There was an argument that, in order for share buybacks and similar measures to truly enhance shareholder value, revisions to tax law and a change in the perception of treasury shares as assets are necessary.

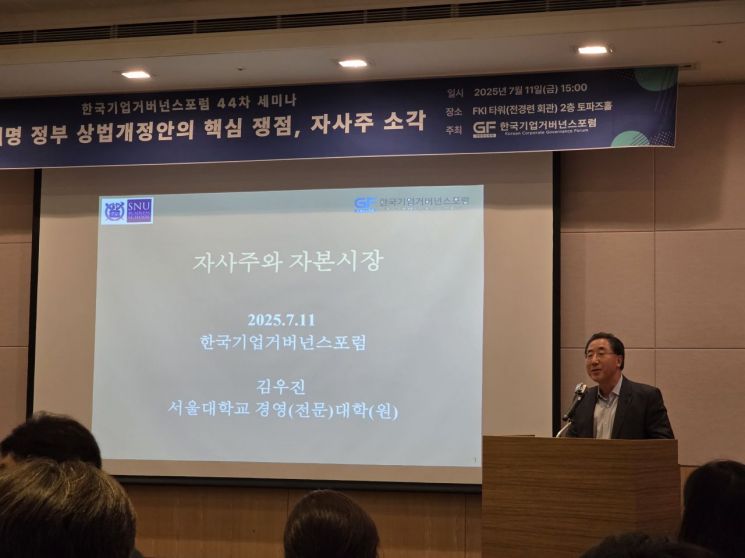

Namwoo Lee, chairman of the Korea Corporate Governance Forum, delivering a greeting at the seminar "Key Issues of the Lee Jae-myung Government's Commercial Act Amendment, Treasury Stock Cancellation" held on the 11th at the Korea Economic Association in Yeouido. Photo by Hyunseok Yoo

Namwoo Lee, chairman of the Korea Corporate Governance Forum, delivering a greeting at the seminar "Key Issues of the Lee Jae-myung Government's Commercial Act Amendment, Treasury Stock Cancellation" held on the 11th at the Korea Economic Association in Yeouido. Photo by Hyunseok Yoo

The Korea Corporate Governance Forum held its 44th seminar on the theme "Key Issues of the Lee Jae-myung Government's Commercial Act Amendment, Treasury Stock Cancellation" on the 11th at the Korea Economic Association in Yeouido.

Attendees included Woojin Kim, professor at Seoul National University Business School; Sangyoung Chun, CFO of Shinhan Financial Group; Hyungkyun Kim, head of Cha Partners Asset Management; Kyusik Kim, attorney at Vista Global Asset Management; and Junbeom Chun, attorney at Wise Forest.

Professor Woojin Kim, who gave the keynote presentation, explained that recognizing treasury shares as assets has led to distortions in the domestic stock market. He said, "Traditionally, under domestic and international accounting standards, acquired treasury shares are recorded on the debit side, but they are recognized as a deduction from equity, not as assets," and added, "However, domestic tax law treats treasury share transactions as profit-and-loss transactions, not capital transactions, in order to tax gains from treasury share sales."

He stated, "The current asset-based approach to treasury shares causes numerous side effects in the capital market," and noted, "Both the earnings per share (EPS) and price-earnings ratio (PER) indicators are overstated, and the KOSPI Composite Index is also distorted."

Hyungkyun Kim, head of Cha Partners Asset Management, also commented, "The correct way to describe a share buyback is that it returns shares contributed by investors back to them," and added, "Because the reality is that contributed capital is being returned to shareholders who want it, it is not an increase in assets but a deduction from equity." He further emphasized, "It is only natural to exclude treasury shares from the calculation of market capitalization."

In addition, Kyusik Kim, attorney at Vista Global Asset Management, cited the case of KT&G, pointing out that by donating treasury shares to welfare foundations and scholarship foundations, the management strengthened its control over the company. He stated, "It is necessary to establish an exception clause for mandatory cancellation on the premise that the operation of foundations and funds is entrusted to external parties and the independence of the board of directors is strengthened."

In response, KT&G explained, "Half of the disposed treasury shares were provided as paid contributions to the employee stock ownership association and others, so it was not a donation. Furthermore, in terms of procedural legitimacy, all procedures, including faithful board resolutions and transparent disclosures, were fully complied with, so the claim is not true."

Namwoo Lee, chairman of the Korea Corporate Governance Forum, emphasized, "Along with dividends, treasury shares are a representative means of shareholder return, but in Korea, they have been used as a means for controlling shareholders to defend their management rights or increase their control," and added, "In discussions on resolving the 'Korea Discount,' improving the treasury share system is always a core issue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)