Consumer Sentiment Index (CCSI) at 110.8 in July

Highest since June 2021 (111.1)

Housing Price Outlook CSI Drops 11 Points Due to June 27 Measures

"Expectations for Rising Stock Prices" Current Household Savings CSI at 97

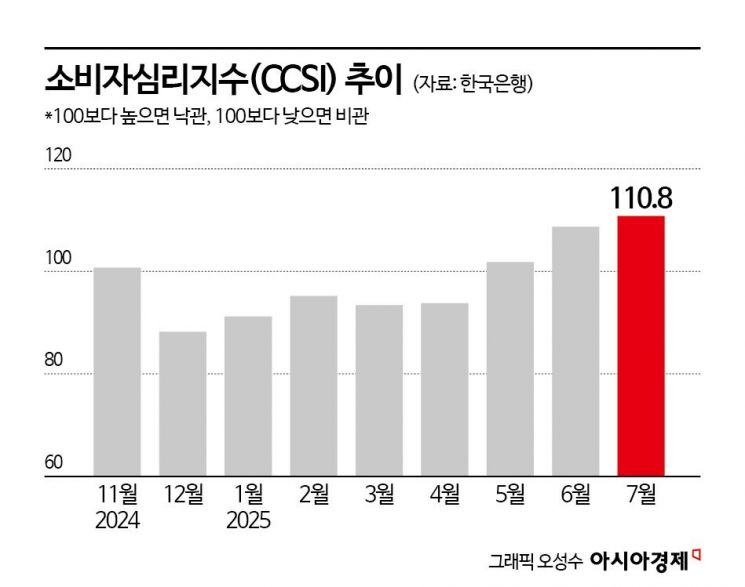

This month's Consumer Composite Sentiment Index (CCSI) reached its highest level in four years and one month. Despite ongoing uncertainties related to tariff negotiations with the United States, the index continued its upward trend for the third consecutive month, following significant increases in the previous two months, supported by improvements in consumption and strong exports.

CCSI at 110.8... Highest since June 2021

According to the "July 2025 Consumer Survey Results" released by the Bank of Korea on the 23rd, this month's CCSI stood at 110.8, up 2.1 points from the previous month. This is the highest level in four years and one month since June 2021 (111.1). The CCSI is a sentiment indicator calculated using six key indices that make up the Consumer Survey Index (CSI). The long-term average is set at 100; a reading above 100 is considered optimistic compared to the long-term average, while a reading below 100 is considered pessimistic.

Until November last year, the CCSI remained above the benchmark value of 100, but it plunged to 88.2 in December following the 12·3 Martial Law crisis, which cooled consumer sentiment. For the next five months until April this year, it stayed below the benchmark. However, in May, the index jumped by 8 points?surpassing the benchmark for the first time in six months?driven by factors such as the easing of trade risks following the mutual tariff suspension. Last month, expectations for the new government's economic policies contributed to another significant rise (6.9 points). This month, the index continued to climb, albeit slightly, marking the third consecutive month above the benchmark. Lee Hyeyoung, head of the Economic Sentiment Survey Team at the Economic Statistics Department 1, explained, "Despite the sharp increases over the past two months, the CCSI continued to rise slightly in July compared to the previous month, supported by improvements in consumption and strong exports."

Housing Price Outlook CSI Drops 11 Points but Remains Above Long-Term Average

The Housing Price Outlook CSI, which surged to 120 last month, fell by 11 points to 109. This is the largest decline since July 2022, when it dropped by 16 points. At that time, downward pressure came from falling apartment sales prices, weakened buyer sentiment, and rising market interest rates amid base rate hikes. This month's decline is attributed to expectations of falling housing prices following the 6·27 household debt management measures, as well as a slowdown in the rise of apartment sales prices in the Seoul metropolitan area. Nevertheless, despite the sharp drop, the index still remains above the long-term average (107). Lee commented, "Since more people still expect prices to rise, the index remains slightly above the long-term average of 100," adding, "Given the ongoing slowdown in the rise of apartment sales prices, we should continue to monitor the movement of the Housing Price Outlook CSI."

The Current Economic Assessment CSI and the Current Living Conditions CSI both rose significantly. The Current Economic Assessment CSI, which compares the current situation to six months ago, rose by 12 points to 86, driven by improved consumption and strong exports. This is the largest increase since November 2020, when it rose by 14 points. The Current Living Conditions CSI reached 94, the highest since June 2018 (94). The Interest Rate Outlook CSI (95) climbed by 8 points, reflecting the base rate freeze and increases in mortgage rates by major commercial banks.

The Future Economic Outlook CSI, which reflects expectations for the economy six months from now, dropped by 1 point to 106. However, as it remains above the benchmark value of 100, Lee analyzed that people still have a positive outlook for the future economy. Lee said, "After rising sharply for two consecutive months, the index has paused slightly," adding, "The slight decline is attributed to lingering uncertainties related to tariff negotiations."

The Current Household Savings CSI (97) and the Household Savings Outlook CSI (101) recorded their highest levels since June 2010 and November 2010, respectively. This is analyzed as reflecting expectations for rising stock prices and stable inflation.

The expected inflation rate for the next year (2.5%) rose by 0.1 percentage point from the previous month, as the pace of consumer price increases accelerated due to continued rises in processed food prices and a turnaround in petroleum product prices. The expected inflation rates for three years and five years from now were 2.4% (unchanged from the previous month) and 2.5% (up 0.1 percentage point from the previous month), respectively. The main items expected to influence consumer prices over the next year, based on response rates, were agricultural, livestock, and fisheries products (48.0%), public utility fees (42.2%), petroleum products (32.7%), and industrial products (32.7%). Compared to the previous month, the response rate for petroleum products increased by 12.0 percentage points, while those for agricultural, livestock, and fisheries products (-3.5 percentage points) and industrial products (-2.8 percentage points) decreased.

This survey was conducted from the 8th to the 15th of this month, targeting 2,500 urban households nationwide, with 2,286 households responding.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.