No alternatives to resolve criminal risks included,

business community voices concern

Ruling party pushes for additional legislation,

including cumulative voting and retirement of treasury shares

Companies preparing internal countermeasures,

such as analyzing shareholder tendencies

With the promulgation of the revised Commercial Act, a sense of powerlessness is spreading throughout the business community. While the ruling party has announced plans for additional legislation, including the mandatory retirement of treasury shares, the legislative process for measures requested by corporations?such as the easing of the crime of breach of trust?has been relatively slow. As a result, companies believe they have effectively lost their means of defense. Some companies are reportedly beginning to prepare internal scenarios to defend against threats to management control.

President Lee Jae Myung is speaking at the Cabinet meeting held on the 15th at the Yongsan Presidential Office Building in Seoul. Photo by Yonhap News

President Lee Jae Myung is speaking at the Cabinet meeting held on the 15th at the Yongsan Presidential Office Building in Seoul. Photo by Yonhap News

According to the business community on the 16th, major corporate groups in South Korea have determined that it will be difficult to block the legislative initiatives being led by the Democratic Party, and have begun preparing their own response strategies. An official from one of the four major conglomerates stated, "This is not a situation where the political sphere and the business community can negotiate or make exchanges," adding, "At the level of the Chief Financial Officer (CFO) organization, we have begun analyzing shareholder tendencies, including aggressive funds."

Within companies, there are reports that they are analyzing major shareholders' voting histories, public statements, and the purposes behind their shareholdings, and are even simulating the possibility of an actual vote showdown if cumulative voting is introduced. Some companies are also considering adjusting the pool of board candidates before regular general meetings of shareholders or preemptively assessing the likely positions on specific agenda items in order to develop response strategies.

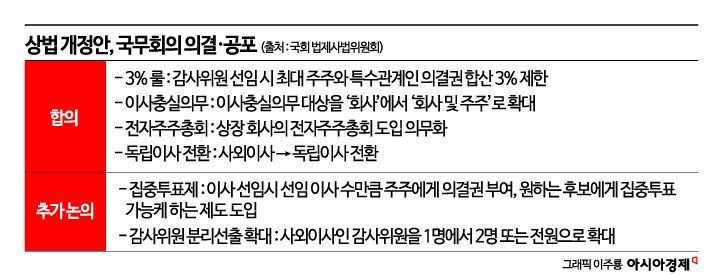

The revised Commercial Act, promulgated at the Cabinet meeting the previous day, includes the so-called "3% rule," which limits the combined voting rights of the largest shareholder and related parties to 3%; a provision expanding directors' fiduciary duty from "the company" to "the company and its shareholders"; mandatory electronic shareholder meetings; and a requirement for outside directors to become independent directors.

Concerns are mounting over threats to management control due to the revised Commercial Act, which lacks supplementary measures. The amendment could hinder reasonable management decisions in areas such as mergers and acquisitions (M&A) and overseas investments. There are also concerns that companies may face demands for high dividends from activist funds or even attacks on management control.

The ruling party is not stopping here and is accelerating follow-up legislation. The second round of amendments, which are even stronger and include the mandatory cumulative voting system and expanded separate election of audit committee members?both measures that the business community has been concerned about?are scheduled to be processed during this month's extraordinary session of the National Assembly. The third round of amendments, such as the mandatory retirement of treasury shares, is targeted for passage during the regular session in September.

A representative from the business community pointed out, "We have expressed sufficient concerns, but the bills are being processed faster than expected," and added, "If the mandatory cumulative voting system is implemented, it will significantly increase the likelihood that directors favored by minority shareholders will be elected."

On the other hand, progress on measures reflecting the business community's demands?such as the introduction of the 'business judgment rule'?remains slow. The business judgment rule stipulates that if a director fulfills their duty of care based on sufficient information, they are not considered to have violated their duty even if the company incurs losses. Democratic Party lawmaker Kim Tae Nyon has introduced revisions to the Commercial Act and the Criminal Act to this effect. The proposal calls for the complete removal of the special breach of trust provision from the Commercial Act, while clearly defining the 'business judgment rule' in the Criminal Act.

In addition, there are calls for additional management control defense measures referencing overseas examples, such as the introduction of "dual-class voting rights," which would grant multiple voting rights per share, or "poison pills," which would allow existing shareholders to purchase shares at a price lower than market value. However, there has been no legislative movement from the ruling party on these issues so far.

A business community representative stated, "Given the practical limitations in blocking follow-up legislation, each company must now find its own survival strategy," adding, "With communication with the political sphere becoming more difficult, there is a growing sense of resignation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)