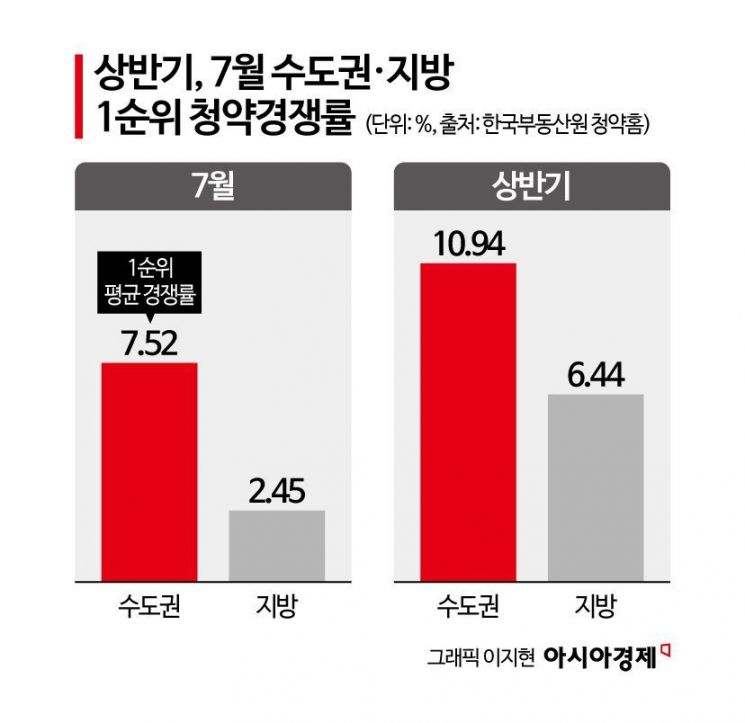

July Provincial Subscription Competition Rate at 1:2.45

Single-Digit Rates in 12 Cities and Provinces

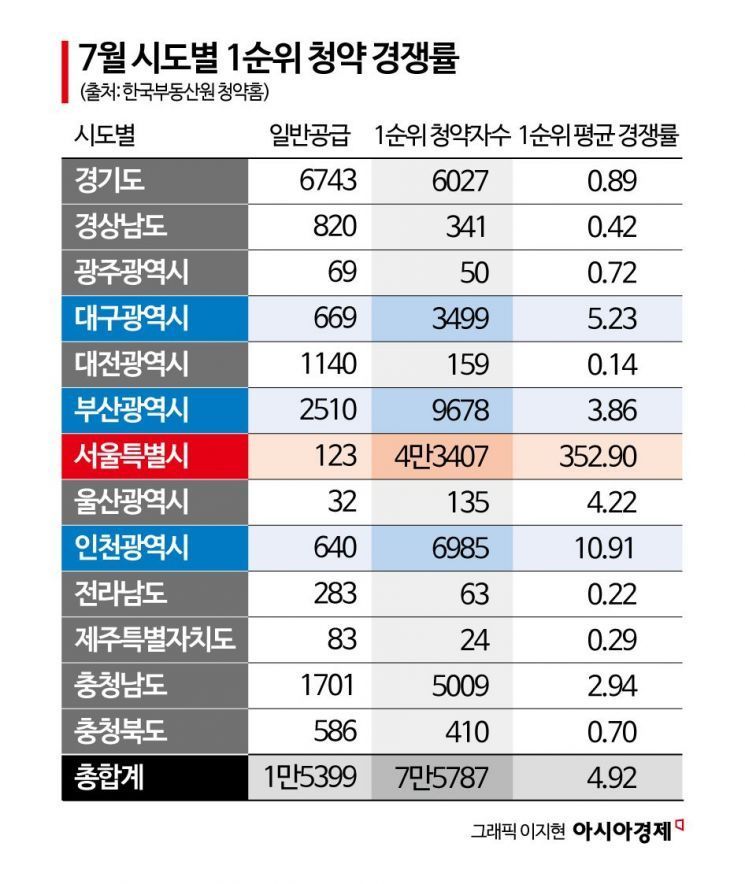

Demand Concentrated on Certain Complexes in Daegu and Ulsan

Limited "Balloon Effect" from Loan Regulations

"It's close to the industrial complex, so it seems convenient for commuting. There haven't been any new apartment launches in the first half of the year, so I'm interested." (A man in his 30s living in Chuncheon)

On July 27, the model house for 'Chuncheon Dongmun The East Urban Foret' in Gangwon Province was crowded with visitors dreaming of homeownership despite the sweltering heat. The prospective buyers ranged from young couples in their 30s to people in their 60s. They toured two types of units?Type A and Type C, both with an exclusive area of 84㎡?checking whether various options were included.

On the 27th, visitors who came to the Dongmun The East Urban Foret model house in Chuncheon are looking around the scale model. Photo by Lee Jieun

On the 27th, visitors who came to the Dongmun The East Urban Foret model house in Chuncheon are looking around the scale model. Photo by Lee Jieun

The model house was filled with genuine homebuyers, most of whom were local residents. There was no visible investment demand from those coming down from the Seoul metropolitan area. One month after the June 27 loan regulation, there was little interest in whether the Chuncheon subscription market would rebound. Instead, people were paying more attention to factors such as location, sale price, and transportation.

B, a newlywed in their 30s living in Chuncheon, said, "The sale price for a new 30-pyeong apartment in Chuncheon has already exceeded 500 million won. Since there is no longer a price advantage as there used to be, it will be difficult for regional investors, who had considered buying real estate in Seoul, to turn their attention to local apartments."

This atmosphere was different from the expectation that investment demand from the provinces would return to Seoul real estate due to the loan regulations. An industry insider explained, "In the provinces, the proportion of genuine homebuyers is higher than that of investors, and there is a strong preference for new builds. In particular, Chuncheon has not seen any new apartment launches since the second half of last year, so the combination of supply shortages and real demand for occupancy has been driving up the prices of new apartments."

The industry expects this trend to continue in other provincial projects as well. Only complexes with attractive sale prices and product appeal are expected to draw genuine demand. With construction costs soaring, affordable sale prices have become a crucial factor in determining the success of subscriptions. According to the Korea Housing and Urban Guarantee Corporation (HUG), as of the end of June, the average sale price in the five major metropolitan cities outside Seoul was 6,026,000 won per square meter, up 0.05% from the previous year. In other provincial areas, the price rose by 5.52% to 4,700,000 won per square meter.

This year, provincial projects that attracted strong subscription demand also had reasonable sale prices. For example, in Daegu, the 'Beomeo 2nd Aiapark' project attracted 3,233 first-priority applicants for 43 available units. This project was the first in Daegu this year to close first-priority subscriptions successfully. Its location in Beomeo-dong, Suseong-gu, a well-known school district, and its lower sale price compared to nearby complexes were significant factors in its popularity.

Due to these high sale prices, there are predictions that the so-called "balloon effect" of the June 27 loan regulation will also be limited. As cost-effective complexes that can guarantee a safety margin are disappearing, there is little chance that investment demand from the Seoul metropolitan area will shift to the provinces.

Park Jimin, head of Wol-yong Subscription Research Institute, explained, "Those who considered investing in Seoul from the provinces will only enter the provincial subscription market if a clear safety margin is guaranteed. As the number of complexes offering such margins decreases due to rising sale prices, it will be difficult for subscription demand to spread across all provincial areas." He added, "The polarization phenomenon, where demand is concentrated in specific regions and complexes, is expected to continue in the future."

A representative from RealToday also said, "Since provincial areas are less affected by the June 27 measures, the impact of loan regulations will likely be limited. Buyers will continue to focus on location and future value, maintaining the trend of choosing subscriptions based on location and product appeal in the first half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.