Financial Supervisory Service Releases Key Points on Indemnity Health Insurance on July 15

Neuroplasty: Only Outpatient Benefits Covered If Hospitalization Is Not Medically Necessary

Subscriber A of an indemnity health insurance policy was diagnosed with obesity and hyperlipidemia at a hospital and underwent gastric reduction surgery. A filed a claim for reimbursement of the surgical expenses with the insurance company, but the claim was denied. This is because, under the terms of the indemnity insurance policy, damages related to obesity are not covered. However, if the gastric reduction surgery is performed for the treatment of conditions such as diabetes, rather than obesity, the procedure is covered by the national health insurance and thus eligible for reimbursement under indemnity insurance.

On July 15, the Financial Supervisory Service released a notice regarding "Important Considerations for Indemnity Health Insurance."

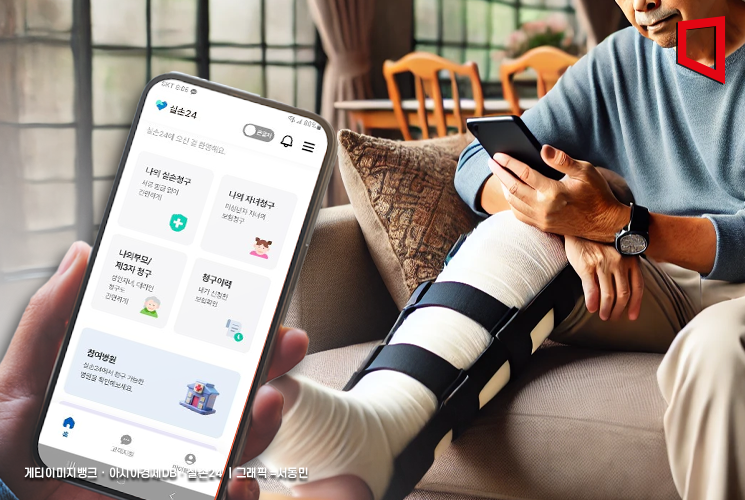

A patient filing a reimbursement claim for actual medical expenses through a smartphone application.

A patient filing a reimbursement claim for actual medical expenses through a smartphone application.

Subscriber B of an indemnity policy underwent neuroplasty at a hospital and filed a claim for inpatient medical expenses with the insurance company. The insurer determined that, since there were no complications or need for follow-up monitoring after the neuroplasty, hospitalization was not medically necessary for the procedure and paid benefits only up to the outpatient treatment limit. The Health Insurance Review and Assessment Service also published 18 case studies regarding neuroplasty procedures, stating that, in these cases, there was no evidence of changes in condition requiring inpatient observation or limitations in daily life, and thus hospitalization fees were not recognized. It is important to note that, if the need for hospitalization is not acknowledged for neuroplasty, reimbursement may be limited to the outpatient benefit cap.

Subscriber C of an indemnity policy purchased multiple moisturizers (MD cream) with a doctor's prescription for the treatment of xerosis (dry skin) and filed a claim for reimbursement. The insurer denied payment for all but one moisturizer per outpatient visit, arguing that the purchase of additional moisturizers does not constitute a medical act performed by a physician. The Supreme Court ruled that, under the policy, outpatient miscellaneous expenses refer not to all costs required for treatment, but only to those arising from medical acts performed by a physician. Therefore, the cost of moisturizers purchased by someone other than the physician is not eligible for reimbursement.

Subscriber D of an indemnity policy, who was residing overseas, canceled their existing indemnity policy in November of last year. In March of this year, D requested a refund of the premiums paid during their period of stay abroad. The insurer denied the refund, stating that all contractual relationships, including premium refunds, were terminated at the time of cancellation. However, the financial authorities took a different view. They determined that if the insured can provide evidence of continuous overseas residence for more than three months, the insurer must refund the indemnity insurance premiums for that period.

A representative from the Financial Supervisory Service stated, "Recently, disputes have been continuously arising regarding indemnity insurance coverage for non-insured treatments that are not covered by the national health insurance," and advised, "Policyholders should carefully review whether a treatment is covered by indemnity insurance before receiving hospital care to avoid any disadvantages when filing claims."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.