Emergence of Embedded Finance as a Core Strategy for Banks

KB Kookmin Bank Sells Out 200,000 "KB Byeolbyeol Accounts" Launched with Starbucks

"KB Monimo Daily Interest Account" Also Sold Out, Marking Successful Entry into Embedded Finance

Following the launch of the "KB Monimo Daily Interest Account" in collaboration with Samsung Financial Networks, KB Kookmin Bank has also sold out the "KB Byeolbyeol Account" released in partnership with Starbucks, earning recognition for its successful entry into the "embedded finance" sector. KB Kookmin Bank is currently preparing for the second launch of the Monimo Account, aiming to solidify its position as a leader in embedded finance. Banks are accelerating their efforts in embedded finance, which has emerged as a new growth engine, in order to secure low-cost deposits and strengthen their platform capabilities.

According to the financial sector on July 25, KB Kookmin Bank's "KB Byeolbyeol Account," launched with Starbucks on April 1 with a limit of 200,000 accounts, was completely sold out by July 21. The "KB Byeolbyeol Account" is a representative model of embedded finance, offering a parking account with an annual interest rate of up to 2.0% for amounts up to 3 million won upon initial subscription. Customers who deposit at least 500,000 won per month receive one Starbucks Americano Tall size coupon, up to a maximum of 12 coupons. Additionally, if customers link their account as a payment method at Starbucks and order drinks via Siren Order, they receive additional Starbucks star rewards.

A KB Kookmin Bank representative stated, "Approximately 40% of customers who opened the Byeolbyeol Account are new to the bank, with a significant increase in the inflow of women in their 20s and 30s, which was previously the most vulnerable customer base."

Previously, KB Kookmin Bank also succeeded in selling out the "KB Monimo Daily Interest Account," which was launched in collaboration with Samsung Financial Networks. The "KB Monimo Daily Interest Account" gained popularity as a "high-interest" parking account during a period of low interest rates, offering a maximum annual rate of 4.0%. All 225,000 accounts were sold within 40 days of launch, and the bank is now preparing for a second round of sales. KB Kookmin Bank is currently in discussions with the Financial Services Commission, aiming to obtain approval for an additional 500,000 accounts for the "KB Monimo Daily Interest Account" by August. About 10% of customers who opened the "KB Monimo Daily Interest Account" were new to the bank, and KB Kookmin Bank is reportedly considering various internal measures to convert these new customers into loyal clients.

A KB Kookmin Bank official commented, "Unlike Monimo, there are no discussions yet regarding additional sales of the Byeolbyeol Account," but added, "However, we are exploring partnership strategies in various sectors, including distribution, to attract new customers."

With products launched in collaboration with various platforms consistently selling out, KB Kookmin Bank is being recognized for the successful establishment of its embedded finance model. Embedded finance refers to the model of seamlessly integrating financial services within platforms. It is not only a core pillar of KB's digital strategy but also one of the key strategies in the financial sector recently. Unlike KakaoBank and others, traditional financial institutions have the advantage of overcoming the limitation of a weak platform foundation, which has made business expansion difficult. Another feature is the ability to attract low-cost deposits during periods of low interest rates.

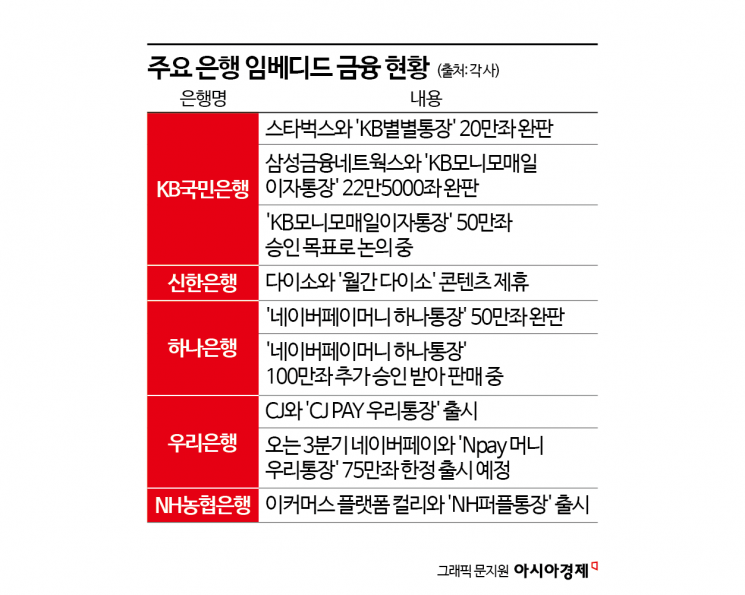

As embedded finance has emerged as a core strategy in the financial sector, other major banks are also driving their embedded finance initiatives. Hana Bank, after selling out 500,000 accounts of the "Naver Pay Money Hana Account" within five months of its launch with Naver Pay, has received approval to sell an additional 1 million accounts. Shinhan Bank, through its partnership with Daiso, offers Daiso gift certificates based on the subscription and balance of Shinhan Bank financial products. NH NongHyup Bank has launched the "NH Purple Account" in collaboration with Kurly Pay, the easy payment service of e-commerce platform Kurly, providing various benefits. Woori Bank also plans to launch the "Npay Money Woori Account" in partnership with Naver Pay, limited to 750,000 accounts, in the third quarter. Previously, Woori Bank launched the "CJ PAY Woori Account" in partnership with CJ OliveNetworks.

An industry official stated, "Due to household loan regulations, it is no longer possible to grow through interest income alone," and added, "We are actively seeking partnerships with different industries to strengthen fee-based, non-interest income."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.