Domestic Market Limitations Shake Construction Materials Industry

KCC Restructures Portfolio for Survival

Silicone Performance Supports Fundamental Transformation

Amid a structural crisis in the domestic construction materials industry caused by shrinking demand and market saturation, KCC, a leading company in the sector, has decided to shift its corporate identity. The company plans to move away from its traditional manufacturing structure focused on construction materials and paints, and instead transform itself into an R&D-based platform company that designs and supplies high-performance materials.

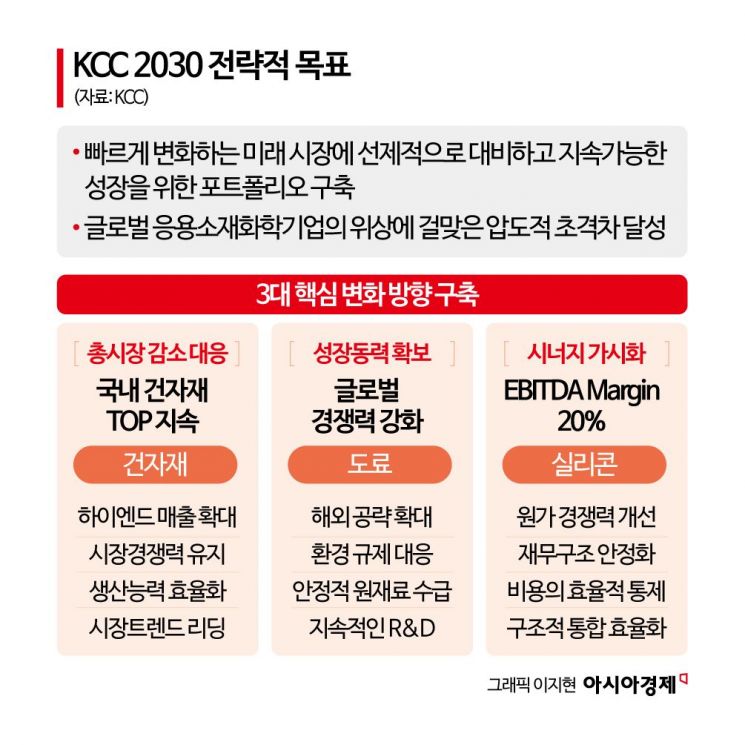

According to industry sources on July 17, KCC has officially announced its identity shift to an applied materials and chemical company through its recently released strategic document, 'Vision 2030.' Leveraging the global R&D infrastructure of Momentive, a silicone specialist acquired in 2019, KCC aims to ensure that its materials are incorporated into the initial design stages of products in high-value industries such as semiconductors, healthcare, and displays. The company’s strategy is to establish a stable, long-term revenue structure through this approach.

This transformation goes beyond simple business diversification and is more of a 'structural response' to the growth limitations faced by the domestic construction materials industry, which is heavily reliant on the domestic market. According to the Ministry of Land, Infrastructure and Transport, the total floor area of new building construction in South Korea has seen double-digit declines since 2022. Although there was a slight rebound last year (+4.8%), it still remains at only 70-80% of the historical average. In its investor relations materials, KCC stated, "Strategic responses are needed due to the contraction of the total construction materials market."

Amid this crisis, construction materials companies are each attempting their own forms of transformation. LX Hausys is strengthening its entry into the B2C (business-to-consumer) remodeling market, while Hanssem is focusing on expanding its home furnishing business. Dongwha Enterprise has sought new revenue sources such as secondary battery components through its subsidiary Dongwha Electrolyte, but has yet to achieve significant results as the electric vehicle chasm (temporary demand slowdown) persists.

KCC has taken a fundamentally different approach by redefining its business areas and initiating an essential structural transformation early on. Last year, revenue from its silicone division reached 2.995 trillion won, accounting for 45% of the company's total sales. While the construction materials and paint divisions have struggled, silicone has effectively become the group’s core business driving overall performance.

Alongside this business structure transformation, KCC is also working on financial stabilization. The company recently issued 882.8 billion won worth of exchangeable bonds (EBs) using its stake in HD Korea Shipbuilding & Offshore Engineering as collateral, and plans to repay approximately 640 billion won in high-interest debt borrowed for the Momentive acquisition. This is expected to reduce annual interest expenses by about 60 billion won.

Park Sera, a researcher at Shin Young Securities, commented, "While KCC is emphasizing a high-end strategy tailored to market polarization, it appears to be acutely aware of the limitations of the domestic market in its traditional construction materials and paint businesses." She added, "This transformation is not so much a choice for value enhancement as it is an inevitable step for survival."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.