Foreign Investors Net-Buy Over 6 Trillion Won in July

Clear Shift to Net Buying of Samsung Electronics

Positive Outlook for Large-Cap Stocks and KOSPI Index

Korea-US Trade Deal Expected to Further Support Foreign Buying

Foreign investors continued their net buying streak in the domestic stock market for three consecutive months. In particular, as foreign investors have clearly shifted to net buying of Samsung Electronics, there are growing expectations that this will lead to a rise in large-cap stocks and the KOSPI index.

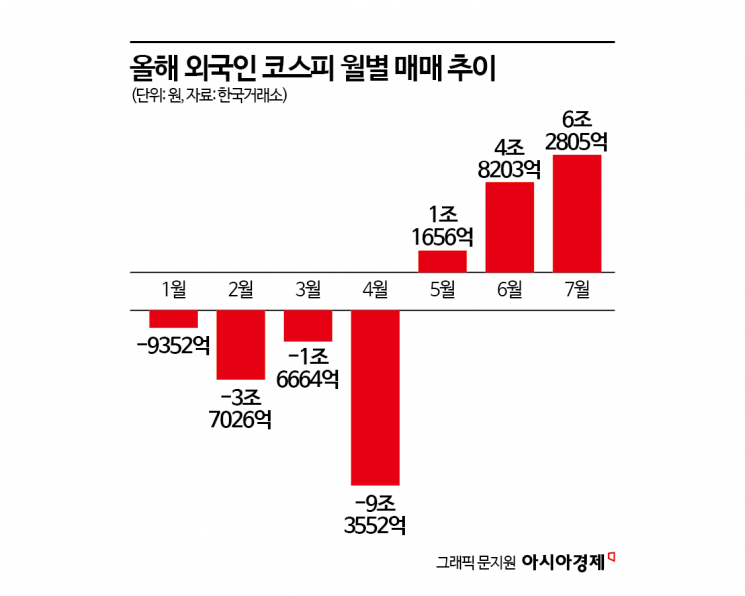

According to the Korea Exchange on August 1, foreign investors recorded a net purchase of 6.2805 trillion won in the Korea Exchange market last month. Foreign investors, who had maintained a net selling trend in the domestic stock market since August of last year, turned to net buying in May this year after 10 months. Since then, they have continued their buying trend for three consecutive months.

The scale of net purchases is also expanding. Foreign investors bought 1.1656 trillion won in May, 4.8203 trillion won in June, and over 6 trillion won last month in the Korea Exchange market.

The stock most heavily purchased by foreign investors last month was Samsung Electronics. They poured 3.4951 trillion won into Samsung Electronics, which accounted for more than half of the total net purchase amount. The foreign ownership ratio rose from 49.64% at the beginning of this month to 50.64%. Other top stocks in terms of net purchases by foreign investors included Hanwha Ocean (857.5 billion won), SK Square (456.7 billion won), Isu Petasys (329.3 billion won), Alteogen (314.6 billion won), Hanwha Aerospace (249.1 billion won), Doosan (242.6 billion won), Kia (213.1 billion won), Korea Electric Power Corporation (210.4 billion won), and SK (207.3 billion won).

The shift of foreign investors to net buying of Samsung Electronics is analyzed to stimulate the inflow of global funds into the domestic stock market. Lee Kyungmin, a researcher at Daishin Securities, said, "Samsung Electronics accounts for more than 20% of the KOSPI market capitalization and the MSCI Korea ETF. The reason why foreign passive funds are heavily influenced by the performance of Samsung Electronics is because of this significant weighting," adding, "From the beginning of this year to July 30, Samsung Electronics contributed 138.6 points to the KOSPI's rise through its rebound alone. The turnaround in Samsung Electronics will also lead to an inflow of passive funds in terms of liquidity, which will act as a driving force for large-cap stocks, previously neglected sectors, and the KOSPI index as a whole."

The conclusion of the Korea-US tariff negotiations is also expected to have a positive effect on the inflow of foreign buying. Lee Jaeman, a researcher at Hana Securities, said, "From the perspective of the domestic stock market, attention should be paid to the won-dollar exchange rate and foreign investors," adding, "The won-dollar exchange rate recently rebounded from a low of 1,354 won to 1,390 won. As uncertainties ease, the won-dollar exchange rate is expected to turn downward again, and the net buying by foreign investors that has continued since May is likely to persist." He continued, "After the inauguration of President Donald Trump and until the announcement of reciprocal tariffs, foreign investors recorded a net sale of 15.6 trillion won (from January to April) in the KOSPI. Considering that foreign investors have made net purchases of about 9.7 trillion won from May to July, it can be seen that about 62% has been recovered."

Experts advise paying attention to sectors or stocks into which foreign buying is flowing. Researcher Lee Kyungmin said, "With the return of foreign index funds, the supply and demand of large-cap sectors such as automobiles, secondary batteries, bio, chemicals, and steel, which account for a large proportion of the KOSPI market capitalization, are also expected to improve," adding, "These have been neglected stocks that have underperformed due to overlapping concerns such as tariffs."

Researcher Lee Jaeman said, "In this Korea-US trade negotiation, the government mentioned that it would actively support the entry of shipbuilding, semiconductors, secondary batteries, bio, and energy industries into the US market, and the uncertainty in the automobile sector has also been eased by the conclusion of this negotiation," adding, "From a strategic perspective, attention should be paid to companies within these sectors where the foreign ownership ratio has declined, the short selling ratio is high, and the earnings growth rate in the second half of the year is high."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)