Besant Says "No Reason for Powell to Resign Immediately"

Calls for Thorough Review of Fed's Non-Monetary Policy Areas Continue for Second Day

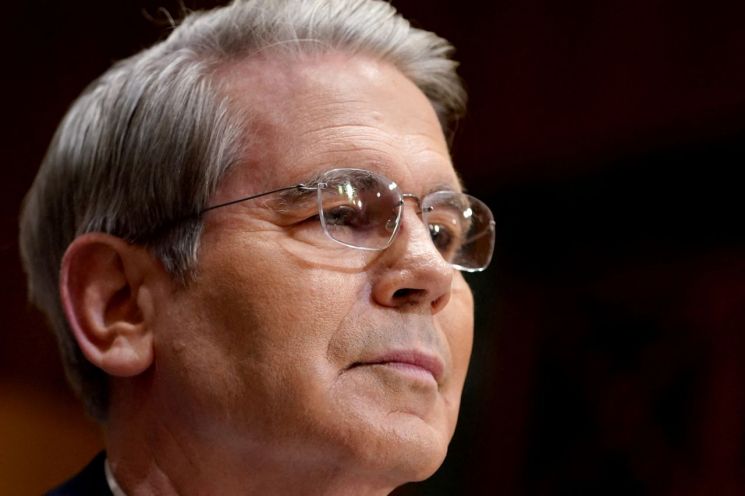

On July 22 (local time), U.S. Treasury Secretary Scott Besant stated that there is no reason for Federal Reserve (Fed) Chair Jerome Powell, who is facing pressure from the White House to cut interest rates and calls for his dismissal, to resign immediately. However, for the second consecutive day, Besant continued to apply pressure on Powell by raising concerns about the Fed's non-monetary policy areas.

In an interview with Fox Business that day, Secretary Besant said, "His term ends in May (next year). If he wants to finish his term, he can do so, and if he wishes to resign early, he can do that as well."

Regarding the Fed's monetary policy, he emphasized, "That issue should be set aside as if it were locked in a jewelry box," stressing that there should be no political interference.

However, for the second day in a row, he raised the need for a thorough review of the Fed's non-monetary policy areas.

Secretary Besant pointed out, "The central bank has continued to grow and grow. This happens because there is no oversight. The Fed is not subject to budget appropriations; it simply prints and spends money." He went on to emphasize, "A thorough review of this is necessary."

The previous day, Secretary Besant had also pressured Chair Powell by mentioning the need to re-examine the Fed's overall functions and operations. These remarks came as the White House is raising concerns about excessive renovation costs for the Fed's headquarters building.

While acknowledging the independence of monetary policy to prevent turmoil in financial markets, Secretary Besant is now mounting comprehensive pressure on Chair Powell by focusing on non-monetary policy areas, especially as the White House and the Fed are in a sensitive standoff over interest rate cuts.

President Trump has publicly demanded several interest rate cuts from Chair Powell since returning to office at the end of January. However, Powell has maintained a stance of holding rates steady due to concerns about inflation resulting from tariffs.

Amid these developments, some on Wall Street have argued that it would be preferable for Chair Powell to voluntarily resign in order to protect the Fed's independence.

Mohamed El-Erian, former CEO of the world's largest bond manager PIMCO, currently Master of Queens' College at the University of Cambridge and advisor to Allianz Group, wrote on social media platform X (formerly Twitter) that "If Chair Powell's goal is to protect the Fed's operational autonomy, then he should resign. That would be better than the current situation, where threats to the Fed's independence are growing and spreading. If he remains in office, there is no doubt that these threats will only intensify."

Although Chair Powell has repeatedly stated that he has no intention of resigning voluntarily in order to protect the independence of monetary policy, as the Trump administration escalates its criticism beyond "attacking Powell" to questioning the entire operation and functions of the Fed, El-Erian has expressed the view that "it would be better for him to step down."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)