Revenue Reaches 22.2 Trillion Won, Operating Profit Hits 9.2 Trillion Won

Surpassing Last Year's Record-Breaking Q4

AI Investments Continue Despite Tariff Uncertainties

'Second HBM' SoCAM to Be Supplied Within This Year

SK Hynix achieved a record-breaking quarterly performance in the second quarter of this year, with operating profit surpassing 9 trillion won, driven by increased sales of high-bandwidth memory (HBM). The explosive growth in HBM sales, fueled by expanding demand for artificial intelligence (AI), combined with shipments of DRAM and NAND flash exceeding expectations, pushed revenue above 22 trillion won, far surpassing the initial estimate of around 20 trillion won. To maintain this growth momentum, SK Hynix announced plans to double its HBM shipments this year compared to last year and to significantly expand its investment scale.

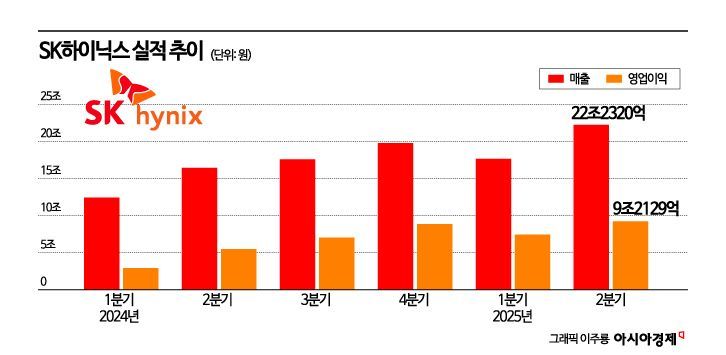

On July 24, during its Q2 earnings conference call, SK Hynix announced that its consolidated operating profit for the second quarter reached 9.213 trillion won, a 68.5% increase from the same period last year. Revenue rose 35.4% year-on-year to 22.232 trillion won. Net income increased by 69.8% to 6.996 trillion won. The operating margin remained in the 40% range at 41%, following 42% in the previous quarter.

SK Hynix surpassed its previous record set in the fourth quarter of last year (revenue of 19.767 trillion won and operating profit of 8.082 trillion won), achieving the highest quarterly results in its history. HBM sales for AI accelerators were the main driver of this performance. Last year, SK Hynix became the world's first company to mass-produce the HBM3E 12-layer product, supplying it in large quantities to Nvidia.

On the same day, SK Hynix President Song Hyun-jong explained, "The last quarter began with concerns about slowing demand due to trade disputes and economic uncertainties. However, aggressive AI investments by big tech companies continued, leading to sustained growth in demand for AI-oriented memory. In addition, customers made preemptive purchases to prepare for external uncertainties, creating a more favorable environment than expected."

In particular, both DRAM and NAND flash shipments exceeded forecasts, contributing to the best performance in the company's history. Song stated, "For DRAM, the full-scale expansion of HBM3E 12-layer product sales and increased demand for server and PC DRAM drove shipments to grow to the mid-20% range, surpassing expectations."

SK Hynix expects to maintain stable results in the second half of the year. Market observers predict that operating profit in the third and fourth quarters could exceed 10 trillion won. Song explained, "Customer inventories remain at stable levels. As demand growth is expected with the launch of new products in the second half, we believe the likelihood of a sharp decline in demand for inventory adjustment is low."

HBM4, which is being prepared for mass production in the second half of this year, is also expected to impact results in the latter half. He emphasized, "Our plan to double HBM shipments compared to last year remains unchanged, based on our superior product competitiveness and mass production capabilities. Through this, we expect to continue generating stable results despite external uncertainties. Our HBM3E products are highly rated by all customers in terms of performance, supply, and reliability, and we plan to maintain our industry-leading competitiveness with HBM4 as well."

Accordingly, the company also announced plans to significantly increase equipment investment for HBM production. Song stated, "We will increase investment this year compared to our previous plans, focusing on products with high demand visibility and secured profitability, in line with our principle of enhancing investment efficiency."

Additionally, Song announced plans to supply SoCAM, a next-generation low-power memory module referred to as the 'second HBM,' within this year. It is known that major semiconductor companies have been supplying samples of SoCAM to Nvidia for qualification testing.

SK Hynix explained that the significant increase in memory-related customer demand was also influenced by uncertainties stemming from U.S. tariff policies. In the Q&A session, SK Hynix stated, "Customers initially aimed to keep inventory levels conservative in the first half of this year, but as uncertainties related to tariff policies increased, they shifted their strategy to secure appropriate inventory levels. As a result, purchase demand from major customers with previously low inventories increased significantly." The company added, "While future tariff policies could affect purchase demand, we will focus on stable business operations centered on products with high demand visibility."

Regarding concerns that the strengthened U.S. export controls on semiconductor equipment to China could reduce the utilization of its Chinese factories, the company responded, "We are concerned about the geopolitical situation, but there has been no change in our Verified End-User (VEU) status. The Chinese factories will continue to operate as originally planned."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.