Preliminary Results Announced for Administrative Review of Korean Acetone Anti-Dumping

"Maritime Transportation Costs Appear Double-Counted... Objection Filed"

Regulatory Net Cast Even on Small Exports... Final Ruling Expected Early Next Year

The U.S. Department of Commerce has issued a preliminary determination of a 0.69% anti-dumping margin on acetone exports from Kumho P&B Chemical, a subsidiary of Kumho Petrochemical. In addition to President Donald Trump's policy of strengthening reciprocal tariffs, the emergence of precise price regulations on individual items is putting double pressure on the domestic petrochemical industry. Industry observers point out that, even if the export volume is not high, a dumping margin can be calculated depending on single transactions or shipping terms, indicating the need for a comprehensive review of future pricing and contract structures.

According to industry sources on July 16, the Department of Commerce recently released its preliminary administrative review results for imports of Korean acetone from March 2023 to February 2024. This investigation was conducted in response to an annual request by the Coalition for Acetone Fair Trade, an alliance of U.S. acetone producers, and included Kumho P&B and LG Chem as subjects of review. Previously, in March, the United States decided to extend anti-dumping duties on acetone from Korea and four other countries for another five years. According to the Ministry of Trade, Industry and Energy, Korea's acetone exports to the U.S. dropped from 95,000 tons in 2018 to 2,300 tons in 2023, a decline of more than 90% since the imposition of these regulations.

According to the preliminary results, Kumho P&B was found to have exported acetone to the U.S. at prices lower than its domestic normal value during the review period, resulting in a dumping margin of 0.69%. Under U.S. anti-dumping regulations, a margin exceeding 0.5% is considered "not de minimis" and is subject to duties or cash deposits. LG Chem reported no exports to the U.S. during the same period, and as there were no objections, it was excluded from the review.

Acetone is a transparent, highly volatile substance produced as a by-product of the phenol process and is an essential raw material for manufacturing chemical intermediates such as bisphenol A (BPA) and methyl methacrylate (MMA). In Korea, Kumho P&B and LG Chem are the main producers. Both companies operate cumene process-based facilities that produce phenol and acetone together.

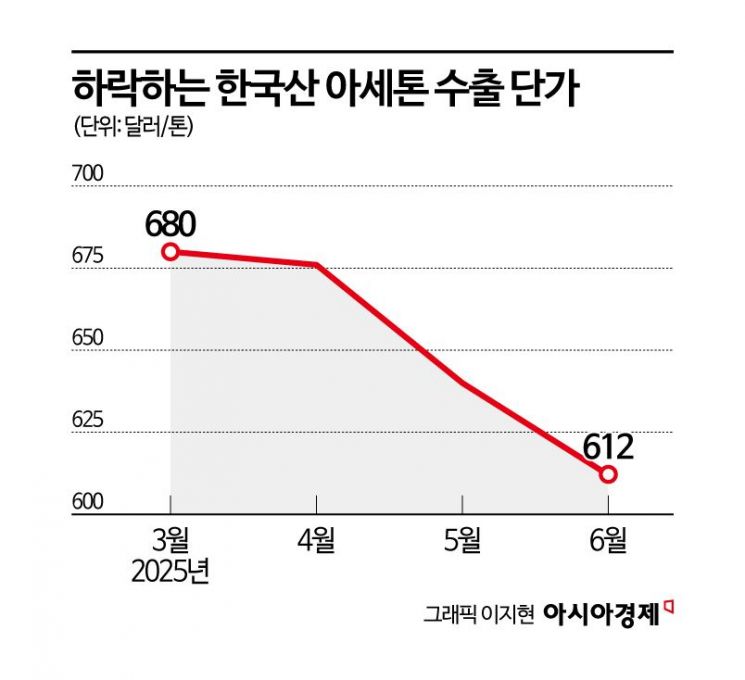

The U.S. Department of Commerce will accept stakeholder opinions on the preliminary determination within 21 days, followed by rebuttal submissions and a hearing process, before issuing a final determination in early 2026. An industry official stated, "Even with a small export volume, a margin can arise from a single transaction or a specific condition," and added, "It is necessary to comprehensively review pricing strategies and export terms to prevent the expansion of such regulations to other petrochemical products in the future." According to the Korea Customs Service, the export price of Korean acetone has been declining for four consecutive months, from $680 per ton (about 940,000 KRW) in March to $612 per ton in June.

Kumho P&B has filed an objection regarding this determination. A company official stated, "We have submitted an objection to the Department of Commerce after confirming that certain items, such as maritime transportation costs, were excessively reflected due to double counting," and added, "We plan to continue supplementing data and responding until the final results are announced, which is expected early next year." The official further noted, "Although the proportion of exports to the U.S. is in the single digits and not large, we are closely monitoring the situation as there is a relevant market."

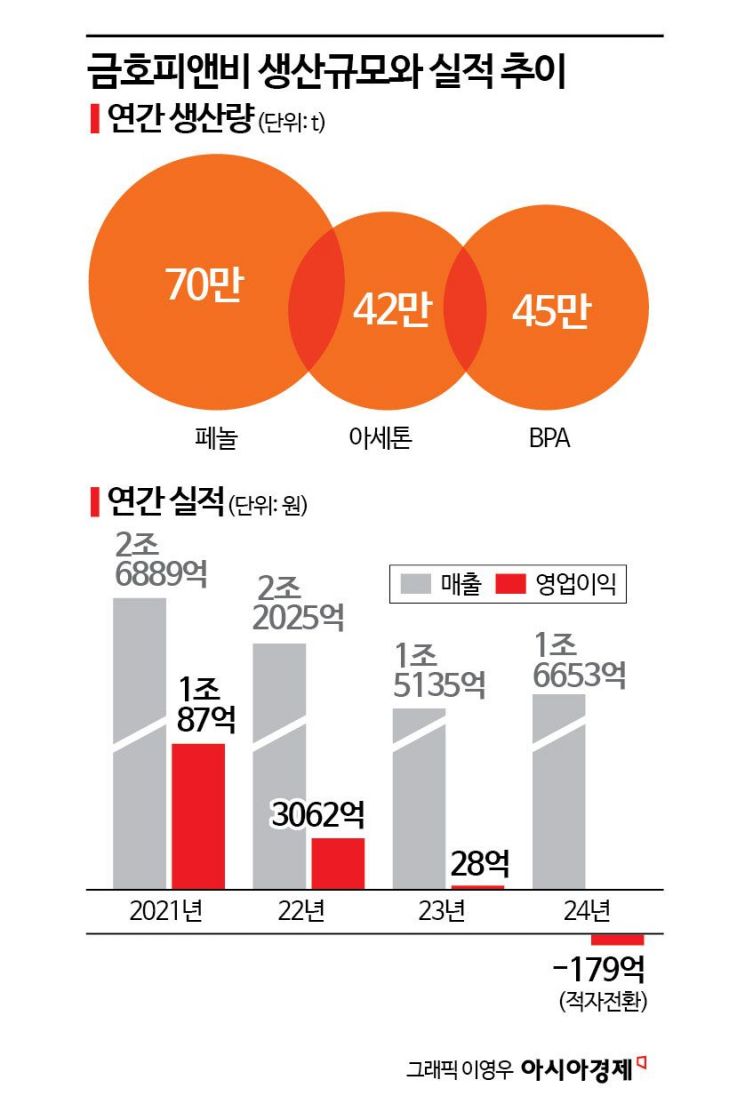

Kumho P&B has an annual production capacity of 700,000 tons of phenol, 420,000 tons of acetone, and 450,000 tons of BPA at the Yeosu National Industrial Complex. Its performance has been declining for four consecutive years. In 2021, sales reached 2.6889 trillion KRW and operating profit was 1 trillion KRW, but by 2023, sales had shrunk to 1.5135 trillion KRW and operating profit to 2.8 billion KRW. Last year, the company recorded an operating loss of 17.9 billion KRW.

This determination comes at a time when the domestic petrochemical industry is facing a triple challenge of high oil prices, sluggish demand, and oversupply. For commodity product groups like acetone, which are highly volatile in unit price, margin rates and regulatory risks can react sensitively to export prices. This serves as a warning to companies that meticulous management of pricing and transaction terms is essential.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)