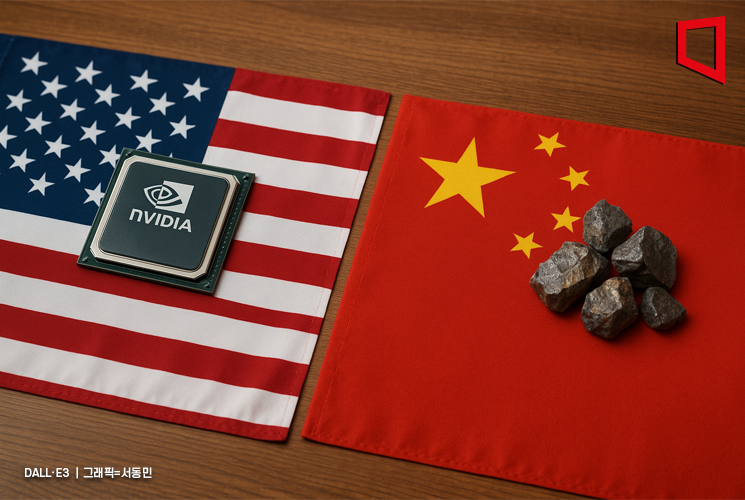

US: "Nvidia H20 Chip Sales Used as Bargaining Chip in Rare Earth Talks with China"

Fourth-Best Chip in Performance, So It's Acceptable

Nvidia Hits $170 for the First Time as Exports to China Resume

The Donald Trump administration's decision to allow the export of Nvidia's H20 chip to China was made in exchange for China resuming its rare earth exports. This appears to be a strategic choice to block the outflow of advanced semiconductor-related technology while partially opening export channels for domestic companies. Following the US authorities' approval of artificial intelligence (AI) chip sales to China, Nvidia's stock price soared by 4.04% to $170.70 on July 15 (local time), reaching an all-time high.

Secretary of Commerce Howard Lutnick explained the reason for permitting the H20 chip export in an interview with CNBC that day, saying, "The Biden administration allowed China to purchase these chips last year. Then we stopped it, and after reaching a (rare earth) magnet agreement with China, we said we would start selling chips to China again."

The magnet agreement mentioned by Secretary Lutnick refers to the deal reached between the US and China during the second round of trade negotiations held in London, UK, in June, where China agreed to lift its rare earth export controls to the US, and the US agreed to partially ease its export controls to China.

In other words, the US allowed the export of Nvidia's H20 chip to China on the condition that China would resume its rare earth magnet exports to the US.

Secretary Lutnick stated, "You have to consider that this (H20) is an old chip. Former President Joe Biden allowed it to be sold to China, and we reconsidered that decision. But now Nvidia has released its most advanced chip."

He continued by explaining that Nvidia has developed its latest chip, Blackwell, and possesses the H200 and H100 chips, so the H20 chip, which is now allowed to be sold to China, ranks fourth in terms of performance.

He added, "We do not sell the best products to China. We do not sell the second or third best products either. I think selling the fourth best product is acceptable." This implies that while the US will not completely block Nvidia's exports to the Chinese market, it will not supply its flagship products containing core AI technology. At the same time, it provides Nvidia with some export channels, offering the company some breathing room.

As the US government lifted export restrictions on Nvidia's H20 chip to China, Nvidia's stock price surged by 4% that day. Its market capitalization increased to $4.165 trillion, reaching a record high. The positive news from Nvidia spread across the entire AI sector, with the Philadelphia Semiconductor Index rising by 1.27%.

Secretary Lutnick said that the US aims to develop semiconductors that are "one step ahead" of the AI chips China can develop on its own, and to allow China to continue purchasing chips of lower specifications. He added, "President Trump wants to sell just enough for Chinese developers to become addicted to US technology."

Previously, Nvidia had been supplying the lower-performance H20 chip to China in place of high-performance AI chips due to export regulations under the Biden administration. However, starting in April, the Trump administration made government approval mandatory for H20 chip exports as well, tightening control.

Afterward, Secretary of the Treasury Scott Besant revealed that these export control measures were used as leverage in the US-China trade negotiations held consecutively in May and June of this year. In an interview with Bloomberg TV that day, Secretary Besant said, "That was a bargaining chip we used in Geneva and London."

He explained that H20 export controls were discussed during the negotiations, saying, "China had things we wanted, and we had things China wanted."

David Sacks, who oversees the Trump administration's AI and cryptocurrency policy, expressed concern in a Bloomberg TV interview that export restrictions would actually increase dependence on Huawei. He said, "Huawei is becoming much more competitive, and if we hand over the entire Chinese market to Huawei, it will massively subsidize Huawei's research and development (R&D)." He added, "If we prevent other countries from purchasing US technology, we are pushing them into China's arms." He explained that, in order to block the virtuous cycle where increased demand for Huawei leads to higher profits and more R&D investment, export restrictions should be lifted to ease market monopolies and disperse demand to US companies.

Meanwhile, Secretary Lutnick criticized the Korean government in the same interview, explaining the background of US steel tariffs and claiming that the Korean government is effectively subsidizing its steel industry through low electricity rates.

Secretary Lutnick asserted, "China, Japan, and Korea provide electricity to their steel companies for free or virtually free. Then they dump steel on us and destroy our domestic steel companies."

This has long been claimed by US steelmakers, but the Korean government and steel companies maintain that it is not true. In September 2023, the US Department of Commerce made a final determination that Korea's low electricity rates effectively act as a subsidy for the steel industry, imposing a 1.1% countervailing duty on heavy plate exported to the US by Hyundai Steel and Dongkuk Steel.

However, in December last year, the US Court of International Trade (CIT) initially ruled in favor of the Korean government in a lawsuit over countervailing duties imposed on Hyundai Steel. The US Department of Commerce argued that the high electricity consumption in the steel and related industries indicated specificity (targeted support for specific industries), but the CIT found that considering only consumption volume was not reasonable.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.