HUG Resumes Market Safety Net Role After 12 Years

Liquidity Crisis Relief Expected for Construction Industry

"Effectiveness in Question... Difficult to Meet Criteria," Say Industry Voices

Even before the event began, all 120 prepared booklets were distributed, and the 100 seats provided were insufficient, requiring additional chairs to be brought in. On this day, the Housing and Urban Guarantee Corporation (HUG) held an information session to introduce the detailed support criteria and procedures for the 'Safe-Back Unsold Home Repurchase' and 'Project Financing (PF) Special Guarantee' programs.

Both programs are government liquidity supply measures designed to support construction companies facing a stagnant housing market and funding shortages. The Ministry of Land, Infrastructure and Transport allocated budgets for these support projects through this year's second supplementary budget, and at the information session, detailed operational plans for each project were announced.

Funding at Half the Sale Price... 2.4 Trillion KRW to 10,000 Unsold Regional Homes

On the afternoon of the 24th, attendees are listening to explanations at the Unsold Housing Safe Buyback and PF Special Guarantee Project briefing session hosted by the Ministry of Land, Infrastructure and Transport and the Housing and Urban Guarantee Corporation (HUG) at the Construction Hall in Gangnam-gu, Seoul. Photo by Seo Yoon Choi

On the afternoon of the 24th, attendees are listening to explanations at the Unsold Housing Safe Buyback and PF Special Guarantee Project briefing session hosted by the Ministry of Land, Infrastructure and Transport and the Housing and Urban Guarantee Corporation (HUG) at the Construction Hall in Gangnam-gu, Seoul. Photo by Seo Yoon Choi

The Safe-Back Unsold Home Repurchase program allows HUG to purchase unsold apartments in regional areas before completion at up to 50% of the sale price, then allows the developer to repurchase them within one year after completion. Projects with a construction progress rate of at least 50% and with sale guarantees are eligible. During the financial crisis (2008?2013), HUG played a stabilizing role in the market by supplying around 19,000 units and 3.3 trillion KRW through a similar program.

On the surface, it appears that HUG is purchasing the unsold inventory, but in reality, it is closer to providing funding support. A HUG representative explained, "Because the program is called 'repurchase,' some may misunderstand that ownership is transferred at half the sale price. However, in reality, it is a method of lending funds to developers at an annual interest rate of 2?3% within a maximum of 50% of the sale price."

From the second half of this year through 2028, HUG will purchase a total of 10,000 units and provide 2.44 trillion KRW in funding. Of this, 250 billion KRW will be covered by the supplementary budget, with the remainder sourced by HUG. The original supplementary budget plan proposed 300 billion KRW (200 billion in equity, 100 billion in loans), but this was reduced during the National Assembly's budget review due to concerns over moral hazard among construction companies.

Undersold Housing Buyback Assurance Annual Support Scale. Provided by Korea Housing & Urban Guarantee Corporation

Undersold Housing Buyback Assurance Annual Support Scale. Provided by Korea Housing & Urban Guarantee Corporation

HUG plans to announce the first round at the end of August, accept applications from September, and begin purchasing approximately 2,000 units (worth 480 billion KRW) from the end of October. The repurchase deadline is within one year after the building's ownership registration, and the repurchase price will be the initial purchase price plus actual costs such as funding and taxes.

HUG will raise funds through bond issuance and similar means, and the annual operating yield is estimated to be in the upper 2% range. When taxes such as acquisition tax and property tax are added, the repurchase price could rise to as much as 113% of the purchase price, according to HUG.

In this regard, HUG and the Ministry of Land, Infrastructure and Transport are working with the Ministry of the Interior and Safety to amend the "Local Tax Special Cases Restriction Act." When HUG purchases unsold homes, it incurs tax burdens such as acquisition tax, property tax, and comprehensive real estate holding tax, and they plan to request a legal amendment for exemption. A HUG representative stated, "Since the public sector is temporarily purchasing unsold homes, we plan to request exemption from these taxes," adding, "We are also negotiating to include acquisition tax incurred during the developer's repurchase process in the exemptions."

If the law is amended and taxes are exempted, the repurchase price is expected to drop to about 106%. If national housing bonds purchased by HUG are sold at a discount, the price could fall to as low as 103%.

Currently, the bill has been proposed in the National Assembly as a member's bill, and the government expects it to pass within the second half of this year. However, a HUG representative noted, "If the legal amendment is delayed and HUG has to pay the taxes first, those amounts may be reflected in the repurchase price," adding, "We will do our best to complete the process as quickly as possible to avoid that."

New PF Special Guarantee for Small and Medium Construction Companies Outside the Top 100

In response to criticism that existing PF guarantees have been supplied mainly to large companies, HUG also unveiled a 'PF Special Guarantee' exclusively for small and medium-sized construction companies. Eligible companies are those ranked outside the top 100 in construction capability evaluations and have a HUG credit rating of BB+ or higher. The range of lending institutions has also been expanded to include secondary financial institutions (including savings banks).

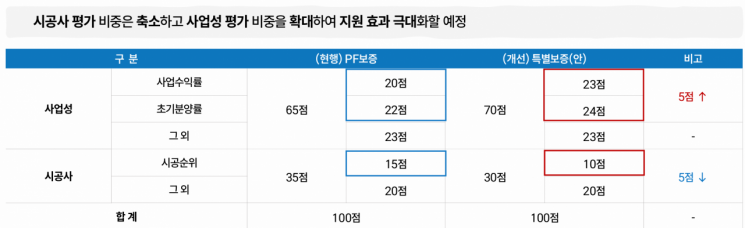

The guarantee review criteria have also been partially relaxed. Previously, construction company evaluation (ranking) accounted for a relatively large portion of the standard PF guarantee, but the special guarantee now places greater emphasis on business feasibility evaluation (such as initial sales rate and project profitability) rather than construction capability. The scoring has been adjusted from 65 points for business feasibility and 35 points for construction company evaluation to 70 points and 30 points, respectively, for the special guarantee.

A total of 2 trillion KRW will be distributed sequentially: 400 billion KRW this year, and 800 billion KRW each in 2026 and 2027. A dedicated consultation window will be operated, and a "one-stop review system" will be established to handle everything from review to guarantee in a single process.

Comparison of Current PF Guarantee and Newly Established PF Special Guarantee Evaluation Criteria. Provided by Housing and Urban Guarantee Corporation

Comparison of Current PF Guarantee and Newly Established PF Special Guarantee Evaluation Criteria. Provided by Housing and Urban Guarantee Corporation

"Interest Alone Is 80 Million KRW per Month... Regional Sales Rates Make Business Feasibility Standards Unattainable"

On site, while there was agreement with the intent of the program, many expressed doubts about its effectiveness. Lee, the CEO of a small construction company based in Incheon, said, "The PF Special Guarantee requires a HUG credit rating of BB+ or higher, but for companies whose management has already deteriorated, it is not easy to meet that standard." He continued, "There are over 19,000 general construction companies nationwide, but those struggling the most are the small companies ranked below 3,000. Our company is in the top 1,000, but we still haven't achieved a BB+ rating."

Another small construction company representative said, "I understand that HUG, not being a charity, must have certain standards. The problem is that, under current market conditions, many small and medium-sized companies can't even meet those standards." He added, "There needs to be a realistic alternative for the liquidity crisis faced by small-scale projects."

Kim, a project director from a developer who traveled from Jeju for the session, said, "In the past, we also applied for HUG guarantees but failed due to not meeting the sales rate criteria. This time, the business feasibility-focused evaluation method hasn't changed much, so the effectiveness still seems low." He added, "The regional sales market is so stagnant that it's difficult to meet the business feasibility standards. The initial sales rate criteria are set based on the Seoul metropolitan area, which is very different from actual local conditions." Kim also said, "There were many construction companies present today, but hardly any developers, probably because expectations are low."

Another developer representative said, "We own the land, but we can't even start construction because we can't secure PF funding. We're paying 70 to 80 million KRW a month just in land-secured loan interest." He continued, "We're barely holding on with just a land-secured loan, without a bridge loan. I came to the session hoping that the new support programs in the supplementary budget might help, but in reality, there wasn't much that would be of practical help to small developers like us."

Regarding these institutional limitations, HUG explained, "Even as a public institution, unconditional funding is not possible. At the very least, the possibility of completion and the ability to repurchase must be verified." A HUG representative said, "We are well aware of the difficulties in the market, and the relaxation of evaluation criteria is a measure reflecting that reality. However, if funds are provided to projects with no business feasibility at all, it will inevitably lead to guarantee defaults."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.