Hyosung Heavy Industries Surpasses 1 Million Won on July 14

Becomes Fourth Emperor Stock After Samyang Foods, Taekwang Industrial, and Samsung Biologics

Anticipation Builds for Entry Into AI Power Equipment Supercycle

The fortunes of the contenders vying for the next "Emperor Stock" (stocks priced over 1 million won) have diverged. While Hanwha Aerospace, which had been closely trailing Samyang Foods and running at the front of the pack, faltered, Hyosung Heavy Industries capitalized on the "supercycle" (boom) in artificial intelligence (AI) power equipment and managed to overtake its rivals, crossing the finish line first.

According to the Korea Exchange on July 15, Hyosung Heavy Industries closed at 1,008,000 won the previous day, up 3.07%, officially becoming an Emperor Stock. Since the beginning of this year, Hyosung Heavy Industries is the second stock to surpass the 1 million won mark, following Samyang Foods. In contrast, Hanwha Aerospace, which was once considered a strong candidate for Emperor Stock status, ended the day at 807,000 won with a slight gain, falling short of expectations.

Initially, Hanwha Aerospace was leading the race to become the next Emperor Stock. Having risen approximately 122% this year, Hanwha Aerospace overtook Hyundai Motor in May to become the fifth-largest company by market capitalization, establishing itself as a leading player in "K-defense." Although it ceded the first Emperor Stock title of the year to Samyang Foods, on June 16 it soared to 987,000 won during intraday trading, coming within reach of the milestone.

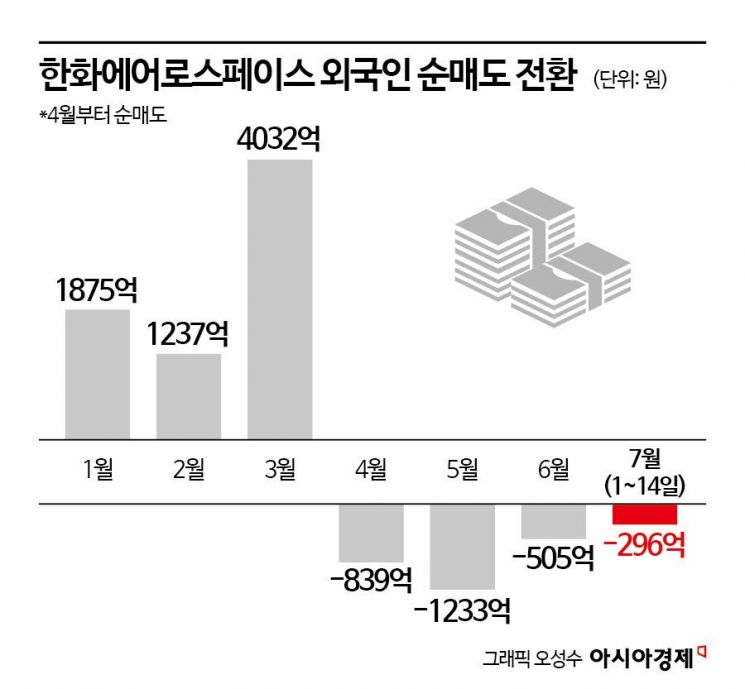

However, the upward momentum began to stall as foreign investors, who had been driving the stock price, started to realize their gains. After purchasing 714.4 billion won worth of Hanwha Aerospace shares in the first quarter alone, these investors turned net sellers in the second quarter, offloading 287.3 billion won worth of shares through the previous day. Although the company revised its large-scale rights offering?previously seen as a negative?to ease the burden on existing shareholders and continued to present rosy earnings forecasts, these measures were not enough. Currently, the stock has undergone a correction of about 20% from its peak, pushing its market capitalization out of the top ten.

Meanwhile, Hyosung Heavy Industries, which had been tightening its pursuit, seemed to be taking a breather after hitting 998,000 won last week and then pulling back. However, it quickly surged past the 1 million won mark in a single day. Just as with Hanwha Aerospace's previous rally, foreign investors were at the center of the surge, making net purchases totaling 398.9 billion won. Above all, expectations that investments in power infrastructure and demand for data centers will skyrocket amid intensifying competition among global powers for AI supremacy have fueled investor sentiment.

Since the beginning of this month, as many as eight securities firms have predicted that Hyosung Heavy Industries would achieve Emperor Stock status. As global electricity demand has surged?evidenced by U.S. data center rental fees reaching all-time highs?there has been a flood of interest in the nation's number one GIS (Gas Insulated Switchgear) manufacturer. On July 1, the company announced a GIS equipment order worth approximately 264.1 billion won from a U.S. power company, marking the largest single order contract for circuit breakers.

Jo Yeonju, a researcher at Mirae Asset Securities, said, "The share of domestically produced high-voltage transformers imported into the U.S. is expected to rise from 9% in 2022 to a cumulative 22% by 2025, creating a favorable environment." She raised the target price for Hyosung Heavy Industries by over 100%, from 600,000 won to 1,220,000 won. Second-quarter sales are projected to reach 1.392 trillion won (up 17% year-on-year), with operating profit expected at 136 billion won (up 116%), indicating a strong earnings surprise.

The fact that overseas subsidiaries are winning local orders and are thus free from tariff risks is also providing a boost to the stock price. With the Changwon ultra-high voltage transformer plant, which completed its expansion last month, now in operation, the Memphis plant in the U.S. is also expected to double its production capacity (CAPA) by the end of next year. Son Hyunjung, a researcher at Yuanta Securities, stated, "2026 will mark the beginning of structural growth, driven by the full recognition of high-value orders from North America and the effects of overseas CAPA expansion in locations such as Memphis." She set the target price at 1,220,000 won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)