Neurofit, Autocrypto, and Dow InSys Show Disappointing Stock Performance

Individuals Suffer Losses After Buying Newly Listed Stocks on Debut Day

July IPOs See High Opening Prices Followed by Declines

The government has taken steps to revitalize the domestic stock market, but individual investors are still not seeing much success. Many individuals have suffered losses after investing in newly listed companies entering the stock market.

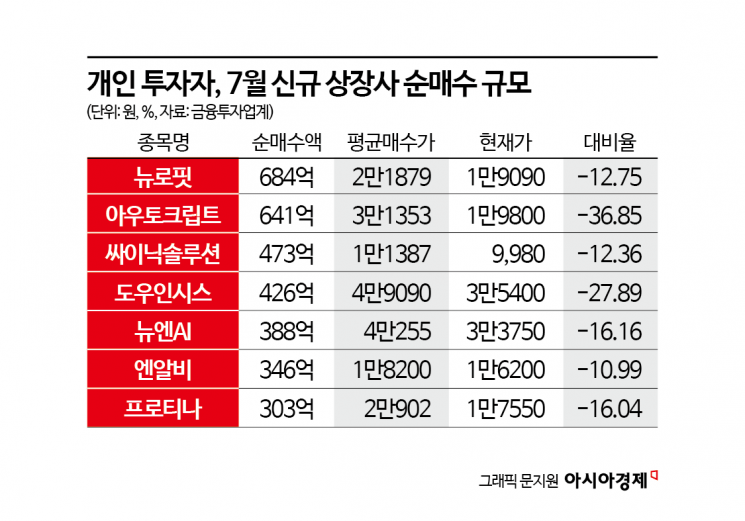

According to the financial investment industry on July 30, eight companies have newly listed on the KOSDAQ market this month: NewN AI, Scinic Solution, New Kids On, Autocrypto, Dow InSys, Neurofit, NRB, and Proteina.

Proteina, a big data bio company specializing in protein-protein interaction (PPI), was listed on the KOSDAQ market the previous day. It started trading at 23,750 won, which is 70% higher than its IPO price of 14,000 won. At one point during the session, it rose to 25,350 won, but as IPO investors rushed to sell, it closed at 16,730 won. The daily price fluctuation exceeded 30%. On this day alone, individuals made a net purchase of 34.6 billion won, but their valuation loss rate reached -11%.

Individuals also bought 68.4 billion won worth of Neurofit shares over three days after its listing on July 25. Given that the average purchase price per share was 21,900 won, they recorded a valuation loss rate of -13% in just three trading days. In contrast, institutional investors sold at an average of 26,700 won during the same period, achieving a 90% profit compared to the IPO price of 14,000 won. On the first day of listing, trading started at 28,600 won and rose to 29,400 won, but as institutional investors sold off, it closed at 20,300 won.

Neurofit is a company that researches and develops brain imaging analysis solutions and therapeutic medical devices. From July 15 to 16, it held an IPO subscription for general investors, attracting about 6.7296 trillion won in subscription deposits. During demand forecasting, it recorded a competition ratio of 1,087.6 to 1 and set the IPO price at the upper end of the desired range, 14,000 won. As the market for Alzheimer's disease treatments expands, demand for brain imaging analysis is surging. Neurofit's AI-based solution has attracted significant attention in the market.

The losses for individuals who invested in Autocrypto, a global automotive software developer, are even greater than those for Neurofit. From July 15 to 29, after Autocrypto entered the KOSDAQ market, individuals accumulated a net purchase of 64.1 billion won. The average purchase price was 31,400 won, but the current price has dropped to 19,800 won, resulting in a valuation loss rate of -37%. The IPO price was set at the upper end of the desired range, 22,000 won, during demand forecasting, and more than 5.4 trillion won in subscription deposits were collected from general investors.

Dow InSys, a primary partner of Samsung Display, has also not escaped the so-called listing jinx. On its first day of listing on July 23, the stock price soared to 59,000 won, but within five days it had fallen to 35,400 won. Individuals purchased 42.6 billion won worth of shares, only to record a valuation loss rate of -28%. Although there are expectations that Dow InSys will supply ultra-thin glass (UTG) for the foldable iPhone expected to be released in the second half of next year, the stock price continues to decline.

An official from the financial investment industry explained, "Since June 2023, when the price fluctuation limit on listing day was expanded, speculative funds aiming for short-term profits have poured in." He added, "Overhang concerns in the early stages of listing often act as a factor driving down stock prices," and advised, "You should be cautious on the highly volatile first day of listing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)