, Figma's upward momentum did not last long. Although expectations for the adoption of artificial intelligence (AI) tools boosted its valuation (market capitalization of $60 billion) to about three times the level when Adobe attempted to acquire the company in 2022, the burden of valuation following the post-IPO surge spurred selling, causing the stock price to drop more than 47% from its peak. Given that 66.7% of Figma's shares are reportedly held by retail investors, Korean retail investors are also expected to be hit hard.

Nevertheless, as optimism about the US stock market persists, analysts say that if investors reduce their exposure to theme stocks in pursuit of excess returns, there will still be opportunities for a rebound. Choi Bowon, a researcher at Korea Investment & Securities, stated, "In early to mid-August, the market is likely to experience a temporary pullback as macro indicators reflecting tariff impacts come into play. However, considering the strong performance of large-cap companies, improved outlooks for the second half of the year, and the fading of tariff-related concerns, there is still room for further gains." He projected the S&P 500 index's expected range for August to be between 5,950 and 6,500.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)