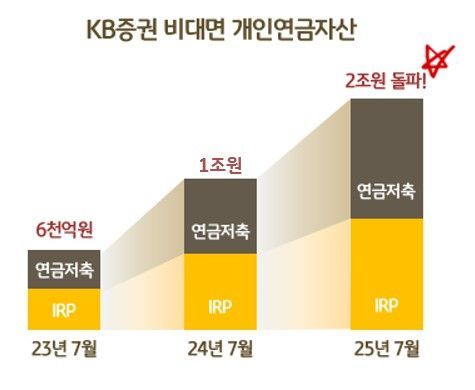

KB Securities announced on August 5 that the personal pension assets (Individual Retirement Pension, IRP, and pension savings) of its non-face-to-face clients have surpassed 2 trillion won based on valuation.

As of the end of last month, KB Securities' non-face-to-face personal pension assets reached 2.0105 trillion won, marking an increase of approximately 86% compared to the same period last year. During the same period, the number of pension clients and net deposits also grew by 36% and 42%, respectively.

In particular, the number of clients in their 20s and 30s more than doubled, confirming that interest in pension asset management is rising among younger customers.

Additionally, the proportion of deposits and installment savings investments decreased by about 9% year-on-year, while the proportion of investments in exchange-traded funds (ETFs) and funds increased by more than 10% during the same period, indicating a shift in the asset composition of KB Securities' non-face-to-face pension clients. This change is the result of growing interest in retirement planning and tax benefits, as well as a paradigm shift in asset management from 'saving' to 'investing'.

Accordingly, KB Securities continues to introduce differentiated and customized pension asset management services for non-face-to-face clients. Last month, KB Securities launched a new 'Pension Insight' section on its flagship mobile trading system (MTS), 'M-able', providing clients with an overview of their pension assets as well as a variety of investment products and related content. The company has also simplified the process for opening Individual Retirement Pension (IRP) accounts and launched a non-face-to-face service for transferring funds from matured Individual Savings Accounts (ISA) to pension accounts, thereby enhancing services to allow clients to manage their pension assets easily and conveniently on their own.

In addition, KB Securities is offering a lifetime waiver of management and asset management fees for clients who open IRP accounts non-face-to-face, along with a 'one-stop' service through the dedicated non-face-to-face pension consultation center, 'Pension Asset Management Center', which opened in March. This center provides comprehensive consultation services covering everything from pension enrollment and contributions to investment and withdrawals. Clients who transfer (or newly deposit) their pension assets to KB Securities to use non-face-to-face pension asset management services can also participate in the ongoing IRP and pension savings net increase event until the end of August, receiving both event benefits and services.

Son Heejae, Head of the Digital Business Group at KB Securities, stated, "Interest in pension assets is growing across various age groups," and added, "We plan to continuously improve and expand our services so that clients can manage and operate their pension assets easily and securely in a non-face-to-face manner, reflecting their diverse needs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)