Average Deposit Rates at Major Banks Remain in the 2% Range,

While Mortgage Rates Stay Above 4%

Loan-Deposit Rate Spread Widens Again After Three Months

Although the base interest rate has remained at 2.50% for two consecutive months, banks have been rapidly lowering deposit and savings account rates, while mortgage loan rates remain at high levels. As banks respond passively to lowering lending rates due to the government's strengthened household debt management policy, the spread between household loan and deposit rates at major banks has widened again after three months.

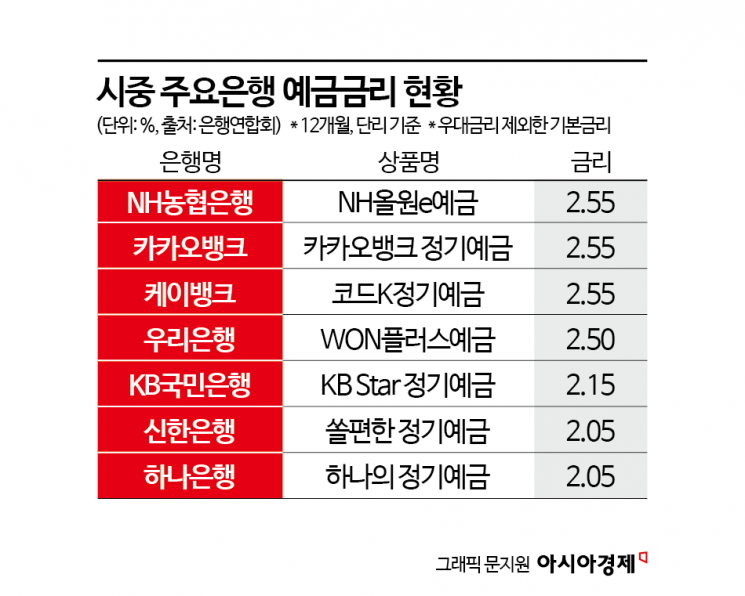

According to the Korea Federation of Banks on July 31, the one-year maturity deposit rates (simple interest) at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) and internet banks ranged from a minimum of 2.05% to a maximum of 2.55%. Previously, commercial banks had already begun lowering interest rates on deposit and savings products. On July 28, Hana Bank announced on its website that it would reduce the base rates for a total of 12 deposit and savings products by 0.1 to 0.5 percentage points starting that day. As a result, the base rate for Hana Bank's "Hana Regular Deposit" (one-year maturity) dropped by 0.15 percentage points from 2.2% to 2.05% per annum. Shinhan Bank also lowered the base rates for 14 regular deposit and 22 savings products by 0.05 to 0.2 percentage points on July 7. Internet banks, which had been known for offering higher rates, cut their deposit rates even more sharply. On July 18, KakaoBank reduced the highest rate for its "One-Month Savings" product by 1 percentage point, from 7% to 6% per annum. K Bank also lowered the base rate for its "Curious Savings" product by 0.5 percentage points.

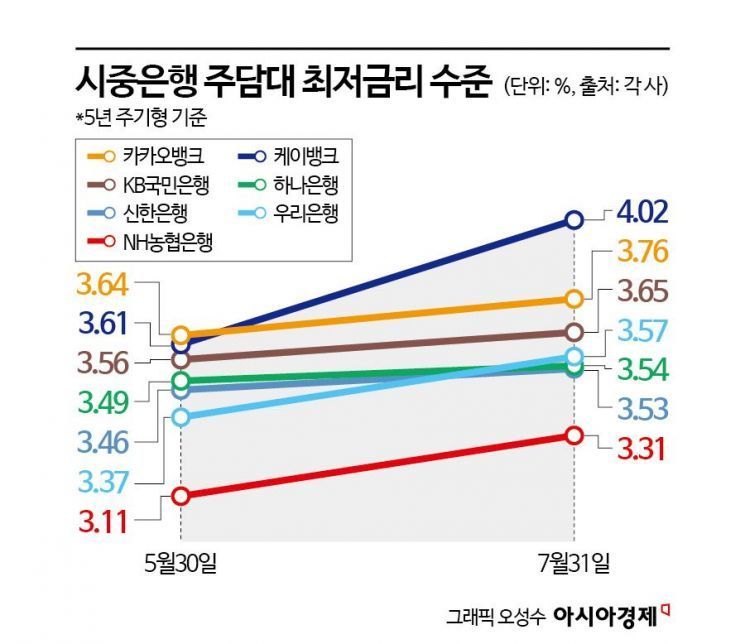

In contrast, mortgage loan rates have continued to rise since April and remain at high levels. As of July 31, the lowest fixed (mixed/periodic) mortgage rate at KB Kookmin Bank was 3.65%, the highest since April (3.78%). The lowest mortgage rates at Shinhan Bank and Hana Bank were 3.53% (five-year financial bond) and 3.54% (five-year fixed/mixed), respectively. Woori Bank's rate rose from 3.28% at the end of April to 3.57% (five-year variable), an increase of 0.29 percentage points.

One reason why deposit and savings rates are falling quickly while loan rates remain high is the government's strong stance on managing household debt. A commercial bank official explained, "Since the government is telling us to reduce lending, the only way to control loan demand is to keep loan rates high." The official added, "In the past, if we wanted to issue more loans, we needed to attract more funds, so we would raise deposit and savings rates. But now, the mortgage loan limit is capped at 600 million won, and there is a policy to reduce lending by about half in the second half of the year, so there is no need to raise deposit and savings rates to attract more funds."

Previously, through the June 27 real estate measures, the government announced that the target for household loan growth in the banking sector for the second half of the year would be reduced by 50% compared to the beginning of the year.

As deposit rates fall and lending rates remain high, the spread between loan and deposit rates has rebounded after three months. According to the Korea Federation of Banks, the average spread between new household loan and deposit rates (excluding policy loans for low-income households) at the five major commercial banks last month was 1.418 percentage points. This is an increase of 0.082 percentage points from the previous month's average of 1.336 percentage points. The loan-deposit spread is calculated by subtracting the deposit rate from the lending rate, and the spread at the five major banks had narrowed slightly in April and May, but widened again in June.

By bank, Shinhan Bank had the largest spread at 1.50 percentage points, followed by KB Kookmin Bank (1.44 percentage points), NH Nonghyup Bank (1.40 percentage points), Hana Bank (1.38 percentage points), and Woori Bank (1.37 percentage points). Of these, only Hana Bank saw its spread narrow from the previous month (1.39 percentage points), while the other four banks saw their spreads widen.

Among internet banks, K Bank had the largest spread at 2.45 percentage points, followed by Toss Bank (2.41 percentage points) and KakaoBank (1.63 percentage points).

A commercial bank official said, "As authorities have left household loan management to the banks' discretion, there is not much room for maneuver," adding, "We will review (the level of interest rates) depending on future developments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)