Rally Stalls as Foreign Buying Slows

Analysts Split Between Raising Target Price and Downgrading Investment Opinion

LIG Nex1 Emerges as a Strong Contender for MSCI Inclusion in August, Drawing Attention to Potential Capital Inflows

Outlooks for LIG Nex1, one of the most favored stocks among foreign investors, are currently divided. While there is little doubt regarding its sales growth, concerns have been raised about its high valuation (the stock price relative to corporate value). Attention is now focused on whether the upcoming Morgan Stanley Capital International (MSCI) regular review in August will serve as a catalyst for a rebound in the stock price.

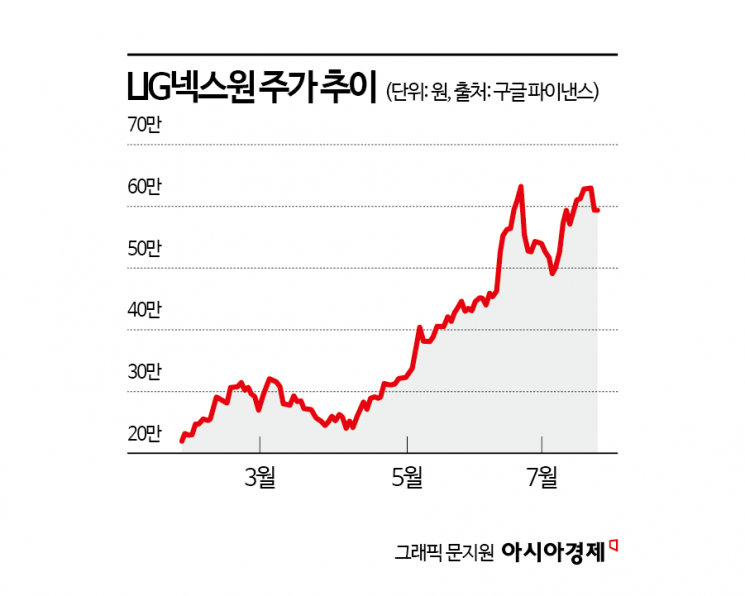

According to the Korea Exchange on July 24, LIG Nex1 closed slightly higher at 593,000 won the previous day. Since April, LIG Nex1 has been on a sharp upward trajectory. The stock surged by nearly 173% until it reached an all-time high of 650,000 won on June 23. However, the price soon retreated, and although it began to rebound again from July 7, it has not surpassed its previous high.

Although foreign investors sold 64 billion won worth of LIG Nex1 shares in January, they became net buyers for six consecutive months starting in February, purchasing approximately 591.6 billion won worth of shares. Excluding exchange-traded funds (ETFs), this ranks as the second-largest net purchase among individual stocks. However, since May, the buying momentum has gradually weakened, which is seen as a reason for the loss of upward momentum in the stock price.

With the rally losing steam, analysts are offering mixed outlooks. Bae Sungjo, a researcher at Hanwha Investment & Securities, raised his target price from 460,000 won to 740,000 won, stating, "The recent Middle East conflict has once again highlighted the importance of air defense systems, making LIG Nex1's long-term growth trajectory clearer as it stands at the center of the Korea Air and Missile Defense (KAMD) system."

On the other hand, some have downgraded their investment opinion, citing concerns over LIG Nex1's valuation. Jang Namhyun, a researcher at Korea Investment & Securities, noted, "As of the closing price on July 21, LIG Nex1's 2026 forward price-to-earnings ratio (PER) stands at 33.8 times. Given that the average 2026 forward PER for European defense companies is 33.5 times, further stock price appreciation at the current valuation is likely to be limited."

Although the company has secured multiple pipelines, including the growing revenue recognition from the UAE Cheongung II project, exports of long-range surface-to-air missiles (LSAM) to the Middle East, and Biho exports to the United States, the nature of these products means it takes a long time to finalize export contracts. As a result, there is a diagnosis that export momentum will be lacking in the second half of this year.

The market's attention is now turning to the upcoming MSCI regular review event in August. Typically, stocks included in the MSCI index tend to see inflows of foreign capital and rising stock prices from 60 trading days before rebalancing until the day of rebalancing. Currently, LIG Nex1 is considered a strong candidate for inclusion by analysts, along with Doosan and Hyosung Heavy Industries. Noh Donggil, a researcher at Shinhan Investment & Securities, commented, "Based on this pattern, investors could consider long/short strategies among stocks entering and exiting the index."

The MSCI index is one of the world's most influential stock indices and adjusts its constituents every February, May, August, and November based on market capitalization and free-float market capitalization. Inclusion in the index can attract passive (index-tracking) funds, while removal may have a negative impact on supply and demand. The results of the upcoming August regular review will be announced on August 8, with actual index changes taking effect after market close on August 26.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)