In early April this year, immediately after U.S. President Donald Trump declared what he called "Liberation Day," the New York Stock Exchange experienced a sharp decline. However, it quickly recovered, and the valuation burden for the New York stock market has once again increased. AllianceBernstein (AB) Asset Management forecast that it is advisable to maintain a strong allocation to U.S. equities, as the profits of American companies are expected to continue rising steadily.

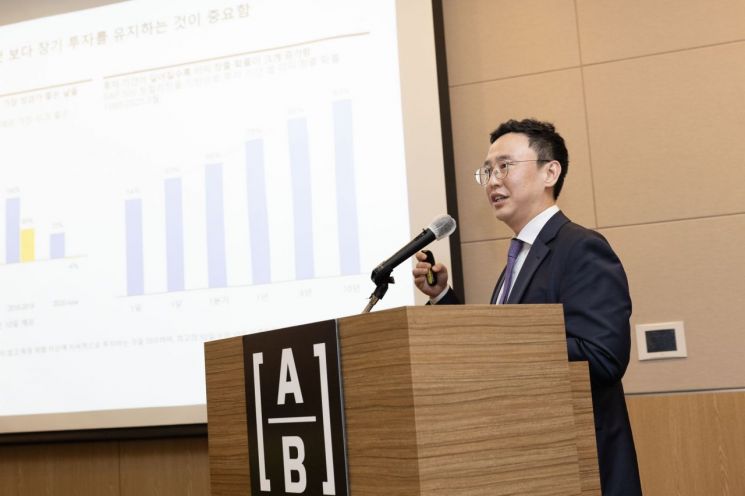

Lee Jaewook, Senior Portfolio Manager at AB Asset Management, said at the "2025 Second Half Global Equity and Bond Market Outlook" briefing held in Yeouido, Seoul, on July 30, "In the first half of this year, the New York stock market was significantly shaken by macroeconomic issues." He added, "The experience of increased volatility due to uncertainty is something we must endure every year."

He analyzed, "The estimated year-on-year growth rate of earnings per share (EPS) for U.S. companies this year is 9.0%. This is expected to maintain a solid growth trend compared to 2.5% for Europe and 4.1% for Japan." He continued, "We have slightly revised our forecasts downward to reflect market uncertainty."

He advised, "The longer the investment period in U.S. equities, the higher the probability of generating returns," and added, "It is extremely difficult in reality to sell at the peak and buy at the bottom." Furthermore, he explained, "Rather than judging market peaks or bottoms solely based on absolute valuation figures, it is more important to assess whether the valuation can be justified by profitability and growth potential. The U.S. stock market still offers high profitability, so it is difficult to say that current valuations are expensive."

Regarding the domestic stock market, Lee emphasized the importance of whether companies can achieve long-term structural improvement. He said, "The recent expansion of shareholder-friendly policies is a positive signal," but also noted, "It is necessary to observe the long-term trend until structural improvements become visible."

AB Asset Management also provided an outlook for the bond market in the second half of the year. Yoo Jaehung, Senior Portfolio Manager, assessed that this is a good time to enter the U.S. bond market. He explained, "There are a significant number of BBB-rated bonds offering yields at the BB (speculative grade) level," and added, "When unpredictable shocks occur, bonds with lower credit ratings inevitably experience greater price volatility." He emphasized, "In times of crisis, investing in highly stable BBB bonds still provides an opportunity to receive high yields."

Yoo predicted, "The U.S. Federal Reserve will cut its benchmark interest rate once or twice in the second half of this year," and added, "The trend of global central banks lowering interest rates will continue going forward."

He noted that as housing costs, which account for a large portion of service prices, continue to decline, this will partially offset the impact of tariffs. While the effects of tariffs cannot be ignored, the rise in consumer prices...

From a price perspective, he explained that although the Trump administration's tariff policy could push up the prices of goods in the U.S., service prices are on a downward trend. He expected that the increase in goods prices due to tariffs would be offset. He analyzed that, contrary to concerns, the inflation rate in the U.S. is not high, and ongoing worries about economic slowdown are creating an environment where interest rate cuts are possible.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.