Sales Increased, but Inventory Valuation Losses Led to Profit Decline

Semiconductor Operating Profit at 0.4 Trillion Won... Fourth Consecutive Quarterly Decline

Foundry Secures Tesla Contract, Providing Momentum for Second-Half Rebound

Mobile Focuses on Flagship Lineup... "Aiming to Drive Further Growth"

Samsung Electronics recorded an "earnings shock" in the second quarter of this year, with operating profit dropping by more than half compared to the same period last year. This was primarily due to significant underperformance in the high-bandwidth memory (HBM) market, considered a core segment for artificial intelligence (AI) semiconductors, and over 2 trillion won in losses from the foundry (semiconductor contract manufacturing) division, which struggled to secure major clients.

However, Samsung Electronics plans to ride the "low-to-high" performance trend and aims for a rebound in the second half of the year. The company intends to improve results in the semiconductor sector through mass production of its in-house mobile chipset "Exynos 2600" based on its most advanced 2nm (1nm = one-billionth of a meter) process, and to enhance market competitiveness by securing major foundry clients, leveraging its contract with Tesla. In the mobile sector, despite a market downturn, Samsung plans to continue growth centered on its flagship lineup.

Operating Profit Halved... Semiconductor Underperformance Takes Toll

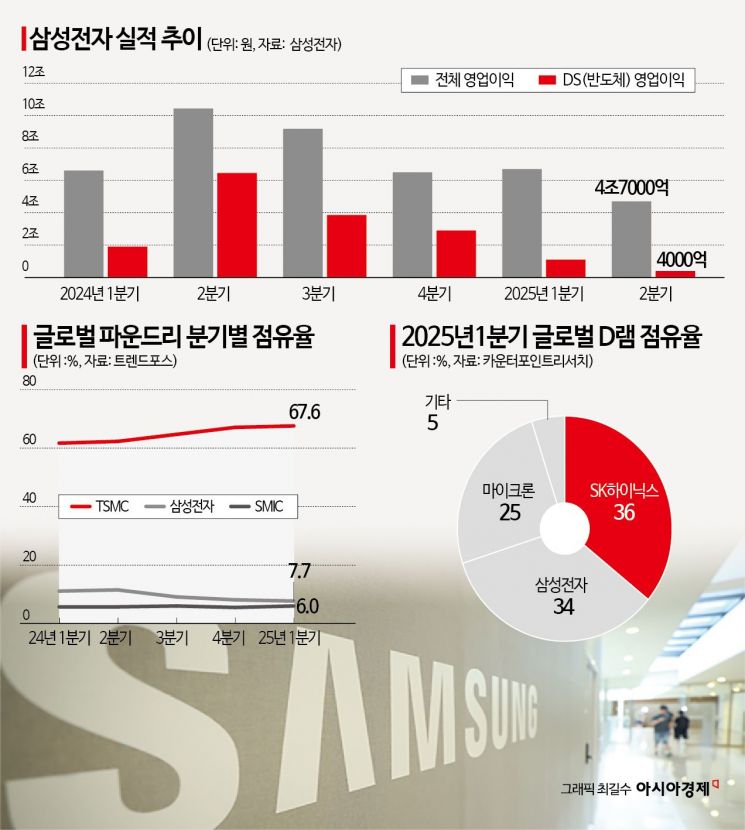

On July 31, Samsung Electronics announced that its consolidated sales for the second quarter of this year reached 74.5663 trillion won, with operating profit at 4.6761 trillion won. Compared to the second quarter of last year, sales increased by 0.6%, but operating profit plummeted by 55.2%. The securities industry had already lowered expectations for Samsung's second quarter results over the past month, but the actual figures fell even further short.

This is attributed to continued losses in the semiconductor division, as well as the impact of the seasonal off-peak period for smartphones. Samsung Electronics explained, "Despite sales growth, operating profit decreased by 800 billion won quarter-on-quarter due to inventory valuation allowances in the memory business and additional inventory allowances in the non-memory business resulting from sanctions on China." The company added, "Sales in the mobile segment fell by 16% due to the diminished effect of new model launches, and operating profit also decreased by 1.4 trillion won."

By division, the Device Solutions (DS) segment, which handles semiconductors, posted an operating profit of only 400 billion won. Considering that the DS segment's operating profit was estimated at least in the upper 1 trillion won range after the preliminary results announcement earlier this month, this is a dismal performance. Semiconductor operating profit has been declining for four consecutive quarters since the second quarter of last year, when it reached 6.45 trillion won.

In memory, the company expanded sales of HBM3E and high-capacity double data rate 5 (DDR5) products to actively respond to server demand, and sales of solid-state drives (SSD) for data centers also increased. However, one-off costs such as inventory valuation allowances weighed on results. The System LSI division achieved solid sales by supplying mobile chipsets for major flagship models, but profitability did not improve due to advanced product development costs.

The foundry division, which recently announced an order from Tesla worth about 23 trillion won over eight years, saw a significant increase in sales compared to the previous quarter. However, results remained sluggish due to additional inventory allowances and lower utilization rates for mature processes.

The Device Experience (DX) division, responsible for finished products such as smartphones and home appliances, recorded sales of 43.6 trillion won and operating profit of 3.3 trillion won. Although mobile sales volumes declined compared to the first quarter, when new smartphone models were launched, steady sales of flagship models led to growth in both sales and operating profit. For TVs, the company increased the proportion of strategic products such as OLEDs, but intensified global competition, including pressure from Chinese manufacturers, led to a decline in results.

The Mobile Experience (MX) division posted second-quarter sales of 28.5 trillion won, up about 7% year-on-year. Its share of total sales was 38.2%, up 2.3 percentage points from the same period last year. Smartphone sales volumes declined compared to the first quarter, when the Galaxy S25 series was launched, but both sales and operating profit grew year-on-year, driven by continued strong sales of flagship smartphones.

Aiming for a Second-Half Rebound... Growth Expected in Semiconductors and Mobile

Although global trade uncertainties and geopolitical risks are expected to persist in the second half, raising concerns of a worldwide slowdown, Samsung Electronics anticipates that growth will spread, led by future industries such as AI and robotics. In particular, the resolution of tariff negotiations with the United States and the foundry division's acquisition of major clients after a period of underperformance are expected to serve as a springboard for a rebound in results.

For semiconductors, the key factors for second-half performance will be the development of next-generation HBM4 and the mass production of 2nm processes. Samsung plans to actively respond to demand for AI server products such as HBM and high-capacity DDR5 in the memory segment. System LSI is expected to focus on mass production of the "Exynos 2600" for next year's flagship lineup. The foundry division aims to improve profitability by mass-producing new mobile products using the 2nm process and expanding sales to key customers.

During the second-quarter earnings conference call, Samsung Electronics stated, "Successfully securing advanced product orders from Tesla has proven our competitiveness in advanced processes. This milestone is expected to lead to additional orders from major clients in the future, and stable operation and profit expansion at the Taylor fab (factory) in the United States are anticipated."

Samsung Electronics has secured a foundry contract with Tesla worth about 23 trillion won over the next eight years, producing AI6 chips that will build Tesla's future ecosystem using the 2nm process. Based on this, full-scale operation of the Taylor fab is expected to begin next year, and Samsung announced that facility investment will increase next year compared to this year to coincide with the start of operations.

For smartphones, the company plans to continue its growth centered on flagship models, including new foldable products such as the Galaxy Z Fold7 and Z Flip7, as well as the Galaxy S25 series. Daniel Araujo, Executive Director of Samsung Electronics' MX division, said, "The smartphone market in the second half is expected to contract due to rising tariffs and economic slowdown caused by high inflation. However, the premium segment is expected to grow slightly year-on-year, driven by economic growth in emerging markets and the premiumization of global consumption patterns."

In particular, the Z Fold7 has become the thinnest model in the Fold series by reducing both thickness and weight compared to its predecessor, and its share in pre-sales before the official launch reached 60%, up from 40% for the previous model.

Samsung Electronics has also officially confirmed the launch of the so-called "twice-folding foldable," the triFold smartphone. Executive Director Araujo said, "We are preparing to launch innovative products, including the triFold and extended reality (XR) headsets, within this year." The industry expects Samsung to unveil a triFold prototype in October.

In addition, for the increasingly competitive TV business, Samsung plans to achieve sales growth by responding early to peak season demand with its "AI TV" lineup, which offers enhanced viewing experiences. For home appliances, the company will restructure its business around high-value-added products such as AI appliances and heating, ventilation, and air conditioning (HVAC), while also optimizing supply locations to reduce the impact of tariffs.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.