DL E&C and GS E&C Deliver Earnings Surprises

Samsung C&T and Daewoo E&C Struggle

Industry Profitability Improves Overall

Second Half Focus: Profit Recovery and Securing New Growth Engines

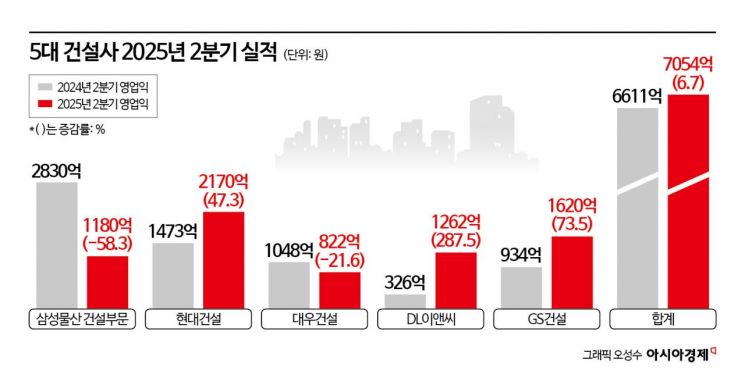

The second-quarter performance of the top five domestic construction companies, ranked by construction capability, showed a stark contrast among individual firms, resulting in mixed fortunes. The results diverged depending on each company's ability to manage the cost ratio of core business divisions and the scale of one-off profits or losses. DL E&C and GS E&C posted an 'earnings surprise' that far exceeded market expectations. In contrast, Samsung C&T and Daewoo E&C failed to escape sluggish results. Hyundai E&C, which implemented a 'big bath' (recognizing potential losses) last year, reported solid results. Despite the differing performances of individual companies, the combined operating profit of the top five construction firms reached approximately KRW 705.4 billion, a 6.7% increase compared to the same period last year (approximately KRW 661.1 billion), confirming an overall trend of improved profitability across the industry.

The standout performer this earnings season was unquestionably DL E&C. The company recorded an operating profit of KRW 126.2 billion in the second quarter, a 287.5% surge compared to the same period last year. Jang Moonjun, a researcher at KB Securities, praised DL E&C's results as "a clean surprise without any one-off factors," adding, "The improvement in the business mix due to the completion of high-cost projects has brought the company into a normalized performance phase."

GS E&C also achieved an operating profit of KRW 162 billion, a 73.5% increase year-on-year, significantly surpassing market expectations, though the details were more complex. Moon Kyungwon, a researcher at Meritz Securities, analyzed that "the effect of increased contract volume outweighed the impact of winding up the European subsidiary." Profits from increased housing contracts (about KRW 200 billion) and the reversal of bad debt provisions related to the Qatar Metro (KRW 70 billion) offset various costs, including the liquidation expenses of the UK modular subsidiary (KRW -120 billion).

Hyundai E&C posted a stable operating profit of KRW 217 billion, up 47.3% from the previous year, demonstrating resilience. On the other hand, the construction division of Samsung C&T saw its operating profit drop to KRW 118 billion, a 58.3% decrease year-on-year, due to the completion of large-scale high-tech projects. Despite improved margins in the housing division, Daewoo E&C's operating profit remained at KRW 82.2 billion, a 21.6% decrease compared to the same period last year, due to increased civil engineering cost ratios and the reflection of bad debt expenses related to unsold units (about KRW 50 billion).

Regarding the outlook for the second half of the year, the prevailing view among securities analysts is that a clear distinction between strong and weak companies will become more pronounced. Depending on each company's situation, the urgent tasks are clearly divided, such as proving profitability or securing future growth engines. Companies with poor performance must first address the urgent issue of 'profitability recovery.'

Kim Seungjun, a researcher at Hana Securities, commented on Daewoo E&C, stating, "This year is a period when costs may be reflected outside of operating profit, marking the bottom in terms of performance," and predicted, "Additional cost recognition will decrease from next year." This suggests that resolving immediate cost risks is crucial. For Samsung C&T's construction division, Kim Soohyun, a researcher at DS Investment & Securities, analyzed, "Profitability is expected to recover in the fourth quarter as revenue from large-scale engineering, procurement, and construction (EPC) projects increases." The ability to execute large-scale orders to fill the gap left by high-tech projects will be put to the test.

Companies that posted strong results in the second quarter now face the challenge of proving 'sustainable growth' as the next step. Park Sera, a researcher at Shin Young Securities, expressed optimism about GS E&C, stating, "The reduction in the proportion of new businesses will serve as an opportunity to refocus on GS E&C's core business." She also emphasized the need to reestablish the competitiveness of core operations following the restructuring of non-core businesses. Regarding DL E&C, which achieved a 'clean surprise,' Jang Moonjun of KB Securities pointed out, "The only weakness is new orders." DL E&C's new order target for this year is KRW 13.2 trillion, but cumulative new orders in the first half amounted to only KRW 2.5 trillion.

Hyundai E&C, which received a stable evaluation, is now moving to consolidate its position. Kang Kyungtae, a researcher at Korea Investment & Securities, stated, "The order cycle for power plants centered on large-scale nuclear power projects will continuously improve the valuation multiples for construction stocks," maintaining a positive long-term outlook. This reflects expectations that Hyundai E&C will not only defend its performance but also elevate its market valuation through nuclear power, a clear future growth engine.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.