Highest Level in 3 Years and 7 Months, Down 19% from Previous Month

Decline in Seoul and Gyeonggi Due to Loan Regulations

Latent Demand Group... Panic Buying Must Be Prevented Through Supply Signals

Since the implementation of the metropolitan area loan regulations in June, the number of first-time homebuyers without prior home ownership has shifted to a downward trend. This cooling occurred just a month after the number of first-time homebuyers reached its highest level in three years and seven months, due to the introduction of stringent regulations. Experts explain that, as those seeking to buy their first home remain a latent demand group, it is important for policy signals to discourage them from making hasty purchases.

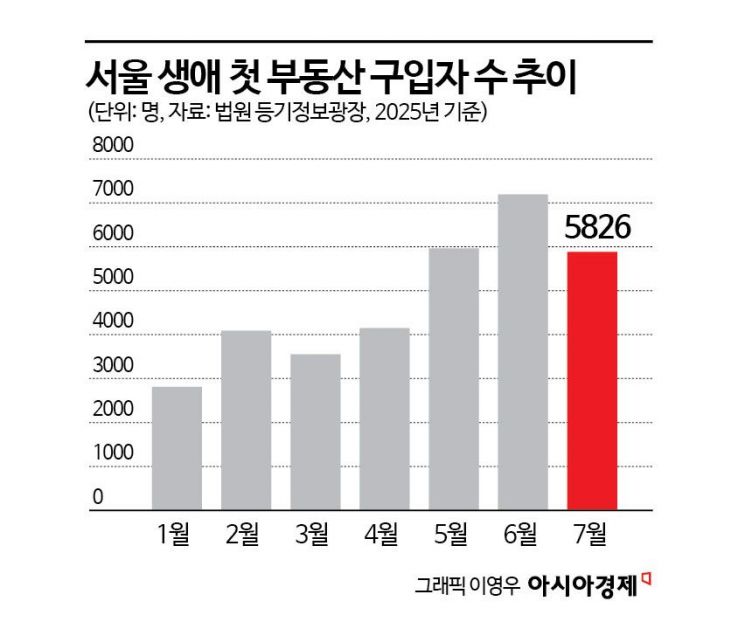

According to the Court Registration Information Plaza on the 5th, the number of first-time real estate buyers who purchased collective buildings (such as officetels, apartments, row houses, and multiplex houses) in Seoul last month was 5,826. This represents a 19% decrease compared to the previous month (7,192), and it is also 2.3% lower than in May.

In Gyeonggi Province, which was also subject to the recent loan regulations along with Seoul, the number of first-time real estate buyers also declined. Last month, the figure stood at 9,860, a 17% decrease compared to June (11,901).

By age group, the decline was less pronounced among younger buyers, while the decrease was greater among middle-aged and older buyers, resulting in different trends across generations. Among those in their 20s and 30s who purchased real estate for the first time in Seoul last month, the numbers decreased by 13% each compared to the previous month. This suggests that younger people were more concerned that they might miss the opportunity to buy a home in Seoul if prices rose further in the future. In contrast, the number of buyers in their 40s dropped by 25%, and those in their 50s by 32% over the same period. The number of buyers in their 60s and those aged 70 or older also fell by 22% each, indicating a greater decline among older age groups compared to younger ones.

The number of first-time real estate buyers had reached 2,812 in January, and then exceeded 7,000 in June for the first time in 43 months since November 2021. The 6·27 loan regulations, which limited the maximum amount of mortgage loans in the metropolitan area to 600 million won and reduced the policy loan limit by 25%, helped to calm the panic buying phenomenon.

The slowdown in the rise of apartment sale prices in Seoul also contributed to the decrease in the number of first-time real estate buyers. As the increase in apartment prices slowed, more potential buyers chose to observe the market rather than immediately purchase a home. According to the Korea Real Estate Board's weekly nationwide apartment price trend survey, apartment sale prices in the fourth week of July rose by 0.12%. The rate of increase narrowed by 0.04 percentage points compared to the previous week (0.16%), marking the fifth consecutive week of deceleration.

Kim Hyosun, Chief Real Estate Specialist at NH Nonghyup Bank, explained, "While the 6·27 measures have played a role in reducing purchasing power, signals that further government regulations may be introduced are causing some buyers to postpone their purchases. Although record-high prices are being reported for some high-priced apartments, the housing market subject to loan regulations is being relatively more affected."

However, there are also arguments that, since those seeking to purchase real estate for the first time have not completely left the market, policies are needed to prevent them from making impulsive purchases. Yoon Sumin, Real Estate Specialist at NH Nonghyup Bank, emphasized, "As long as there is an empirical perception that housing prices will eventually rise even if transaction volumes decrease, those seeking to buy a home for the first time will inevitably remain as latent demand. It is important to send a strong supply signal, indicating that if they wait, they will eventually be able to buy a home, so as to prevent panic buying."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)