Ecopro Reclaims Third Place in Market Cap After Four Days

Ecopro BM’s Strong Earnings Boosted by Recent Secondary Battery Stock Rally

Peptron, Which Surged Nearly 56% Last Month, Slows Down This Month

Gap Between Ecopro and Peptron’s Market Cap at 187.6 Billion Won

The competition between Ecopro and Peptron for the third-largest market capitalization on KOSDAQ is intensifying. Earlier this month, it seemed that Peptron had solidified its position at third place, but with Ecopro reclaiming the spot, the rivalry between the two stocks is expected to continue for the time being.

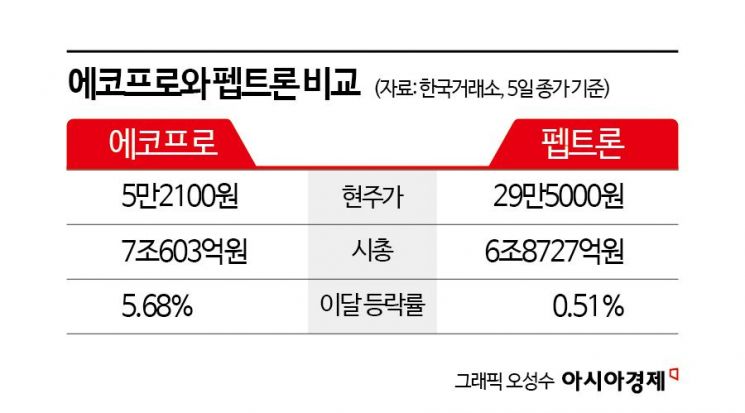

According to the Korea Exchange on August 6, Ecopro closed at 52,100 won on the previous day, up 8.54%. Its market capitalization reached 7.0603 trillion won, regaining the third spot in market cap. This comes just four days after ceding third place to Peptron on July 31. On the same day, Peptron closed at 295,000 won, up 0.34%, with a market cap of 6.8727 trillion won.

In June, the competition for third place was mainly between HLB and Ecopro, but last month, Peptron rapidly emerged as a contender. By late July, the rivalry had narrowed down to a two-way race between Ecopro and Peptron.

Peptron’s stock price surged by 55.87% last month alone, making it a rising powerhouse on KOSDAQ. At the beginning of last month, Peptron ranked seventh or eighth in market cap, but steadily climbed to capture the third spot. Peptron’s stock price gained momentum after the Ministry of Food and Drug Safety granted approval for Loopwon, a one-month sustained-release treatment for prostate cancer and precocious puberty. Loopwon is the first pharmaceutical developed using Peptron’s long-acting drug delivery platform. Um Minyong, a researcher at Shinhan Investment Corp., said, "Loopwon is a product for which Takeda’s once-monthly Lupron is the original, and only a very few big pharma companies such as AstraZeneca, Sanofi, and Ipsen have received approval." He added, "In Korea, Peptron is the only company to have met the criteria for bioequivalence, achieving approval solely based on its own technology, manufacturing, and clinical capabilities, which is noteworthy." However, after the sharp rise last month that pushed the stock price above 300,000 won, the pace of increase has slowed somewhat. This month, the stock has risen by only 0.51%.

Meanwhile, Ecopro, which had long maintained the third-largest market cap on KOSDAQ, has seen renewed optimism with a 5.68% rise so far this month. Although it hit a 52-week low in late May when it fell below the 40,000 won mark, the stock has steadily recovered and is now trading above 50,000 won.

In particular, shares surged after its subsidiary Ecopro BM reported a surprise earnings result for the second quarter of this year. On the previous day, Ecopro BM announced that its consolidated operating profit for the second quarter reached 49 billion won, up 1,159% year-on-year. This marks a second consecutive profitable quarter following the first quarter. The strong performance was driven by a significant increase in shipments of cathode materials for energy storage systems (ESS) and electric vehicles (EV).

With secondary battery stocks expected to remain strong for the time being, attention is focused on whether Ecopro can hold onto its third-place position. Joo Minwoo, a researcher at NH Investment & Securities, said, "In July, secondary battery stocks performed strongly due to rising lithium prices and expectations for ESS orders." He added, "With China’s supply reform plan expected to be announced in September and additional expectations for EV and ESS orders, we anticipate a short-term rebound through September."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.