Second-Half Net Profit of Four Major Financial Holding Companies Estimated at 8.7 Trillion Won

Mortgage Loan Supply Cut in Half... Interest Income Expected to Decline

Fair Trade Commission Set to Impose Fines for LTV Collusion

Banks to Share at Least 400 Billion Won for Bad Bank

Support Also Required for Advanced Strategic Industry Fund

The performance of the four major financial holding companies in the second half of this year is expected to fall significantly short of that in the first half. This is because the scale of mortgage loans in the second half has been reduced to about half due to lending regulations, and the burden of supporting programs such as the bad bank and the Advanced Strategic Industry Fund is considerable. Additionally, the confirmation of sanctions by the Fair Trade Commission within the year is another source of pressure.

According to FnGuide on August 5, the combined net profit of the four major financial holding companies for the second half is estimated at 8.724 trillion won. This represents a 15.5% decrease compared to the total net profit of 10.3245 trillion won in the first half.

Mortgage Loan Limit Halved in Second Half... Interest Income Expected to Decline

The greatest challenge to performance in the second half is interest income. In the first half of this year, the four major banks recorded 17.423 trillion won in interest income. The banks actively promoted mortgage loans, and the widening gap between deposit and lending rates contributed to the increase in interest income in the first half.

However, in the second half, the 6·27 lending regulation has reduced the mortgage loan limit by half. Even if the gap between deposit and lending rates widens, there is a limit, making a decline in interest income inevitable. A commercial bank official said, "This year, the total mortgage loan limit across all financial sectors is about 70 trillion won, with a 45 to 55 split between the first and second halves. Since the financial authorities have reduced the supply of mortgage loans by half in the second half, it does not seem easy to expand interest income."

Banks are turning their attention to corporate loans, but there are limitations due to the risk-weighted assets (RWA) regulation. Each loan held by a bank has a different risk weight, and corporate loans usually have higher risk weights than mortgage loans. Corporate loans require more capital reserves than mortgage loans under capital regulations. Since banks are maintaining a Common Equity Tier 1 (CET1) ratio of around 13% as recommended by the financial authorities, it is not easy to expand corporate loans.

Banks Must Bear at Least 400 Billion Won for Bad Bank Contribution

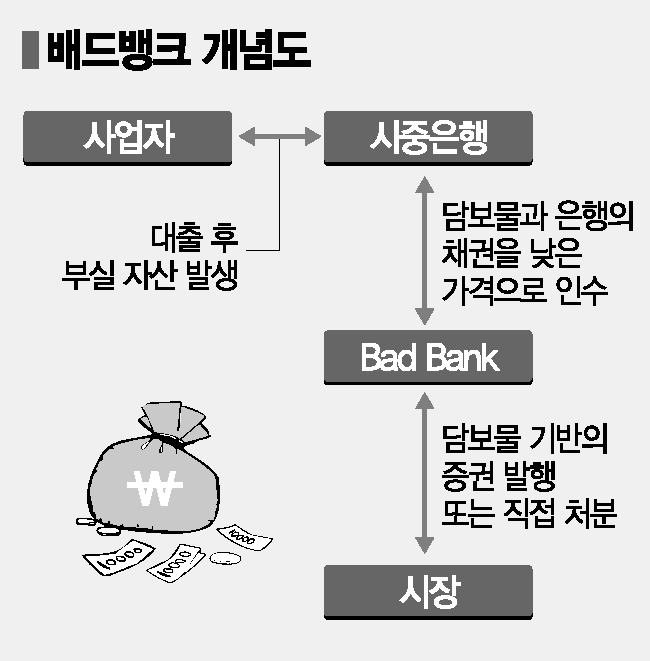

The cost that must be immediately reflected in the financial statements is the 'bad bank (long-term delinquent bond write-off)' program. The bad bank, a presidential campaign pledge of President Lee Jaemyung, has a total budget of 800 billion won. Of this, 400 billion won will be raised through an additional supplementary budget, and financial companies will bear the remaining 400 billion won.

The Korea Federation of Banks, Korea Financial Investment Association, and other financial associations are discussing the cost-sharing ratio for the bad bank. Although not yet finalized, it is known that the banking sector will bear 90% (about 350 to 360 billion won) of the cost. This is because most of the delinquent bonds purchased by the bad bank are held by banks.

Currently, banks are also providing financial support to small business owners in addition to the bad bank. The 'inclusive finance' programs, such as interest rate reductions and debt restructuring, which banks bear on their own, are estimated to amount to about 2.1 trillion won.

This is not the end. As the government shifts the role of finance from supporting the real estate market to 'productive finance,' banks are also required to provide support for this purpose. Under the leadership of Korea Development Bank, a 100 trillion won 'Advanced Strategic Industry Fund' will be created for key industries such as semiconductors, artificial intelligence (AI), and shipbuilding, with banks expected to be responsible for part of the funding.

Fair Trade Commission to Finalize LTV Collusion Sanctions Within the Year... Fine Risk

Meanwhile, the possibility of sanctions by the Fair Trade Commission is also a burden. Last year, the Fair Trade Commission sent an examination report stating that the four major banks exchanged information related to the loan-to-value (LTV) ratio for mortgages and intentionally lowered the LTV. Despite two plenary sessions and a reinvestigation earlier this year, the commission again sent an examination report to the relevant banks, concluding that collusion had occurred and sanctions were necessary.

The four major commercial banks are concerned that the amount of fines could be larger than expected. Fines are calculated by multiplying the standard rate by sales. The Fair Trade Commission initially calculated sales based on interest income from new loans, but during the reinvestigation, it reportedly included interest income from extended loans as well. Considering this, the total fines could reach the trillion-won level, according to the financial sector. Fines are generally treated as non-operating losses, but in some cases, they are reflected as provisions.

Another commercial bank official said, "Sanctions related to LTV collusion are a highly controversial issue, so the timing of accounting treatment will be approached cautiously. However, since the business environment has changed from the first half and the cost of inclusive finance is already fixed, the burden will inevitably increase if fines are also imposed."

Banks' Second-Half Performance Expected to Decline... Volatility in Non-Interest Income and Regulatory Burden

The market already expects the four major financial holding companies' performance to decline in the second half. According to FnGuide's tally, the second-half net profit estimates for the four major financial holding companies are 2.3035 trillion won for KB Financial, 2.0929 trillion won for Shinhan Financial, 2.0237 trillion won for Woori Financial, and 2.3039 trillion won for Hana Financial.

Kim Eungap, a researcher at Kiwoom Securities, analyzed, "Interest income is not expected to show a clear upward trend in the future, and non-interest income will inevitably be volatile. Third-quarter consolidated net profit is expected to be similar to the second quarter, and thereafter, a decrease in provision costs will be an important factor for performance improvement."

Jeon Baeseung, a researcher at LS Securities, also said, "Considering the downward pressure on NIM due to additional rate cuts in the second half, household loan regulations, and the trend of deteriorating asset quality, the momentum for profit growth will not be strong due to a slowdown in core earnings and increased credit loss burden. The unfavorable regulatory stance is also a burden."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)