Vietnamese Processing, Chilean Salmon...

Diversifying Overseas Sourcing and Processing

Declining Sales and Store Numbers...

Entering a Slump

"Please source ultra-low-cost ingredients."

Recently, food supply companies have been inundated with such requests from the headquarters of dining franchise chains. The burden of fixed costs, such as raw material prices and labor costs, continues to grow, but with the prolonged slump in domestic demand, even raising prices has become difficult. As a result, the dining industry is shifting its procurement strategy to prioritize unit cost over quality.

According to the food industry as of August 18, many franchise headquarters are replacing key ingredients such as kimchi, sauces, and cheese and butter products with more cost-effective imported alternatives.

On the 14th, a menu board is posted in a restaurant district in Jongno, Seoul, where dining-out prices continue to soar early in the year. According to the Consumer Price Trends by Statistics Korea, the dining-out price inflation rate last year rose by 6% compared to the previous year, marking the highest figure in 30 years. Photo by Jo Yongjun jun21@

On the 14th, a menu board is posted in a restaurant district in Jongno, Seoul, where dining-out prices continue to soar early in the year. According to the Consumer Price Trends by Statistics Korea, the dining-out price inflation rate last year rose by 6% compared to the previous year, marking the highest figure in 30 years. Photo by Jo Yongjun jun21@

Vietnam-processed, Chilean salmon... Diversifying overseas sourcing and processing

In fact, according to Korea Customs Service import and export statistics, kimchi imports from January to June this year reached 163,147 tons ($93.78 million), up 10.1% from 148,137 tons ($84.34 million) during the same period last year. During the same period, cheese imports from Denmark soared to 8,545 tons, a 213% increase from 2,723 tons the previous year. The import price is about 10% lower than that of cheese from the United States, New Zealand, or Germany. Soy sauce imports also rose by 10%, from 5,423 tons to 5,968 tons, with imports from China increasing by 26%, from 2,258 tons to 2,850 tons.

An industry insider explained, "Instead of using premium ingredients, we are adjusting our supply structure to maintain quality at a reasonable price point. Cost reduction through overseas processing, diversifying countries of origin, and adjusting product specifications are representative strategies."

For example, instead of importing Norwegian mackerel and processing it domestically, some companies now process grilled mackerel in Vietnam and re-import it to lower unit costs. Similarly, salmon sourcing is being diversified from a focus on Norwegian salmon to include Chilean coho salmon and New Zealand king salmon.

For dumplings, companies are adjusting the ratio of meat to vegetables in the filling to maintain a certain level of perceived quality for customers while reducing unit costs. For sauces and kimchi, they are slightly modifying the raw ingredient content to preserve flavor while cutting production costs.

Dining sales and store numbers both decline... Entering a slump

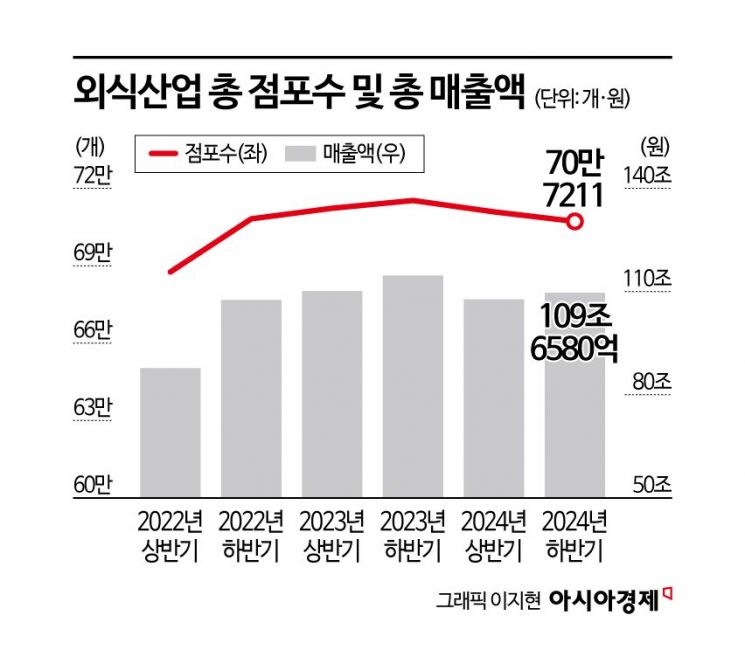

The focus on an "ultra-low-cost strategy" in the dining industry is driven by poor business performance and mounting cost pressures. According to the Korea Foodservice Industry Research Institute, the total sales of dining establishments nationwide rose from 87.7231 trillion won in the first half of 2022 to over 114 trillion won by the end of 2023, but then began to decline the following year. As of the end of last year, sales had dropped to 109 trillion won. The number of stores also decreased from 715,342 at the end of 2023 to 707,211 at the end of last year.

Choi Ji-won, Senior Researcher at the Korea Foodservice Industry Research Institute, analyzed, "In the second half of 2022, the nationwide dining industry saw a temporary rebound in both the number of stores and sales, raising hopes for a recovery, but this trend did not continue. Since last year, the industry has entered a clear decline, with major metropolitan areas, including the Seoul metropolitan area, showing a typical slump characterized by simultaneous contraction in both demand and supply."

At the same time, high interest rates and reliance on loans are putting additional pressure on the dining industry. According to a joint survey by the Korea Foodservice Industry Association and the Foodservice Industry Research Institute, 81.2% of dining businesses responded that they have no capacity to reduce their debt. The average loan amount is 114.17 million won, with 60% of businesses holding two or more loans and 22.4% holding five or more loans.

Loan interest rates are also a problem. The average interest rate at primary financial institutions is around 4.9%, but it jumps to 10.5% at secondary financial institutions and 17.8% at tertiary institutions-a gap of up to 3.6 times. Among all businesses with loans, 36.1% rely on secondary or tertiary financial institutions, and 54.1% said they are unable to repay principal and interest. A staggering 66.1% of businesses mentioned the possibility of closure within a year.

The minimum wage increase is another burden. Last month, the Minimum Wage Commission set next year's minimum hourly wage at 10,320 won, a 2.9% increase from this year's 10,030 won. Based on a 40-hour workweek and 209 working hours per month (including paid weekly holidays), this amounts to a monthly wage of 2,156,880 won, up 60,610 won from the previous year.

While this increase is significant as it marks the first labor-management-public interest agreement in 17 years with consensus from workers, employers, and public interest members, for the dining industry-where labor costs make up a large portion of expenses-it is seen as yet another fixed cost shock.

A franchise representative commented, "Our costs keep rising, but we can't raise prices due to consumer sensitivity, so we have no choice but to demand ultra-low-cost products from suppliers." He added, "In the long run, this creates a major dilemma, as it could threaten both brand image and trust in quality. More companies are now considering expanding overseas, as the domestic market alone has its limits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.