Expansion of Non-Interest Income and Loan-to-Deposit Spread Drives Earnings

Annual Net Profit Expected to Approach 18 Trillion Won

▲(From left) Jonghee Yang, Chairman of KB Financial Group; Okdong Jin, Chairman of Shinhan Financial Group; Youngju Ham, Chairman of Hana Financial Group; Jongryong Lim, Chairman of Woori Financial Group

▲(From left) Jonghee Yang, Chairman of KB Financial Group; Okdong Jin, Chairman of Shinhan Financial Group; Youngju Ham, Chairman of Hana Financial Group; Jongryong Lim, Chairman of Woori Financial Group

The four major financial holding companies (KB, Shinhan, Hana, and Woori) are expected to set another record for all-time high earnings, having achieved nearly 10 trillion won in net profit in just the first half of this year. Although a decrease in interest income was initially expected due to falling market interest rates following a base rate cut and a narrowing net interest margin (NIM), the groups performed better than anticipated thanks to increased non-interest income and a wider loan-to-deposit interest rate spread. The annual net profit forecast for the four major financial holding companies this year stands at around 18 trillion won, which also appears set to break previous records.

According to financial information provider FnGuide on July 24, the combined net profit of the four major financial holding companies for the second quarter is projected to reach 5.1118 trillion won. This represents a slight decrease compared to the same period last year (5.1687 trillion won).

By company, KB Financial Group's net profit for the second quarter is expected to be 1.6413 trillion won, a 4.1% decrease from the same period last year (1.7107 trillion won). KB Financial Group benefited from a high base effect last year, as it reversed a provision of approximately 120 billion won for losses on Hong Kong H-Index equity-linked securities (ELS) in the same period. As a result, securities analysts believe this year's second-quarter results will fall behind those of the previous year.

Woori Financial Group is also expected to see its second-quarter net profit decrease by 8.6% to 878.4 billion won, compared to 961.5 billion won in the same period last year. The results are expected to reflect large-scale selling and administrative expenses, including the development of a mobile trading system (MTS) and new personnel recruitment following the launch of Woori Investment & Securities.

Shinhan Financial Group's net profit is forecast to increase by 1.3%, from 1.451 trillion won in the second quarter last year to 1.47 trillion won this year.

Hana Financial Group is expected to show the most pronounced growth among the four major financial holding companies. Its second-quarter net profit is projected to reach 1.1221 trillion won, more than 7% higher than the same period last year (1.0456 trillion won). This improvement is attributed to continued strong fee income from credit cards, securities brokerage, and operating leases, as well as significant gains from foreign currency translation due to a decline in the exchange rate.

The widening loan-to-deposit interest rate spread also contributed to the increase in net profit for the financial holding companies. The loan-to-deposit spread, which was 1.46 percentage points in January this year, expanded to 1.54 percentage points in May, supporting the solid performance of the banking sector in the second quarter. In addition, the groups secured low-cost deposits through embedded finance, and a surge in last-minute loan demand ahead of the implementation of the third phase of the Debt Service Ratio (DSR) regulation in July is believed to have boosted interest income.

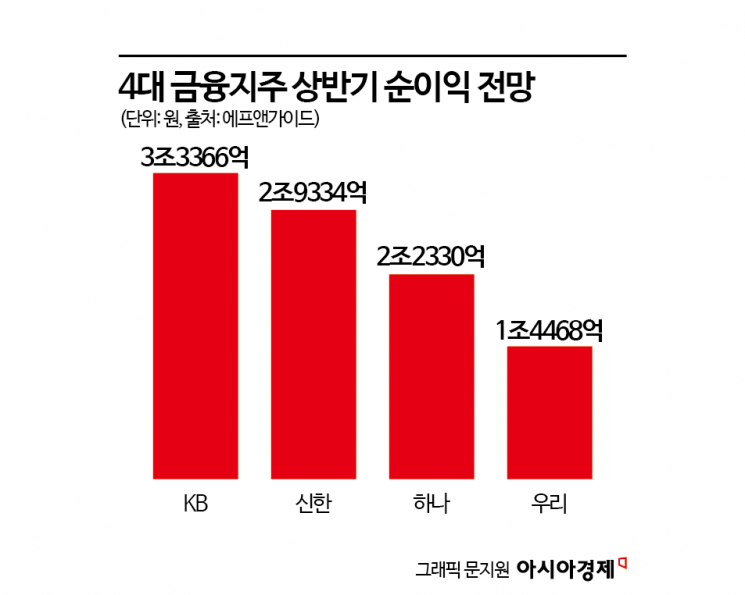

While the second-quarter results varied by company, both first-half and annual net profits are expected to reach all-time highs. The combined net profit forecast for the first half of the year for the four major financial holding companies is 9.9498 trillion won, up 6.5% year-on-year, marking the highest figure ever for a half-year period. By company, first-half net profits are expected to be 3.3366 trillion won for KB Financial Group, 2.9334 trillion won for Shinhan Financial Group, 2.233 trillion won for Hana Financial Group, and 1.4468 trillion won for Woori Financial Group.

The annual net profit for the four major financial holding companies is projected to reach 17.825 trillion won, an increase of about 8% from last year's 16.5268 trillion won.

Kang Seunggeon, a researcher at KB Securities, stated, "Other non-interest income is expected to exceed expectations due to the decline in the exchange rate and the rise in the stock market." He added, "Although there are concerns about regulatory tightening, such as the establishment of a bad bank, the 600 million won limit on mortgage loans, and restrictions on household loan growth, the burden on financial companies is not as great as feared, and the ability of distressed borrowers to repay interest is also expected to recover, so the negative impact will be limited."

Park Hyejin, a researcher at Daishin Securities, commented, "Bank margins have been defended much better than expected, and the growth in won-denominated loans also exceeded expectations due to concentrated demand." She continued, "Non-interest income also advanced, driven by improved fee and trading income amid a falling exchange rate, lower interest rates, and rising indices, resulting in excellent performance."

Meanwhile, KB Financial Group will announce its second-quarter results on July 24, followed by Shinhan, Hana, and Woori Financial Groups on July 25.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)