Report: "Dollar Stablecoins Shake Up the Global Financial Market"

Analysis of the Impact of the "Three U.S. Digital Asset Laws" and Corporate Response Strategies

For the Successful Adoption of the Won Stablecoin... "Digital Asset Foundation and Infrastructure Are Essential"

With U.S. President Donald Trump recently signing the GENIUS Act, a full-fledged implementation of the dollar-based stablecoin system is expected. As a result, competition is forecast to intensify not only among financial institutions but also between non-financial companies and large-scale enterprises.

On July 28, Samjong KPMG released a report titled "Dollar Stablecoins Shake Up the Global Financial Market," emphasizing the urgent need to establish legal and institutional foundations for the Korean won stablecoin to become a "platform currency" that is utilized across digital finance and the real economy, beyond merely serving as a digital asset payment method.

Implementation of the U.S. GENIUS Act: "Aiming to Strengthen Dollar Hegemony"

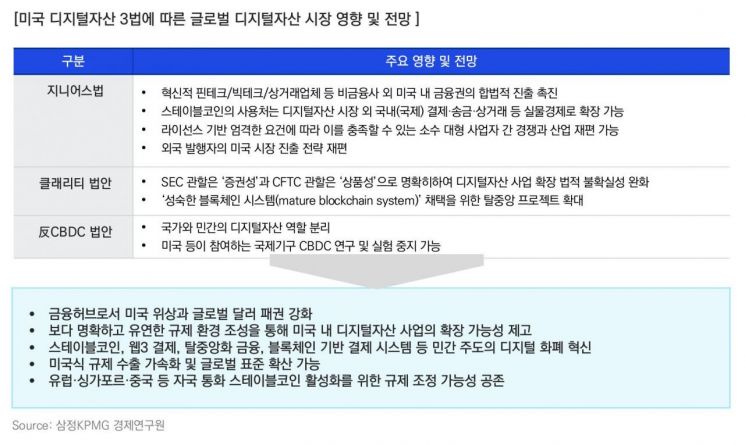

The United States' "Three Digital Asset Laws" consist of the GENIUS Act (Guiding National Innovation in Stablecoins Act), the Clarity Act (Digital Asset Clarity Act), and the Anti-CBDC Act (CBDC Anti-Surveillance State Act).

The GENIUS Act is the first federal law in the U.S. to regulate payment stablecoins. It establishes a regulatory framework and grants legal status through an issuer licensing system, reserve requirements, and disclosure obligations. Stablecoins are digital assets designed to maintain stable value by being linked to fiat currencies such as the dollar or to gold and other commodities. Currently, they are mainly used as payment and settlement methods in digital asset markets.

According to RWA.xyz, a real-world asset tokenization analysis platform, the global stablecoin market capitalization stands at approximately $244.4 billion (about 338 trillion KRW), having grown more than tenfold annually from 2017 to 2024. Of this, dollar stablecoins account for 90%, with Tether (USDT) and Circle (USDC) dominating the market.

With the implementation of the GENIUS Act, dollar stablecoins are being incorporated into the institutional framework, increasing the likelihood of their commercialization not only in the digital asset market but also across payments, remittances, commerce, and international transactions. Notably, the Act restricts the collateral assets of dollar stablecoins to U.S. Treasury bonds and dollars. This aims to boost demand for U.S. Treasuries and strengthen dollar hegemony by promoting the global circulation of the "digital dollar."

If the Clarity Act and the Anti-CBDC Act are also passed, the U.S. will have a clearer and more flexible regulatory environment for digital assets. In particular, the Clarity Act supplements key financial laws such as the Securities Act, Securities Exchange Act, and Commodity Exchange Act with digital asset provisions, expanding the range of digital assets recognized as commodities and clarifying the Commodity Futures Trading Commission's (CFTC) jurisdiction. The Anti-CBDC Act prohibits the Federal Reserve from issuing a central bank digital currency (CBDC) and from conducting monetary policy through it.

Park Sungbae, Deputy CEO and Digital Asset Service Leader at Samjong KPMG, stated, "With the implementation of the Three Digital Asset Laws, the entry of financial institutions into the legal digital asset market will be facilitated, and the participation of non-financial companies such as fintech, big tech, and commerce firms will further expand. As a result, competition among large enterprises with technological capabilities in payment infrastructure and processing speed, as well as capital strength and network effects, will intensify."

Korean Market Must Actively Leverage Private Sector Innovation

Going forward, the global stablecoin market is likely to be divided into U.S.-type and non-U.S.-type models. Some global issuers are expected to withdraw from the U.S. market or consider major business restructuring. The institutionalization in the U.S. is expected to accelerate the adoption of a "mature blockchain system" and serve as an opportunity to clearly separate the roles of the state and the private sector in digital assets.

The domestic market faces the challenges of securing monetary sovereignty, maintaining financial system stability, issuing a won-based stablecoin, and simultaneously achieving global competitiveness. With the inauguration of the new government last month, the "Digital Asset Basic Act" was proposed, sparking full-scale discussions on the definition of the won stablecoin, issuer qualifications and obligations, and investor protection measures. Big tech, fintech, and traditional financial institutions are fiercely competing behind the scenes to quickly capture market share once regulatory uncertainties are resolved.

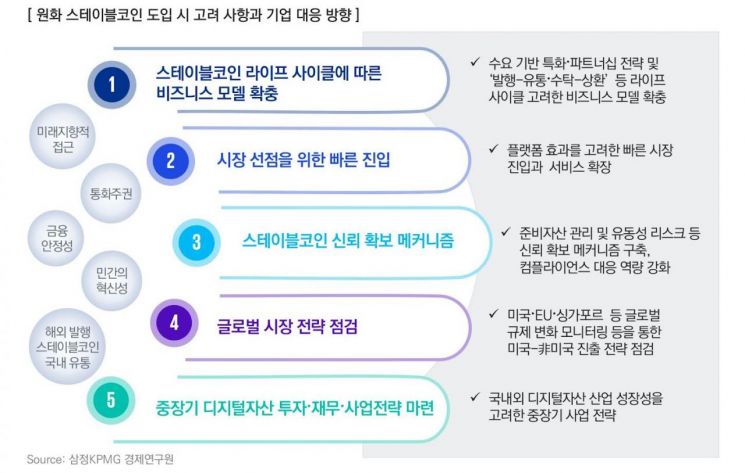

The report stressed the need for a future-oriented approach that actively leverages the innovation of private sector players to strengthen the competitiveness of the won stablecoin. It also pointed out that the regulatory direction for the domestic circulation of foreign-issued dollar stablecoins could have a significant impact on government policy decisions, necessitating a proactive response.

Companies preparing to enter the stablecoin business must establish strategies based on trust and speed, and must not only possess financial, technological, and operational capabilities but also establish compliance and risk management systems. Early market entry to secure initial network effects is crucial, and it is necessary to develop business models that cover the entire lifecycle of stablecoins, including issuance, distribution, redemption, and burning.

Hwang Taeyoung, Executive Director of the Digital Asset Service Team at Samjong KPMG, stated, "Establishing a global expansion strategy is essential, and it is important to continuously monitor regulatory directions in major countries, including the United States, and refine market entry strategies accordingly. For the successful adoption of the won stablecoin, it is necessary to establish a mid- to long-term digital asset business model and systematically build related infrastructure such as digital asset custody, private key management, and reserve operations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)