China Set to Become the World's Largest Hydrogen Vehicle Market

Hydrogen Vehicle Adoption Expands, Focusing on Commercial Trucks and Specialty Vehicles

Hyundai Motor Partners with Guangzhou to Target the Chinese Market

Contributing to Next-Generation Technology Development Through Localization

China's Pursuit of Hydrogen Supremacy Draws Close

On June 26, after about an hour's drive from Guangzhou Baiyun Airport in China, I arrived at Hyundai Motor's 'HTWO Guangzhou' plant. This corporation produces and sells hydrogen fuel cells and is located in the advanced industrial development complex in Huangpu District, Guangzhou, Guangdong Province, China, covering an area of 202,000 square meters (about 60,000 pyeong). The plant has the capacity to produce 6,500 hydrogen fuel cells annually and is currently manufacturing about 1,000 units. As a state-of-the-art plant completed in June 2023, its sophisticated interior design and neat exterior stood out.

First, I toured the production process of the 'EGA (Electricity Generating Assembly)', the core component of the hydrogen fuel cell. The EGA is a thin membrane that can be called the cell of the hydrogen fuel cell. Hydrogen and oxygen meet and react chemically through this microporous membrane, generating electricity. Stacking approximately 400 of these thin membranes forms a hydrogen fuel cell stack, and when the stack is combined with air and hydrogen supply systems, thermal management systems, and more, it becomes a fuel cell system that can be installed in vehicles.

Exterior view of Hyundai Motor's hydrogen fuel cell system production corporation in China, 'HTWO Guangzhou'. Photo by Woo Suyeon

Exterior view of Hyundai Motor's hydrogen fuel cell system production corporation in China, 'HTWO Guangzhou'. Photo by Woo Suyeon

The EGA production line I visited that day resembled a semiconductor factory focused on precision and cleanliness, rather than a typical manufacturing plant assembling machinery. Even before entering the factory, I donned a white gown and shoe covers. The cell production line, which requires a high level of cleanliness, was separated from the outside by glass walls. Beyond the glass, researchers in cleanroom suits were busily inspecting the production line. Moon Guhyun, head of production, emphasized, "We maintain a cleanroom system at the level of semiconductor processes, keeping dust below 10,000 particles per cubic meter." Since this area handles national core technologies, controls to prevent technology leaks and ensure security were strict. Not only was mobile phone photography prohibited, but all entrants were also controlled by metal detectors and facial recognition systems.

As a facility handling hazardous hydrogen, special attention to safety was evident throughout. Hyundai Motor has separated the processes utilizing hydrogen into a dedicated building for management. Inside the building where hydrogen is used, gray explosion-proof walls were installed, and hydrogen detectors were visible on the ceiling. Moon explained, "This building is designed to meet the highest safety standards in China."

After passing through the stack process, I arrived at the activation and performance testing line, where fuel cells with test wires attached to each cell were placed on a conveyor belt. On this line, the activation level of each cell is verified, and simulated driving and testing are conducted for about three hours. The cells are tested under various conditions, including low and high speeds, load operation simulating heavy cargo, and rapid acceleration.

Finally, the final assembly and inspection of system components are handled by experts. Although the plant's production automation level exceeds 90%, all products undergo final inspection by skilled personnel before shipment. At this stage, even the tightness of bolts and nuts is quantified, and all processes are recorded as data. Moon stated, "Even during after-sales service, we can scan the barcode of a specific product and review the entire production process and product status as it was before shipment."

Hydrogen fuel cell 'EGA' produced by Hyundai Motor's China hydrogen fuel cell system manufacturing corporation 'HTWO Guangzhou'. Photo by Woo Suyeon

Hydrogen fuel cell 'EGA' produced by Hyundai Motor's China hydrogen fuel cell system manufacturing corporation 'HTWO Guangzhou'. Photo by Woo Suyeon

Why did Hyundai Motor build a hydrogen fuel cell plant in China?

China is the world's largest producer and consumer of hydrogen. While Korea maintains unrivaled leadership in hydrogen fuel cell system technology, China is the country that uses hydrogen as an energy source the most. According to the China Hydrogen Energy Development Report, as of 2024, China's annual hydrogen consumption exceeded 36.5 million tons, ranking first in the world. Currently, hydrogen is mainly used in the chemical industry, but it is expected to be widely used in transportation, energy storage, and power generation in the future.

Entrance of the headquarters of Hyundai Motor's China hydrogen fuel cell system production corporation 'HTWO Guangzhou'. Photo by Woo Suyeon

Entrance of the headquarters of Hyundai Motor's China hydrogen fuel cell system production corporation 'HTWO Guangzhou'. Photo by Woo Suyeon

As of the end of 2024, the cumulative number of hydrogen fuel cell vehicles (hydrogen vehicles) in China (28,000 units) ranks second in the world after Korea (42,000 units). Thanks to central government policies to foster the hydrogen industry, the distribution of hydrogen vehicles, mainly commercial vehicles, is rapidly expanding in five pilot city clusters (Beijing, Shanghai, Guangdong, Hebei, Henan).

China also has the largest number of hydrogen refueling stations. According to data provider H2 Station, as of the end of 2024, there were 1,160 hydrogen refueling stations worldwide, with 384 installed in China. This is more than Korea (198) and Japan (161) on a single-country basis. China aims to build 1,264 stations in 27 provinces and cities by 2025 and plans to increase the cumulative number of hydrogen vehicles to 1 million by 2035.

It is only natural that hydrogen fuel cell manufacturers such as Hyundai Motor and Toyota are entering China, the world's largest hydrogen consumption market. In particular, China is considered the fastest market to build a hydrogen ecosystem under full government support. In 2024, the Chinese central government enacted the 'Energy Law', officially including hydrogen as an energy source, and began implementation this year. By establishing a legal framework that recognizes hydrogen as an energy source on par with coal, oil, and natural gas, China has made clear its intention to lead the industry's development at the national level. With this, China is accelerating the creation of a hydrogen ecosystem and is also moving to set global standards for the hydrogen industry.

Hyundai Motor's Strategy for the Chinese Hydrogen Market

What is Hyundai Motor's strategy as it enters the world's largest hydrogen market in China? I met Choi Dooha, Executive Director and Head of HTWO Guangzhou, who oversees Hyundai Motor Group's hydrogen strategy for the China region, to discuss this. Choi identified the core task of HTWO Guangzhou as "strengthening global technological competitiveness through localization in China." He said, "Our goal is to secure global technological competitiveness by not only competing with Chinese system companies, whose technological capabilities are rising, but also by strengthening cooperation with local partners." He added, "We are particularly focused on developing and commercializing next-generation hydrogen fuel cells."

Hyundai Motor's hydrogen fuel cell system has already proven to be world-class in terms of performance and durability. However, compared to hydrogen fuel cells produced by Chinese companies, Hyundai's products are more than 1.5 times more expensive. To overcome this limitation, Hyundai Motor is actively developing next-generation (third-generation) fuel cell systems that offer higher performance at a lower cost. To reduce the cost of next-generation fuel cells, Hyundai is considering incorporating promising local Chinese parts suppliers into its supply chain. If cost competitiveness can be secured by reducing various expenses such as logistics, transportation, and labor locally, the company believes it will also be able to export to the global market.

Choi said, "Although hydrogen vehicle sales are increasing in Korea with the launch of the new Nexo, there is no disagreement that China will grow into the world's largest hydrogen vehicle market in the long term. Our role is to develop technologies suited to the local market so that we can offer competitive hydrogen fuel cells without subsidies, and to lay the groundwork in the hydrogen vehicle market, which is expected to grow in earnest after 2030."

Choi Dooha, Executive Director in charge of Commercial Hydrogen for China region, Head of Hyundai Motor HTWO Guangzhou Corporation. Photo by Woo Suyeon

Choi Dooha, Executive Director in charge of Commercial Hydrogen for China region, Head of Hyundai Motor HTWO Guangzhou Corporation. Photo by Woo Suyeon

Collaboration with local companies is crucial to integrate into China's hydrogen ecosystem. In the nascent hydrogen commercial vehicle market, sales are virtually impossible without subsidies. Unlike Korea, which provides purchase subsidies, China grants subsidies based on the annual operating distance of hydrogen vehicles. In addition, since the main customers for fuel cell systems and hydrogen vehicles are government agencies or state-owned enterprises, close cooperation with local governments is essential for this business.

The early-stage Chinese hydrogen commercial vehicle market is growing mainly through government subsidies. Unlike Korea and Japan, which focus on passenger vehicles, China has chosen to concentrate on commercial vehicles such as buses, logistics trucks, garbage trucks, and tractors. There is fierce competition among the five designated pilot regions?Beijing, Shanghai, Guangdong, Hebei, and Henan?to meet their target distribution numbers.

By choosing Guangzhou, Guangdong Province as its partner, Hyundai Motor is helping to convert logistics trucks, buses, garbage trucks, and tractors in the Guangzhou area to hydrogen vehicles. To date, about 500 units have been sold, with a cumulative driving distance of 1.91 million kilometers. Once the next-generation fuel cell system currently under development is introduced, it is expected to be applied to various fields such as ships, aviation, and railways.

Hyundai Motor is set to establish a fuel cell research and development center in China later this month, where it plans to conduct demonstration projects for various mobility applications. Choi said, "Guangzhou City formed a dedicated task force to attract our plant and provided active support by dramatically shortening the complex permitting process for site selection, water, and electricity supply. Having received so much help, we believe we must also contribute to the region's GDP and the development of the hydrogen ecosystem."

China's Pursuit of Hydrogen Supremacy

While Hyundai Motor is expanding its presence in the Chinese hydrogen commercial vehicle market with its technological prowess, there is also a sense of crisis as rapidly growing Chinese companies emerge. More than 60 local Chinese hydrogen fuel cell manufacturers are aggressively increasing their market share with full government support as they quickly build their ecosystem.

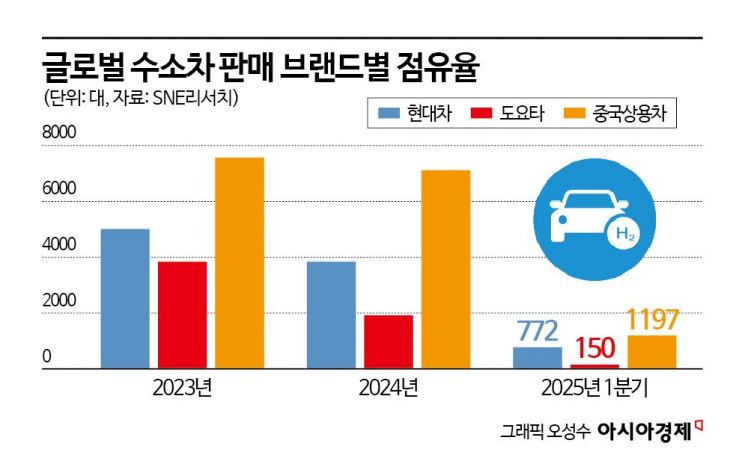

According to SNE Research, in the first quarter of 2025, Chinese companies held a record 56.5% share of the global hydrogen vehicle market. Their sales reached 1,197 units, up 45% from the same month last year. China's share of the global hydrogen vehicle market also reached 56.4%. This means that more than half of the hydrogen vehicles sold worldwide are operating in China. There are predictions that China will have both the largest market and the top market share in hydrogen vehicles, following its dominance in electric vehicles.

In terms of durability, efficiency, and consistent quality, Hyundai Motor is clearly ahead, but the 60-plus Chinese hydrogen fuel cell manufacturers are competing in the market with prices more than 30% lower. Price competitiveness is a major advantage, especially in the commercial vehicle market, which is highly price-sensitive. Furthermore, the development speed of Chinese companies is faster than expected, keeping established leaders like Hyundai Motor and Toyota on edge. Chinese companies have already achieved most of the target technology indicators set by the national promotion policy in 2020, and the localization rate of the five major key components has reached nearly 85%.

Above all, the most formidable aspect of China is the continuity of its policies. Once the government sets a direction, it mobilizes capital, manpower, and technology to foster the industry over the long term. With a clear control tower, there is no policy overlap or confusion, and collaboration among companies and sectors is organic. Industry insiders point out that China is applying the same government-led ecosystem-building approach to hydrogen vehicles as it did in the early electric vehicle market.

In 2022, the National Development and Reform Commission of China announced the country's first government-level comprehensive hydrogen energy development plan, the 'Medium- and Long-term Hydrogen Energy Industry Development Plan (2021-2035)'. In 2023, guidelines were issued to establish industry standards, and in 2024, hydrogen was included in the national energy law, providing a legal basis for systematic industry development. This year, specific details and targets for the second phase (2026-2030) of the medium- and long-term hydrogen energy industry development plan are expected to be presented.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.