High-income individuals have been caught by customs authorities for smuggling expensive whisky or manipulating prices to evade taxes.

The Seoul Main Customs Office of the Korea Customs Service announced on August 5 that it had referred 10 individuals?including doctors, university professors, and company CEOs?to the prosecution for smuggling 5,435 bottles of high-priced whisky (with a market value of approximately 5.2 billion KRW) without import declaration, or for underreporting the value to customs in order to evade taxes such as customs duties.

They are suspected of violating the Customs Act and the Food Sanitation Act, among others. Alongside the referral to the prosecution, an additional 4.1 billion KRW in taxes was collected.

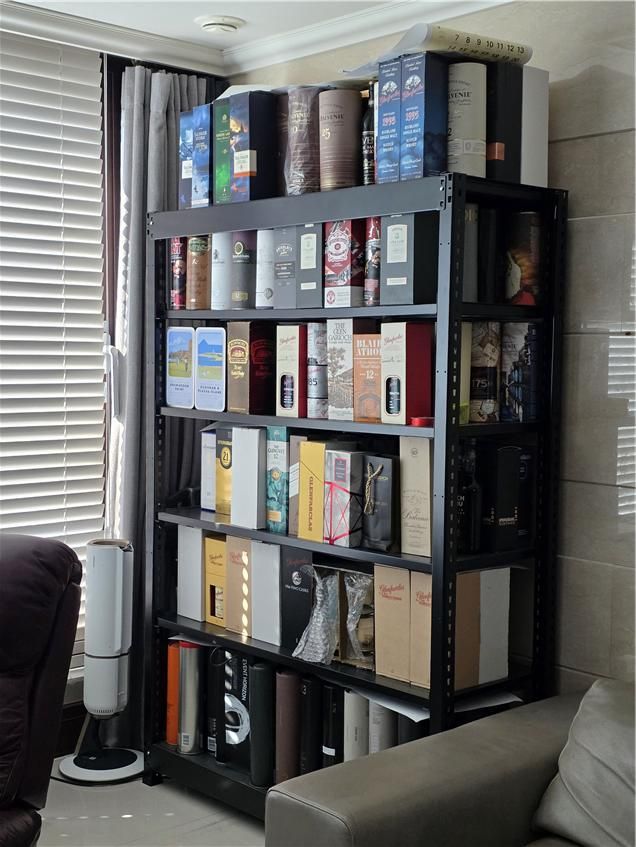

High-end whiskey discovered during the raid is fully stocked in the display cabinet. Provided by Seoul Regional Customs Office, Korea Customs Service

High-end whiskey discovered during the raid is fully stocked in the display cabinet. Provided by Seoul Regional Customs Office, Korea Customs Service

The Seoul Customs Office recently launched an investigation after receiving information that smuggled high-priced whisky was being consumed at gatherings of high-income individuals, such as private clubs.

The investigation, which began in March and lasted four months, involved deploying a large-scale investigative team to conduct multi-layered information analysis, ultimately identifying suspects with either a large quantity of smuggled goods or a high amount of tax evasion.

Authorities checked overseas direct purchase and import declaration records, entry and exit records, overseas credit card usage, and the delivery locations of imported whisky. They then conducted simultaneous searches of the companies and residences of specific suspects. During the searches, 551 bottles of whisky in storage were discovered and seized.

The investigation found that these individuals purchased expensive whisky from overseas liquor sales websites and other sources, then falsely declared the product name or smuggled it without proper import declaration. They are also suspected of evading taxes by underreporting the value of the goods.

For example, Doctor A is suspected of evading approximately 800 million KRW in customs duties and other taxes by importing 395 bottles of whisky worth about 300 million KRW, falsely declaring them as glassware to customs. Among the whisky smuggled by A were products valued at over 10 million KRW per bottle.

Professor B, who works at a prestigious university, purchased 118 bottles of whisky (with a market value of about 45 million KRW), including whisky priced at around 7 million KRW per bottle, through overseas direct purchases in 35 separate transactions. B is suspected of evading 40 million KRW in taxes by declaring the purchase prices as lower than the actual amounts to customs.

Company CEO C is suspected of illegally receiving reductions or evading a total of 500 million KRW in customs duties and other taxes by importing 484 bottles of whisky (worth about 340 million KRW) from overseas whisky sales websites under the names of 11 different individuals, and by underreporting the value of the goods.

In particular, some of those caught were found to have resold the smuggled whisky at a profit. They purchased whisky at relatively low prices by evading taxes and then resold it domestically for unjust gains.

The Seoul Customs Office believes there may be additional cases of whisky smuggling using similar methods and plans to verify both the smuggling activities and the appropriateness of tax payments for additional suspects. For those whose violations are proven, all evaded taxes will be fully collected.

Lee Chulhoon, Director of Investigation Division 1 at Seoul Customs, warned, "If you purchase high-priced liquor through overseas direct purchases and evade taxes by failing to make proper import declarations, you may face both tax collection and criminal penalties."

He also emphasized, "When importing liquor for personal use that exceeds 150 USD through overseas direct purchase, you must pay customs duties and other taxes. Even if the value is less than 150 USD and customs duties and value-added tax are exempt, you are still required to pay liquor tax and education tax."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.