U.S. Tariff Rate Set at 19%

Signs of Order Resumption from Amazon and Others

Non-Mattress Production Also Returning to Normal

With the resolution of U.S. tariff risks, the stalled business clock of Zinus has started ticking again. The company has also resumed production of its non-mattress products, which had previously slowed, raising expectations for a rebound in performance in the second half of the year.

According to the furniture industry on August 6, as the United States has recently finalized tariff rates imposed on its trading partners, orders for Zinus products from major clients such as Amazon and Walmart are gradually recovering. In particular, the U.S. has set a reciprocal tariff rate of 19% on Indonesia, which is the main production base for mattresses, reversing the previously conservative approach of U.S. distribution channels. Throughout the first half of the year, client orders were delayed due to tariff uncertainties, but as the company avoided the initially feared high tariff rate of over 30%, demand is showing signs of recovery. A company representative explained, "Orders from major clients such as Amazon and Walmart have started to increase," adding, "This is why we expect operating profit to grow in the third quarter."

With the normalization of ODM (Original Design Manufacturing) supply and new product launches, which had been temporarily suspended due to tariff issues, the foundation for a rebound in the non-mattress segment is also being laid. Starting this month, Zinus is officially operating a newly established factory near Phnom Penh, Cambodia, and will begin full-scale production of non-mattress products such as frames for the U.S. market. This move is intended to put the segment, which has experienced negative growth for the past three years, back on a growth trajectory. The company plans to enhance supply stability by operating a "two-track system" with production bases in both China and Cambodia, and aims to establish a stable operational system within six months at the latest.

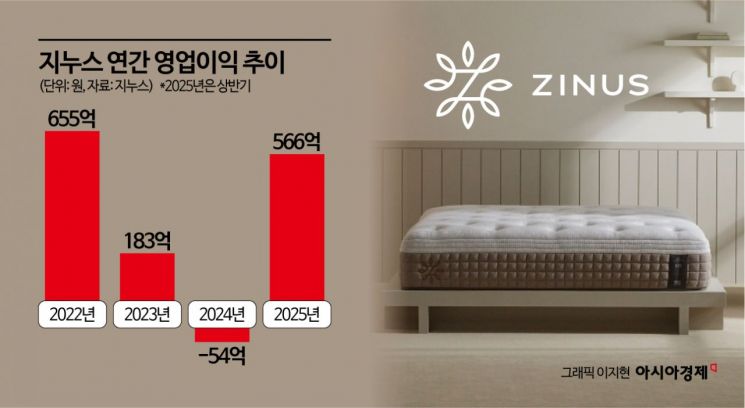

Zinus has suffered from sluggish performance due to weakened U.S. consumer demand, excess inventory, and risks such as anti-dumping and reciprocal tariffs following the COVID-19 pandemic. After being acquired by Hyundai Department Store Group, the company's revenue, which stood at 1.1 trillion won in 2022, fell to 920 billion won, and last year it posted an annual deficit, earning the reputation of the group's "troubled child." However, after implementing comprehensive structural reforms such as reducing the number of products, integrating U.S. logistics centers, and optimizing warehouse operations, the company recently succeeded in turning its performance around. This year, Zinus has also adjusted the prices of its main products to defend profitability.

Performance indicators are also showing signs of recovery. In the second quarter of this year, Zinus posted consolidated sales of 229.5 billion won, an 11.2% increase year-on-year, and achieved an operating profit of 29.1 billion won, returning to profitability. The company explained that sales growth, inventory efficiency, and cost reduction were achieved simultaneously, and the effects of business restructuring were reflected in its performance.

The company also plans to accelerate its expansion into global markets outside the United States. In particular, Zinus began its first sales in the Middle East in June, launching in the United Arab Emirates (UAE). After assessing the market atmosphere in the UAE, the company aims to begin sales in 29 countries within three years. Additionally, Zinus expects to maintain stable double-digit sales growth in the Latin American market, leveraging its subsidiaries in Mexico and Chile.

A company representative stated, "Due to U.S. tariff issues, many furniture companies are seeking to expand production outside China to third countries, resulting in active restructuring of supply sources. We are working to leverage the current situation as growth momentum, including securing additional orders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.