Quarterly Earnings Growth Driven by New Drug Performance

Chong Kun Dang's Operating Profit Expected to Decline by Double Digits

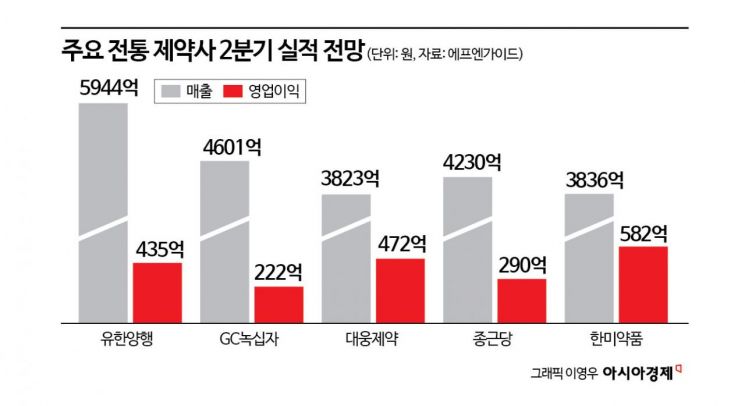

Major traditional pharmaceutical companies such as Yuhan, GC Green Cross, Daewoong Pharmaceutical, Chong Kun Dang, and Hanmi Pharmaceutical are all expected to post increased sales in the second quarter. Despite uncertainties such as tariff risks originating from the United States, rising costs, and prolonged conflicts between the medical community and the government, these companies appear to be overcoming challenges through technology transfers, new drug development, and increased exports.

According to the earnings consensus (average forecasts from securities firms) compiled by financial information provider FnGuide on July 16, Yuhan is expected to record sales of 594.4 billion won and operating profit of 43.5 billion won in the second quarter, representing increases of 12.5% and 235% year-on-year, respectively. Milestone payments for the lung cancer drug Leclaza, which came from Japan and Europe, amounted to approximately 20.7 billion won.

The sales growth of Leclaza is expected to accelerate further, driven by factors such as U.S. approval of Livrivant SC (a subcutaneous injection used in combination therapy with Leclaza), its preferred listing in the NCCN Guidelines (U.S. clinical practice guidelines for cancer), and confirmation of overall survival (OS) data. Yuhan Chemical, which operates a high-margin overseas business, is also expected to see expanded sales. Over the past year, Yuhan Chemical secured orders for active pharmaceutical ingredients (API) worth about 200 billion won from Gilead.

GC Green Cross is expected to report second-quarter sales of 460.1 billion won, up 10.2% year-on-year, and operating profit of 22.2 billion won, up 25.8%. The expansion of domestic and overseas sales of 'Aliglo' contributed significantly, driven by higher domestic blood product prices and increased exports to the U.S. Previously, GC Green Cross expanded Aliglo export volumes starting in March in response to growing uncertainty over U.S. pharmaceutical tariff policies. Exports of the influenza vaccine 'GC Flu' to Thailand will also be reflected from the second quarter. In April, the company succeeded in winning a bid for 5.94 million doses (single-use) of GC Flu, the largest-ever order in the Thai influenza vaccine market.

Daewoong Pharmaceutical's second-quarter sales are projected at 382.3 billion won, a 6% increase year-on-year, with operating profit expected to reach a record 47.2 billion won, up 11.5%. The export growth of the botulinum toxin 'Nabota' is drawing attention. In April, U.S. partner Evolus launched a filler product, and the bundled sales strategy with Nabota is anticipated to boost revenue. Nabota shipments delayed in February will also be reflected in the second quarter. Over-the-counter (OTC) drugs are estimated to grow by more than 13%, driven by expanded distribution channels.

For Chong Kun Dang, expanded prescriptions of newly introduced products such as Fexuclu and Godex, as well as the inclusion of a milestone payment of about 7 billion won related to the dyslipidemia treatment CDK-519, are expected to drive second-quarter sales to 423 billion won, a 6.6% increase year-on-year. However, operating profit is forecast to decline by about 19% to 29 billion won. This is attributed to a higher proportion of low-margin products and the recognition of provisions related to the Gliatilin lawsuit (estimated at about 25 billion won annually).

Hanmi Pharmaceutical's second-quarter sales consensus stands at 383.6 billion won, a 1.4% increase year-on-year. During the same period, operating profit is expected to reach only 58.2 billion won, up 0.1%, according to FnGuide. Hanmi Pharmaceutical's sales are growing mainly in the high-margin prescription drug (ETC) segment, including Rosuzet and the Amosartan family, but appear to be affected by Beijing Hanmi entering a seasonal off-peak period. Hanmi Fine Chemical is also expected to see negative growth both year-on-year and quarter-on-quarter due to continued sluggish API orders.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)