Fair Trade Commission Sanctions CJ and CJ CGV for Unfair Support of Troubled Affiliates through TRS Deals

Perpetual Convertible Bonds Issued at Low Interest Rates Thanks to Credit Enhancement

Independent SMEs and Competitors Suffer as Affiliates Gain Unfair Advantage

Commission Warns: "Disguised Credit Support via Derivatives Also Subject to Penalty"

CJ and CJ CGV are set to face sanctions from the Fair Trade Commission for unfairly supporting financially troubled affiliates through total return swap (TRS) transactions.

On the 16th, the Fair Trade Commission announced that it would issue a corrective order and impose a provisional fine of 6,541 million won on CJ and CJ CGV for violating the Monopoly Regulation and Fair Trade Act (Fair Trade Act).

According to the Fair Trade Commission's investigation, CJ and CJ CGV used TRS contracts as a means of credit enhancement and payment guarantee, enabling their affiliates, CJ Construction and Simulain, to issue perpetual convertible bonds at low interest rates.

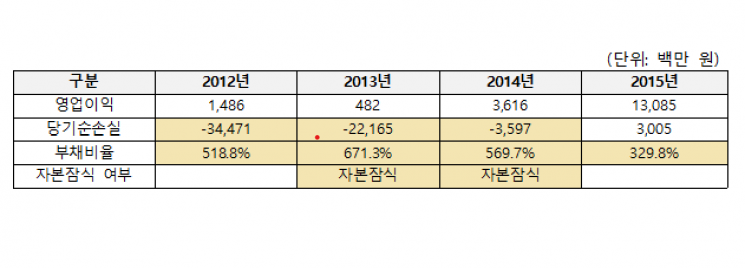

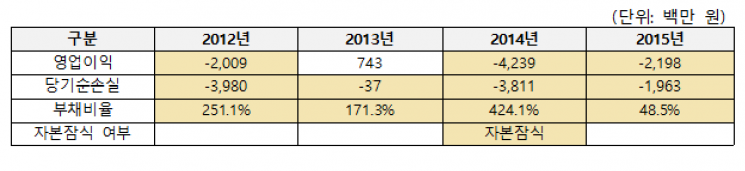

CJ Construction suffered capital impairment for two consecutive years in 2013 and 2014, while Simulain fell into capital impairment in 2014. As a result, by 2015, when the unfair support began, both affiliates were facing severe financial crises, including credit rating downgrades and upward pressure on borrowing costs.

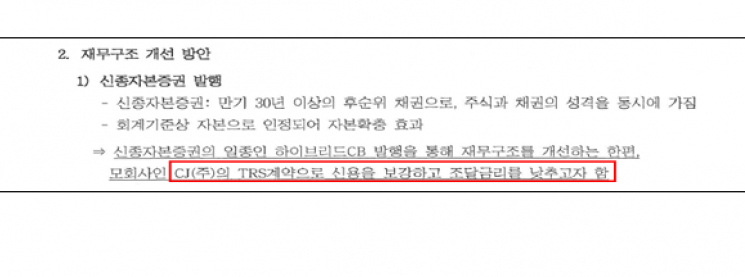

CJ Construction and Simulain attempted to raise capital by issuing perpetual convertible bonds. However, due to their financial distress, it was difficult to attract investors, and even if investors could be found, their low credit ratings meant they would have to issue high-interest debt.

To address this, CJ and CJ CGV entered into TRS contracts on the same day as a prerequisite for financial institutions to acquire the perpetual convertible bonds issued by CJ Construction and Simulain. The acquisition contracts for the perpetual convertible bonds and the TRS contracts were executed as a bundled transaction.

The financial institutions transferred the risks associated with acquiring the perpetual convertible bonds of financially distressed CJ Construction and Simulain to the supporting entities, CJ and CJ CGV, through the TRS contracts. As a result, the TRS contracts effectively functioned as a means of credit enhancement and payment guarantee.

Through the TRS contracts, CJ Construction and Simulain raised approximately 50 billion won and 15 billion won in capital funds, respectively, by issuing perpetual convertible bonds. The interest rates on these bonds were determined based on the creditworthiness of the supporting entities, allowing the affiliates to reduce their fundraising costs by up to 3,156 million won.

The Fair Trade Commission determined that, as a result of this support, CJ Construction and Simulain gained significantly favorable competitive conditions compared to their rivals, thereby undermining fair trade order in the general construction market and the 4D cinema equipment supply market, respectively.

CJ Construction was able to artificially improve its financial structure and avoid a credit rating downgrade, which expanded its opportunities for external contracts and led to a continuous rise in its construction capability ranking. As a result, the competitive opportunities for independent small and medium-sized enterprises were substantially restricted.

Simulain also artificially improved its financial structure, avoided being forced out of the market, and was able to maintain its status as the sole or dominant player in the relevant market by excluding potential competitors.

The Fair Trade Commission stated, "This action is significant in that it uncovered and sanctioned conduct where a financially sound affiliate within a group supported a financially distressed affiliate that could not independently raise funds, thereby restricting market competition and undermining fair trade order."

The Commission also pointed out, "This conduct involved disguising what was effectively a credit enhancement and payment guarantee for an affiliate as an investment through derivatives," and emphasized, "Even if a financial product appears legitimate in form, it may constitute a legal violation if it is abused as a means to support a specific affiliate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)