CPI Growth Rate: 2.4% in May to 2.7% in June

Core CPI Rises 2.9%, Below Expectations

Tariff Impact Becomes Visible... Consumption and Effective Tariff Rate as Variables

Uncertainty Grows Over Future Inflation and Interest Rate Outlook

The U.S. Consumer Price Index (CPI) rose more sharply than expected last month. Analysts attribute this to the gradual reflection of tariff effects in prices as the summer season begins. However, core inflation came in below expectations. As the White House continues to threaten tariffs and extend implementation delays, and as signs of weakening consumer spending emerge, there are growing views that the future trajectory of inflation and interest rates remains uncertain.

U.S. CPI rises from 2.4% in May to 2.7% in June...Tariff impact becomes visible

According to the U.S. Department of Labor on July 15 (local time), the CPI for June 2025 rose 2.7% year-on-year. This increase was larger than May's 2.4% and also exceeded the market forecast of 2.6%. On a month-over-month basis, the index rose 0.3%, higher than May's 0.1%, but in line with expectations. The widening of CPI growth is interpreted as a signal that companies have begun to pass on tariff costs to consumer prices in earnest.

Excluding the highly volatile energy and food sectors, core CPI rose 2.9% year-on-year. This was higher than May's 2.8% but fell short of the market estimate of 3.0%. On a month-over-month basis, core CPI increased by 0.2%, up from May's 0.1%, but still below the forecast of 0.3%. The core CPI, closely watched by the Federal Reserve (Fed), is considered especially important as it provides insight into the underlying trend of inflation.

By category, increases in housing and energy prices were particularly notable. Housing costs rose 0.2% month-over-month. Energy prices increased by 0.9%, with gasoline prices jumping 1.0%. Food prices rose 0.3%, with both grocery and dining-out expenses increasing by the same rate. Apparel, a tariff-sensitive category, rose 0.4%. In contrast, prices for new cars and used cars and trucks declined by 0.3% and 0.7%, respectively. This is attributed to a pull-forward in demand ahead of the 25% auto tariff that took effect in April, resulting in decreased demand last month.

This CPI release drew attention as the first indicator to assess whether the impact of tariffs is being fully reflected in summer prices. Federal Reserve Chair Jerome Powell and other monetary policymakers have repeatedly warned of possible inflationary pressures after summer. Thanks to companies stockpiling inventory before tariffs were implemented, the pass-through of costs to prices was restrained through spring, but there are concerns that as inventories are depleted in summer, tariff burdens will be reflected in consumer prices.

Slowing consumption and tariff delays are variables...Diverging views on inflation and rate outlook

With price increases limited to certain categories and core CPI coming in below expert expectations, there is debate in the market over whether tariffs will lead to broad-based inflation. Whether inflation remains moderate or accelerates will likely be gauged by the CPI data for July and August. In particular, if consumer spending power weakens, companies’ ability to pass on costs may also be limited, making upcoming retail sales data important as well.

Following the CPI release, Thomas Barkin, President of the Richmond Federal Reserve Bank, assessed that price pressures are mounting. In an interview with Bloomberg News, he stated, "Suppliers who have experienced inflation are trying to pass on cost pressures, and consumers, already weary of inflation, are reducing their spending." This means that, amid a tug-of-war between companies and consumers, the future path of inflation will depend on how much companies are able to pass on tariff costs to prices.

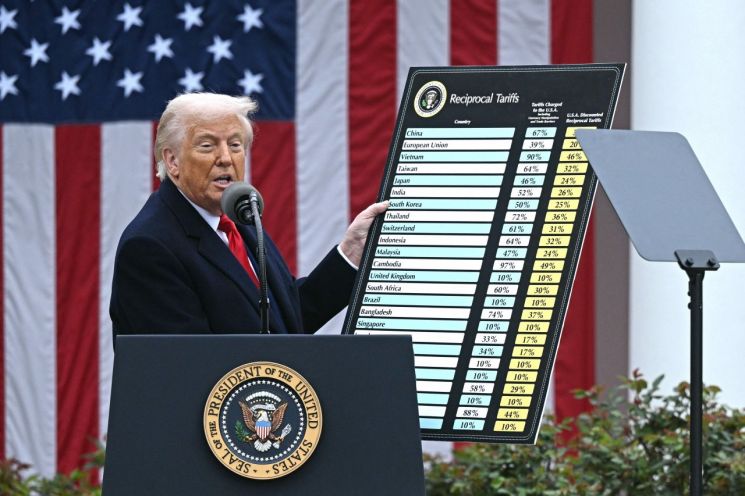

The fluidity of tariff policy is also a variable. President Trump, after announcing reciprocal tariff measures on April 2, has postponed country-specific tariffs beyond the base tariff rate of 10%. The tariff deferral, initially set to expire on July 9, has been extended by President Trump to August 1. Wall Street sees the repeated extensions as a negotiation tactic, with expectations that the effective tariff rate will be set in the mid-10% range.

Ian Lyngen, head of U.S. rate strategy at BMO Capital Markets, said, "Under normal circumstances, this report would trigger discussions of a Fed rate cut," adding, "Unfortunately, the tariff pressures scheduled for August 1 are likely to cause the Fed to hold off on lowering rates."

This is why economists and officials within the Fed are expected to become even more divided over the inflationary impact of tariffs and the path of interest rates.

As uncertainty over the inflation and interest rate outlook grows, the market is lowering its expectations for a rate cut in September. According to CME FedWatch, the federal funds futures market is currently pricing in a 52.5% chance that the Fed will cut rates by 0.25 percentage points from the current 4.25-4.5% at its September meeting. This is down from 58.9% the previous day. The probability of a rate hold in July is as high as 97.4%. Treasury yields are also rising. The yield on the 2-year U.S. Treasury, which is sensitive to monetary policy, rose 5 basis points (1bp=0.01 percentage points) from the previous day to 3.95%, while the yield on the 10-year Treasury, the global bond benchmark, rose 6 basis points to 4.49%.

Meanwhile, President Trump posted on his social media platform Truth Social immediately after the CPI release, stating that "consumer prices are low" and that "the Fed should cut rates by 3 points (3 percentage points) right now."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)