Manufacturing Production Index for SMEs at 98.4 in May

Gap Between Large Corporations and SMEs Widens by 1.5 Times in One Year

Impacts of Domestic and Global Adversities... Trend Expected to Continue

"Mid- to Long-Term Approach and Structural Improvement Needed"

The polarization between large corporations and small and medium-sized enterprises (SMEs) is intensifying due to the prolonged domestic economic downturn and global uncertainties. SMEs, which are relatively more vulnerable to external shocks, have been hit hard by recent adverse domestic and international developments. Experts have expressed concern that this polarization is likely to persist for the foreseeable future.

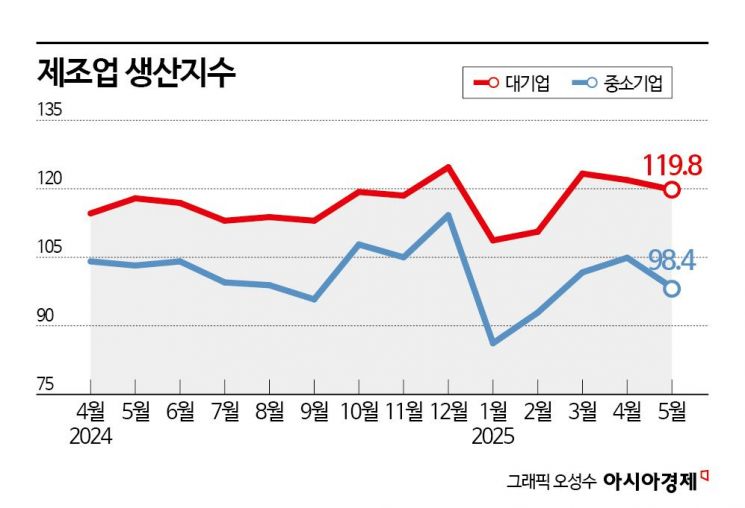

According to Statistics Korea on July 21, the manufacturing production index (2020=100) for large corporations and SMEs in May of this year was 119.8 and 98.4, respectively, resulting in a gap of 21.4. This figure is nearly 1.5 times higher than the gap of 14.7 recorded in May of last year. The gap in the manufacturing production index between large corporations and SMEs has been steadily widening since last year. In April of last year, the gap had narrowed to 10.5, but by January of this year, it had more than doubled to 22.5 and has remained at a similar level through May. The manufacturing production index is an indicator that quantifies the changes in manufacturing activity for large corporations and SMEs, using 2020 as the base year (100). A higher value indicates more active production.

An industry official explained, "The widening gap in the manufacturing production index between large corporations and SMEs, which are the backbone of the domestic industry, indicates a deepening economic imbalance. While the manufacturing recession that began in earnest in the second half of 2022 has shown signs of gradual recovery centered on large corporations since the end of 2023, SMEs have been recovering at a much slower pace."

Analysts point out that the recent sharp widening of the production index gap between large corporations and SMEs is the result of a combination of domestic and international factors, such as uncertainty in the trade environment. Domestically, structural economic stagnation has played a role, while externally, tariff pressures stemming from the Trump administration and the US-China trade war have shaken Korean SMEs, which lack the capacity to respond, at their core. In particular, given that more than 90% of SMEs are focused on the domestic market, the persistently weak domestic consumer sentiment has had a significant impact. The situation is similar for SMEs in the upstream and downstream industries of steel, aluminum, and automobiles, which are subject to high US tariffs. According to a survey by the Korea Chamber of Commerce and Industry, 60.3% of domestic manufacturing companies are directly or indirectly affected by US tariff policies, and among these, 50.8% are SMEs.

No Minseon, a research fellow at the Korea Small Business Institute, analyzed, "Compared to large corporations, SMEs collapse more quickly when the economy is bad and recover more slowly when the economy improves. The positive effects of last year's export boom did not reach SMEs, and then a series of adverse domestic and international factors, such as the US-China trade conflict and political turmoil related to impeachment, hit them hard."

Experts predict that this trend will continue for the time being. This is because there are few factors that could resolve uncertainties such as the deterioration of global supply chains, and the domestic economic downturn is also unlikely to rebound in the short term. In this situation, there are concerns that SMEs, which lack sufficient financial resources, may collapse rapidly, leading to overall imbalances such as widening employment and wage gaps. Researcher No advised, "In addition to short-term financial support, there needs to be a fundamental improvement in the working and operational environments of domestic SMEs, and a mid- to long-term approach to strengthening their technological capabilities. Efforts to improve their structure, such as supporting digital transformation (DX) including the introduction of smart factories, are also necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)