On July 30, Samsung Asset Management unveiled its "Top 5 Recommended Pension Account Funds for the Second Half of the Year" for investors aiming to achieve successful retirement planning through pension accounts.

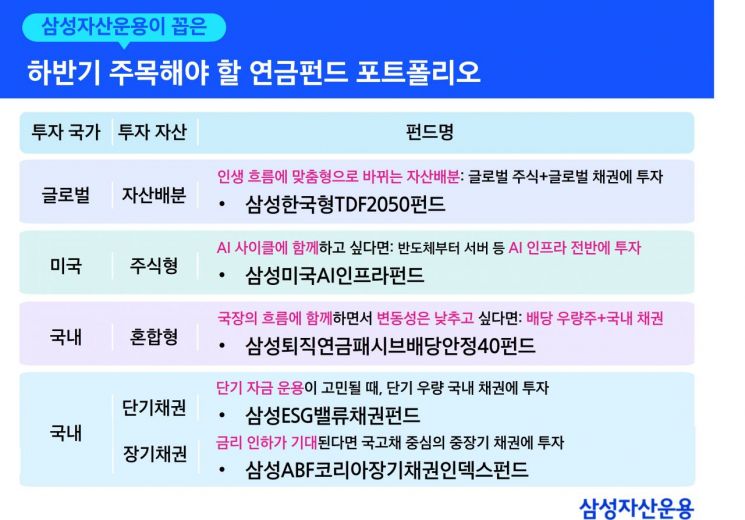

Samsung Asset Management selected five investment asset classes to enable stable and efficient asset allocation even in complex market conditions: U.S. equity, global asset allocation, domestic hybrid, domestic short-term bonds, and long-term bonds. The company highlighted a variety of funds that can participate in the AI-driven global stock market trends while effectively managing volatility.

For investors who find it difficult to select from a wide range of funds on their own, Samsung Asset Management proposed a lifecycle strategy with automatic asset rebalancing as an alternative. The Samsung Korea TDF 2050 Fund is a representative target date fund (TDF) that invests in global assets and automatically adjusts the allocation between stocks and bonds in line with the investor's retirement date. It is structured to be optimized for pension investment.

Investors in their 30s and 40s, whose retirement is expected around 2050, can achieve efficient asset allocation through TDF 2050. Samsung Asset Management offers a variety of products with different target dates in five-year increments up to TDF 2060, allowing for tailored investment strategies by age group.

As a strategy to effectively respond to long-term global trends such as the U.S. government's large-scale infrastructure investment and the rapid increase in demand for the AI industry, the company proposed the "Samsung US AI Infra" fund. This is a thematic fund that focuses on core infrastructure companies forming the foundation of AI, such as U.S. semiconductor, data center, and power companies. As a key asset to benefit from the growth of the AI industry, it is an appropriate choice for pension investors seeking to invest proactively in future growth engines.

In the domestic market, the new government's stock market revitalization policies and the trend toward increased dividends have had a positive impact recently. The company recommended the "Samsung Retirement Pension Passive Dividend Stable 40" fund, which invests in large-cap stocks with high dividend growth rates while also diversifying into domestic bonds to reduce volatility. As a bond-mixed fund with relatively low volatility, it is suitable for investors who may be concerned about the rapid rise in the domestic stock market.

In the bond sector, short-term and long-term strategies can be distinguished depending on the nature of the funds. Short-term funds typically have a strong parking-type orientation. The "Samsung ESG Value Bond" fund, which invests in high-quality domestic bonds with relatively short duration, can be an alternative. It is less sensitive to interest rates while still offering the potential for interest income.

With expectations for interest rate cuts expanding in the second half of the year, interest in long-term bonds is growing. The "Samsung ABF Korea Long-Term Government Bond" fund employs a long-duration strategy focused on government bonds, allowing investors to expect capital gains when interest rates fall.

Jeon Yongwoo, Head of Pension OCIO at Samsung Asset Management, stated, "When investing over a long period through a pension account, a diversified strategy that flexibly responds to various market environments is key," and added, "The recommended funds can provide practical assistance in long-term asset building by reflecting various factors such as policy momentum, industrial structural changes, and interest rate cycles."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)