At the End of July, South Korea's Foreign Exchange Reserves Reach $411.33 Billion, Up by $1.13 Billion

US Dollar Index (DXY) Rises 2.5%... Dollar-Converted Value of Non-Dollar Assets Declines Relatively

New Issuance of Foreign Exchange Stabilization Bonds and Increased Investment Income Drive Growth

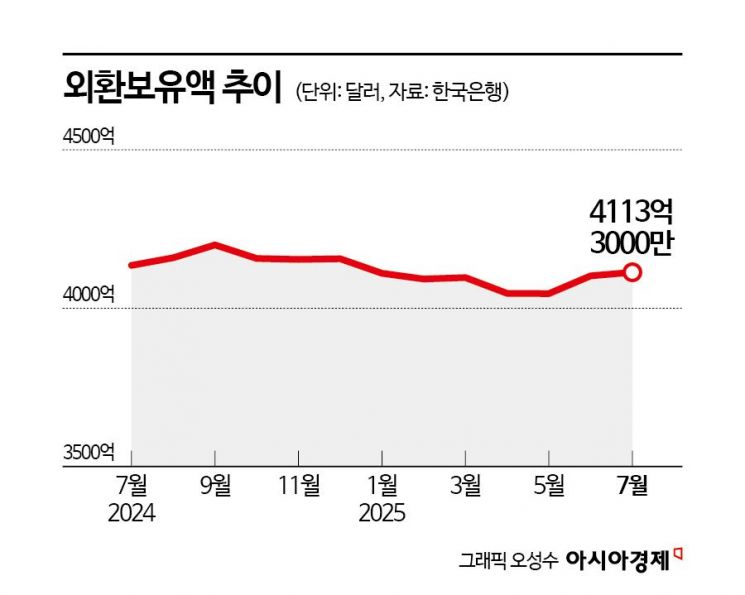

South Korea's foreign exchange reserves increased for the second consecutive month. Although the dollar-converted value of non-dollar foreign assets decreased due to the strong US dollar, the reserves continued to rise for two months in a row. This was attributed to both the new issuance of Foreign Exchange Stabilization Bonds (Oe-pyeong-chae) and an increase in investment income.

According to the Bank of Korea on the 5th, as of the end of last month, South Korea's foreign exchange reserves stood at $411.33 billion, up $1.13 billion from $410.2 billion at the end of the previous month. During this period, the strong US dollar led to a relative decrease in the dollar-converted value of non-dollar foreign assets. However, the proceeds from the issuance of 1.4 billion euros worth of Oe-pyeong-chae, issued on June 26, were deposited in July, and investment income also increased, allowing the reserves to continue their upward trend. In July, the US Dollar Index (DXY) rose by about 2.5%.

South Korea's foreign exchange reserves steadily increased until the second half of 2021. At the end of October 2021, the reserves reached $469.2 billion, approaching $470 billion. However, starting in 2022, the reserves shrank as they were affected by the US Federal Reserve's policy rate hikes. Around October last year, the uncertainty in trade policy intensified following the election of US President Donald Trump, and the continued strong dollar, combined with additional domestic political risks such as the year-end emergency martial law situation, led to ongoing dollar sales to defend the exchange rate, resulting in a decline in reserves. Although there were minor fluctuations, from February to May this year, the reserves even fell below the $410 billion level.

Among the components of the July foreign exchange reserves, securities?which include government bonds, corporate bonds, and government agency bonds?increased by $6.56 billion from the end of the previous month to reach $365.06 billion. Securities accounted for 88.8% of the total foreign exchange reserves. Deposits decreased by $5.29 billion to $21.25 billion (5.2%). Special Drawing Rights (SDR) from the International Monetary Fund (IMF) amounted to $15.71 billion (3.8%), gold stood at $4.79 billion (1.2%), and the IMF position was $4.52 billion (1.1%).

Meanwhile, as of the end of June, South Korea's foreign exchange reserves ranked 10th in the world, maintaining its position from the previous month. Within the top 10, only Saudi Arabia (7th) and Germany (8th) saw their reserves decrease, by $1.3 billion and $100 million, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)