Record High Number of Financial Institutions Subjected to Prompt Corrective Action in a Decade

Widespread Warnings for Savings Banks and Real Estate Trust Firms as Real Estate Project Financing Delinquencies Grow

Number of Institutions Receiving Prompt Corrective Action Expected to Continue Rising for the Time Being

In the past year, there has been a sharp increase in the number of financially distressed institutions that have been subjected to Prompt Corrective Action (PCA) by financial authorities. As real estate project financing (PF) delinquencies have expanded, savings banks, capital companies, and real estate trust firms have been the main targets of management improvement demands. Although these financial institutions facing heightened insolvency risks are seeking solutions through measures such as selling management rights and paid-in capital increases, it is expected that the authorities will continue to impose PCA for the time being.

Highest Number of Financial Institutions Subjected to PCA in a Decade

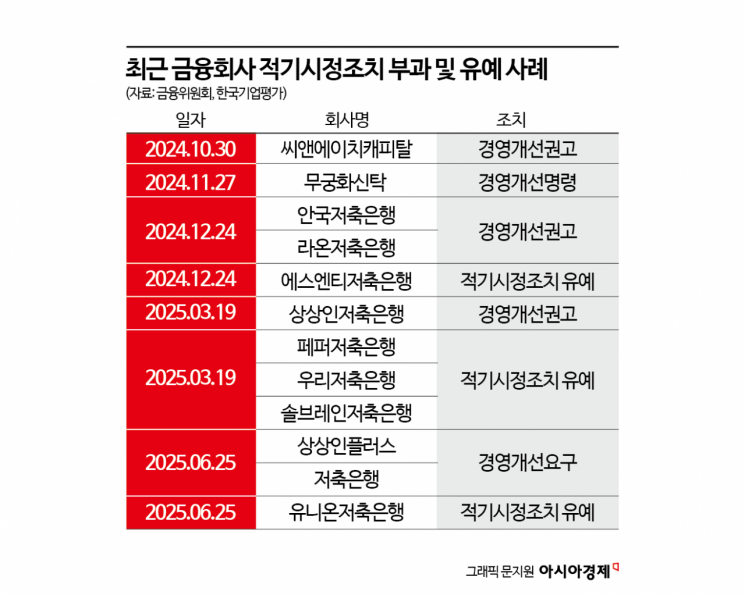

According to the Financial Services Commission, the Financial Supervisory Service, and Korea Ratings, a total of 12 financial institutions received PCA or deferrals from the authorities between October last year and June this year. PCA is a management improvement measure imposed by financial authorities on institutions showing signs of insolvency. The measures range from the lowest level, a management improvement recommendation, to a management improvement request, and a management improvement order. If these improvements are not implemented, the measures can escalate to business suspension or even market exit, making PCA a powerful supervisory tool for maintaining financial soundness.

PCA for domestic financial institutions was extremely rare, with only four cases in total from 2014 to the first half of last year. However, starting in the second half of last year with CNH Capital, Mugunghwa Trust, Anguk Savings Bank, and Raon Savings Bank, and continuing this year with SangSangIn Savings Bank, SangSangIn Plus Savings Bank, Pepper Savings Bank (deferred), and Woori Savings Bank (deferred), a number of financial institutions have been required by the authorities to improve their management.

The majority of financial institutions subjected to PCA were already facing severely deteriorated financial soundness due to prolonged deficits. CNH Capital, which received a management improvement recommendation in October last year, had been running large deficits since 2022, and by the end of June 2024, had entered partial capital impairment, with a delinquency rate reaching 25.2%, indicating a significant decline in soundness. Mugunghwa Trust, which received a management improvement order in November last year, had a net capital ratio (NCR) of only 69% as of September, far below the 100% threshold required to trigger a management improvement order. Anguk, Raon, and SangSangIn Savings Bank were also recommended to improve management after being rated as grade 4, indicating weak asset soundness, in their management status evaluations.

Widespread Warnings for Savings Banks and Real Estate Trusts as Real Estate PF Delinquencies Grow

Korea Ratings recently analyzed that the increase in PCA for financial institutions is mainly due to deteriorating asset soundness and declining profitability caused by the expansion of real estate PF delinquencies. In the savings bank sector, real estate PF risks have grown since 2022 due to a sluggish real estate market and declining borrower repayment capacity. As a result, the delinquency rate, which was 4.1% at the end of 2022, rose to 7.4% at the end of 2023 and 9.9% at the end of 2024, indicating a significant deterioration in asset soundness. Out of 79 domestic savings banks, 39 recorded losses last year. Real estate trust companies have also continued to struggle with poor profitability as new orders have slowed, land trust income has declined, trust account loans have expanded, and provisions for bad debts have increased.

Korea Ratings expects the number of financial institutions meeting the criteria for PCA to continue to rise for the time being. Despite efforts by savings banks to clean up bad assets and increase capital, the average delinquency rate for the 79 savings banks was 10.4% at the end of March 2024, up from the end of 2024. Among these, 23 institutions had delinquency rates of 12% or higher. In the insurance sector as well, the key soundness indicator, the new solvency margin ratio (K-ICS), continues to face downward pressure. As of the end of March, five insurance companies had a K-ICS ratio below 150%, with concerns mainly centered on small and medium-sized insurers. Real estate trust companies have also seen slow recovery in soundness, with four companies still recording losses this year.

Kim Junghyun, a senior analyst at Korea Ratings, explained, "PCA can lead to credit rating downgrades and falling bond prices, significantly increasing investment risk. There is a possibility that fundamentals could deteriorate rapidly due to business contraction and weakened financial flexibility resulting from declining credibility." He added, "It is necessary for financial institutions to present sufficient and effective management improvement plans, such as capital increases or asset sales, and to implement them swiftly and proactively during the pre-hearing process before PCA is imposed by the authorities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)