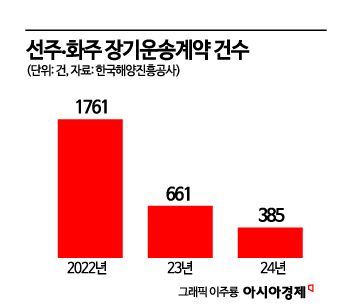

Only 385 Long-Term Contracts Last Year

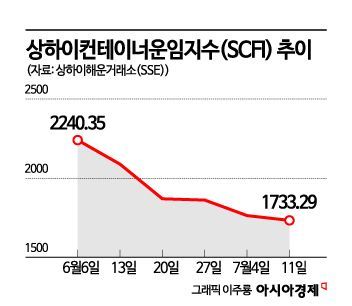

Further Decline Expected Due to Ongoing SCFI Drop

Government Reviewing Measures Such as Extension of Tax Credits

On February 13th, containers were piled up at Pyeongtaek Port, Gyeonggi Province. Photo by Kang Jinhyung

On February 13th, containers were piled up at Pyeongtaek Port, Gyeonggi Province. Photo by Kang Jinhyung

Long-term shipping contracts, which are considered a form of "insurance" for shipping companies by guaranteeing stable revenue, have shrunk to just a quarter of their previous level over the past two years. There are warnings that instability in maritime logistics will further increase as concerns over a global economic downturn grow, and tariff risks originating from the United States intensify.

According to the Korea Ocean Business Corporation on July 14, the number of reported long-term shipping contracts last year was only 385. The number of long-term contracts plummeted for two consecutive years, with 1,761 in 2022 and 661 in 2023. Under the Shipping Act, revised and enforced in July 2020, shipowners (shipping companies) and cargo owners (exporters) are required to report freight rates, charges, and fuel costs to the government when they sign cargo transport contracts lasting three months or longer. The signing of long-term shipping contracts between shipowners and cargo owners is generally seen as an indication that they expect shipping rates to rise in the future. Conversely, when a decline in maritime freight rates is anticipated, the number of long-term contracts tends to decrease.

The number of contracts is expected to decrease even further this year. The Shanghai Containerized Freight Index (SCFI), which reflects freight rates on global shipping routes, fell for the fifth consecutive week last week, reaching 1,733.29. An industry official said, "Cargo owners usually prefer short-term contracts when they expect freight rates to fall, believing that long-term contracts would be disadvantageous. Unlike during the pandemic, when rates surged sharply, this year there is an oversupply of vessels and low demand for cargo, leading many cargo owners to predict a decline in rates."

However, there are concerns that a low number of long-term shipping contracts makes it difficult to prepare for logistics bottlenecks. If the global economic downturn worsens or if the United States implements high tariff policies and maritime cargo volumes drop sharply, a shipping industry centered on short-term contracts could see its profitability and stability severely shaken. Long-term contracts, which guarantee freight rates and cargo volumes for at least three months, have the advantage of securing stable rates and vessel space (the total amount of cargo that can be loaded on a ship) regardless of supply chain crises.

Since the bankruptcy of Hanjin Shipping in 2017, the government has introduced various incentives to expand long-term shipping contracts, but the situation has shown little improvement. An official from the Ministry of Oceans and Fisheries said, "Even HMM, the leading national shipping company, is not yet at a stage where it can be considered fully self-reliant. With a global market share of only about 3% and vessel capacity six times smaller than that of 2M (Maersk and MSC), safety measures such as long-term contracts are all the more necessary."

To encourage long-term shipping contracts between shipowners and cargo owners, the government is considering extending and expanding tax credits. Under the current Restriction of Special Taxation Act, companies certified as "excellent shippers" based on their performance in long-term contracts can receive corporate tax reductions until the end of this year. The current tax credit rate is about 1% of the freight paid to national shipping companies. The industry has been calling on the government to raise the tax credit rate to at least 3%. A government official said, "We are continuing discussions with relevant agencies and associations on whether to extend tax support for certified excellent shippers and, if so, how to implement such an extension."

There are also calls to establish consultative bodies so that small and medium-sized cargo owners can access long-term contracts. Kim Inhyun, professor emeritus at Korea University Law School and captain, said, "In advanced countries such as the United States, industry associations sign long-term contracts with shipping companies on behalf of smaller cargo owners. In Korea as well, it is necessary to form industry-specific cargo owner associations for small and medium-sized companies, and to have these associations sign long-term contracts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)